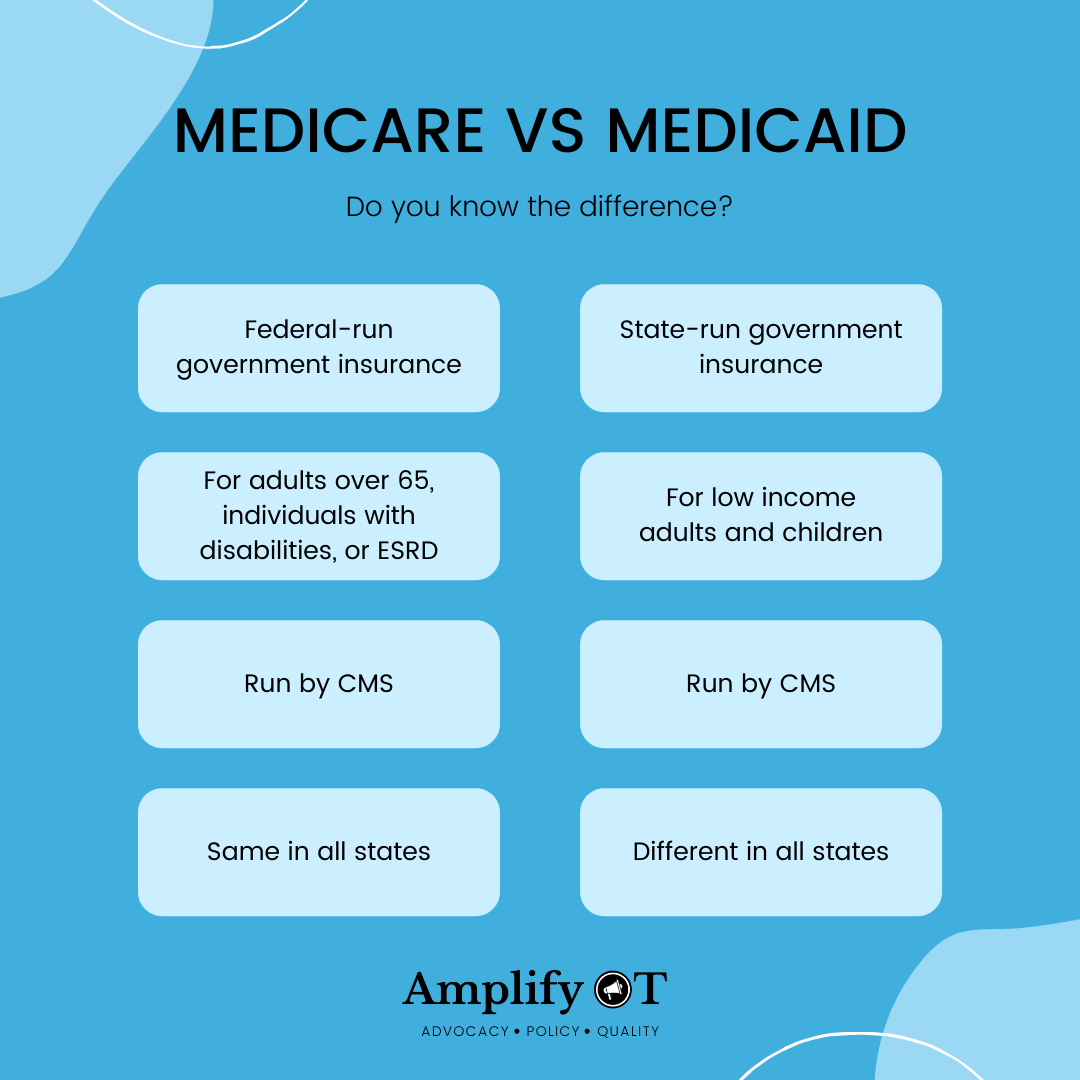

Medical bills on credit reports have become a contentious issue in recent years, with many consumers and advocacy groups arguing that they should not be included in credit scoring models. The reasoning behind this argument is that medical debt is often beyond the control of the individual, and including it in credit reports can unfairly penalize people who are already struggling with health issues. In this article, we will delve into the complexities of medical bills on credit reports, exploring the current landscape, the impact on consumers, and potential reforms.

