Medicaid trust, also known as a Medicaid asset protection trust, is a type of irrevocable trust designed to help individuals protect their assets from Medicaid spend-down requirements while still qualifying for Medicaid benefits. This type of trust has gained popularity in recent years, particularly among seniors and individuals with disabilities who require long-term care but wish to preserve their assets for future generations. In this article, we will delve into the details of Medicaid trust, its benefits, and how it works, providing a comprehensive understanding of this complex topic.

Understanding Medicaid Trust

A Medicaid trust is an irrevocable trust, meaning that once it is created, it cannot be changed or terminated. This is in contrast to a revocable trust, which can be modified or terminated by the grantor at any time. The irrevocable nature of a Medicaid trust is what allows it to protect assets from Medicaid spend-down requirements. When an individual creates a Medicaid trust, they transfer their assets into the trust, and the trust is then managed by a trustee for the benefit of the grantor and their beneficiaries.

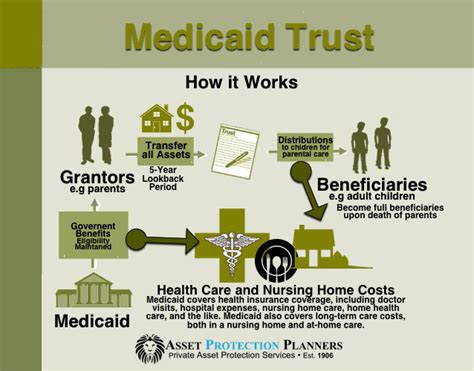

How Medicaid Trust Works

The primary goal of a Medicaid trust is to shield assets from Medicaid’s asset test, which determines an individual’s eligibility for Medicaid benefits. Medicaid has a five-year look-back period, during which time any assets transferred into a trust may be subject to penalty. However, if the assets are transferred into an irrevocable trust, such as a Medicaid trust, they are not considered countable assets for Medicaid purposes. This allows the grantor to qualify for Medicaid benefits while preserving their assets for future generations.

| Medicaid Trust Benefits | Description |

|---|---|

| Asset Protection | Protects assets from Medicaid spend-down requirements |

| Medicaid Eligibility | Allows grantor to qualify for Medicaid benefits while preserving assets |

| Tax Benefits | May provide tax benefits, such as reducing estate taxes |

| Control and Flexibility | Allows grantor to maintain control over assets and make changes to the trust |

Key Considerations

While a Medicaid trust can be an effective tool for protecting assets and qualifying for Medicaid benefits, there are several key considerations to keep in mind. First, the trust must be irrevocable, meaning that once it is created, it cannot be changed or terminated. Second, the trust must be properly funded, meaning that the grantor must transfer their assets into the trust. Finally, the trust must be managed by a trustee who is responsible for making decisions about the trust assets.

Medicaid Trust vs. Other Asset Protection Strategies

There are several other asset protection strategies that individuals may use to protect their assets from Medicaid spend-down requirements. These include gifting assets to family members or friends, creating a revocable trust, or using an annuity. However, each of these strategies has its own advantages and disadvantages, and may not provide the same level of protection as a Medicaid trust.

Key Points

- A Medicaid trust is an irrevocable trust designed to protect assets from Medicaid spend-down requirements

- The trust must be properly funded and managed by a trustee

- Medicaid trust laws and regulations vary by state, so it's essential to consult with an experienced attorney

- A Medicaid trust can provide asset protection, Medicaid eligibility, tax benefits, and control and flexibility

- Other asset protection strategies, such as gifting or creating a revocable trust, may not provide the same level of protection as a Medicaid trust

Conclusion

In conclusion, a Medicaid trust is a powerful tool for protecting assets from Medicaid spend-down requirements while still qualifying for Medicaid benefits. By transferring assets into an irrevocable trust, individuals can preserve their assets for future generations while ensuring that they receive the long-term care they need. However, it’s essential to consult with an experienced attorney who is familiar with the specific laws and regulations in your state to ensure that your Medicaid trust is properly established and meets your unique needs.

What is a Medicaid trust?

+A Medicaid trust is an irrevocable trust designed to protect assets from Medicaid spend-down requirements while still qualifying for Medicaid benefits.

How does a Medicaid trust work?

+A Medicaid trust works by transferring assets into an irrevocable trust, which is then managed by a trustee for the benefit of the grantor and their beneficiaries.

What are the benefits of a Medicaid trust?

+The benefits of a Medicaid trust include asset protection, Medicaid eligibility, tax benefits, and control and flexibility.

Meta Description: Learn about Medicaid trust, an irrevocable trust designed to protect assets from Medicaid spend-down requirements while still qualifying for Medicaid benefits. Discover how it works, its benefits, and key considerations.