Understanding Medical Debt and Credit Reports

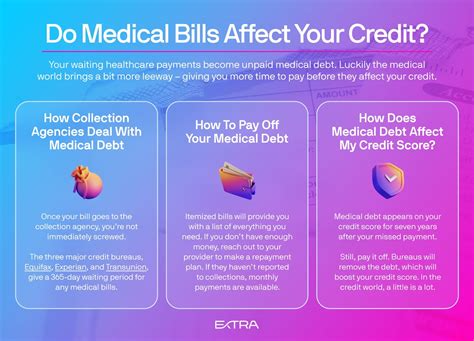

Medical debt arises when an individual receives medical care but is unable to pay the resulting bill. This can happen for a variety of reasons, including unexpected illnesses, accidents, or lack of adequate health insurance. When a medical bill goes unpaid, the healthcare provider may send it to a collection agency, which can then report the debt to the major credit bureaus (Equifax, Experian, and TransUnion). Once reported, the medical debt can appear on the individual’s credit report, potentially lowering their credit score.

Current Landscape: Credit Reporting and Scoring

The Fair Credit Reporting Act (FCRA) regulates how credit reporting agencies collect, use, and share consumer credit information. Under the FCRA, medical debt can be included in credit reports, but there are specific guidelines that must be followed. For example, collection agencies must wait at least 180 days before reporting medical debt to the credit bureaus, allowing time for insurance claims to be processed and bills to be paid. However, the presence of medical debt on credit reports can still have a significant impact on an individual’s credit score, making it more difficult to secure loans, credit cards, or other forms of credit.

| Category | Percentage of Credit Score |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| Types of Credit | 10% |

| New Credit | 10% |

Impact on Consumers

The inclusion of medical bills on credit reports can have far-reaching consequences for consumers. A study by the Consumer Financial Protection Bureau found that approximately 43 million Americans have medical debt on their credit reports, with the average amount totaling around $579. For many individuals, this can lead to a vicious cycle of debt, where the presence of medical debt on their credit report makes it more challenging to secure affordable credit, further exacerbating their financial difficulties.

Potential Reforms and Solutions

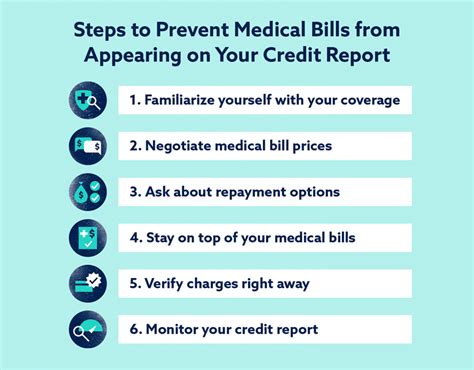

There are ongoing efforts to reform how medical debt is handled in credit reporting. Some proposed solutions include removing medical debt from credit reports altogether or implementing more nuanced credit scoring models that differentiate between medical debt and other types of debt. Additionally, there are advocacy efforts to extend the waiting period before medical debt can be reported to credit bureaus, giving consumers more time to address their bills.

Key Points

- Medical debt can significantly impact credit scores, making it harder for individuals to secure credit.

- Current regulations require a 180-day waiting period before medical debt can be reported to credit bureaus.

- Proposed reforms aim to remove or mitigate the impact of medical debt on credit reports.

- Nuanced credit scoring models could help differentiate between medical debt and other types of debt.

- Advocacy efforts are pushing for extended waiting periods and more consumer-friendly credit reporting practices.

In conclusion, the issue of medical bills on credit reports is complex and multifaceted, involving regulatory, ethical, and practical considerations. As we move forward, it's crucial to balance the need for accurate credit reporting with the need to protect consumers from unfair practices. By understanding the current landscape, the impact on consumers, and potential reforms, we can work towards creating a more equitable and compassionate credit reporting system.

How long does medical debt stay on a credit report?

+Medical debt can stay on a credit report for up to 7 years from the original delinquency date, similar to other types of debt. However, the impact of medical debt on credit scores may diminish over time as newer, more positive credit information is reported.

Can I dispute medical debt on my credit report?

+Yes, you can dispute medical debt on your credit report if you believe it is inaccurate or unfair. Start by contacting the credit bureau and the collection agency to initiate the dispute process. You may need to provide documentation to support your claim, such as proof of payment or insurance coverage.

How can I prevent medical debt from affecting my credit score?

+To minimize the impact of medical debt on your credit score, prioritize paying medical bills promptly, negotiate with healthcare providers or collection agencies if necessary, and maintain good credit habits in other areas, such as making on-time payments and keeping credit utilization low.

Meta Description: Learn about the impact of medical bills on credit reports, current regulations, and proposed reforms. Understand how medical debt can affect credit scores and what you can do to mitigate its effects.