Navigating the world of medical insurance can be a daunting task, especially when it comes to securing coverage for your entire family. With the rising costs of healthcare and the complexity of insurance plans, it's crucial to make informed decisions to protect your loved ones. This comprehensive guide aims to shed light on the intricacies of family medical insurance, offering expert insights and practical advice to help you make the right choices.

Understanding Family Medical Insurance

Family medical insurance, often referred to as a family health plan, is a type of insurance policy designed to cover the healthcare needs of an entire household. It typically includes the policyholder, their spouse, and dependent children, providing a comprehensive safety net for unexpected medical expenses. This type of insurance is particularly valuable in countries like the United States, where healthcare costs can be significant and often unexpected.

A family health plan offers a range of benefits, including coverage for routine check-ups, specialist consultations, hospital stays, prescription medications, and emergency care. It aims to provide financial protection against the high costs associated with medical treatments, ensuring that your family's health is a priority, regardless of financial constraints.

Key Considerations for Choosing Family Medical Insurance

When selecting a family medical insurance plan, several factors come into play. Firstly, it’s essential to understand your family’s specific healthcare needs. Consider the age and health status of each family member, any pre-existing conditions, and the type of medical care they may require in the future. This assessment will help you choose a plan that offers the right level of coverage.

Additionally, consider the network of healthcare providers associated with the insurance plan. Some plans may have a limited network, while others offer a more extensive range of choices. Access to a wider network can be beneficial, especially if your family prefers specific doctors or hospitals.

The cost of the insurance premium is another critical consideration. Family health plans can vary significantly in price, and it's important to find a balance between comprehensive coverage and affordability. Review your family's budget and determine the maximum amount you can comfortably allocate for insurance premiums.

Types of Family Medical Insurance Plans

Family medical insurance plans come in various forms, each with its own set of features and benefits. Understanding the different types can help you make an informed decision based on your family’s unique needs.

HMO (Health Maintenance Organization)

An HMO plan is a popular choice for families seeking comprehensive healthcare coverage. This type of plan typically requires you to select a primary care physician (PCP) who coordinates your family’s healthcare needs. The PCP acts as a gatekeeper, referring you to specialists within the HMO network when necessary. HMO plans often have lower out-of-pocket costs and provide access to a wide range of healthcare services.

PPO (Preferred Provider Organization)

PPO plans offer more flexibility compared to HMOs. With a PPO, you have the freedom to choose any healthcare provider, whether in-network or out-of-network. While out-of-network care may come at a higher cost, the ability to choose your preferred doctors and specialists is a significant advantage for many families. PPO plans often have higher premiums but provide greater control over your healthcare choices.

EPO (Exclusive Provider Organization)

EPO plans are similar to PPOs in that they allow you to choose your healthcare providers. However, EPO plans have a more limited network of providers, and you typically won’t have coverage for out-of-network care. This type of plan is ideal for families who prefer a specific healthcare system or a particular group of providers. EPO plans often offer lower premiums compared to PPOs.

POS (Point of Service)

A POS plan combines elements of both HMO and PPO plans. Like an HMO, you’ll need to select a PCP, but you also have the option to receive care outside the network, similar to a PPO. The cost of care can vary depending on whether you stay within the network or seek out-of-network treatment. POS plans offer a balance between structure and flexibility, making them a popular choice for families.

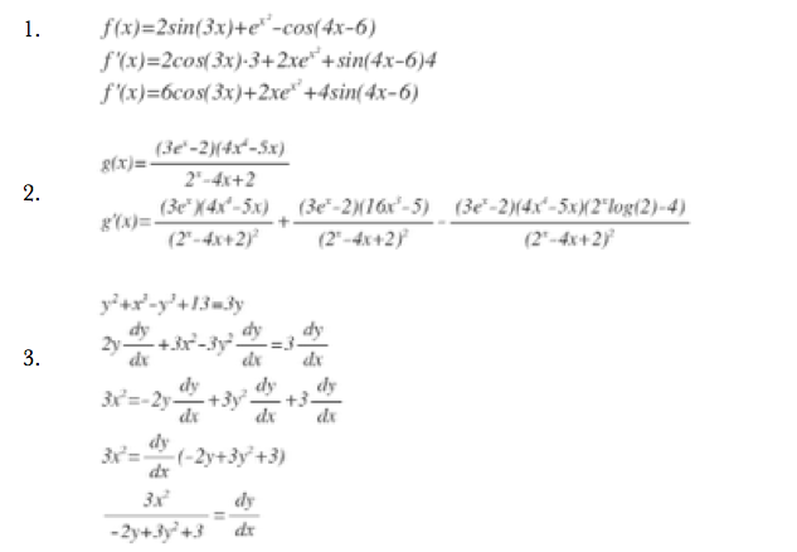

Comparative Analysis of Family Medical Insurance Plans

Let’s take a closer look at the key differences between these plan types to help you make an informed decision.

| Plan Type | Network Flexibility | Cost | Coverage |

|---|---|---|---|

| HMO | Limited to in-network providers | Lower premiums, lower out-of-pocket costs | Comprehensive coverage, including preventive care |

| PPO | Freedom to choose in-network or out-of-network providers | Higher premiums, potential for higher out-of-pocket costs | Flexibility and access to a wide range of providers |

| EPO | Limited to in-network providers, no out-of-network coverage | Lower premiums compared to PPOs | Specific provider network, often with lower costs |

| POS | Balanced approach, combining HMO and PPO features | Varies based on network usage | Flexibility with a PCP, access to a wider network |

Choosing the Right Plan for Your Family

When selecting a family medical insurance plan, it’s crucial to consider your family’s unique circumstances. If you prefer a structured approach and value cost-effectiveness, an HMO plan may be the best fit. For families who prioritize flexibility and the ability to choose their healthcare providers, a PPO or POS plan could be more suitable.

If you have a specific healthcare system or provider group in mind, an EPO plan might offer the right balance of cost and coverage. Remember, the key is to align the plan's features with your family's healthcare needs and preferences.

The Benefits of Family Medical Insurance

Investing in family medical insurance offers a range of advantages that go beyond financial protection. Here are some key benefits to consider:

- Peace of Mind: Knowing that your family's healthcare needs are covered provides a sense of security and peace of mind. You can focus on your loved ones' well-being without worrying about the financial burden of unexpected medical expenses.

- Comprehensive Coverage: Family health plans offer a wide range of benefits, including preventive care, specialist consultations, and emergency treatment. This ensures that your family receives the necessary care when and where they need it.

- Access to Quality Care: With a family medical insurance plan, you gain access to a network of healthcare providers, ensuring you can receive timely and high-quality medical attention. This is particularly beneficial for families with complex or specialized healthcare needs.

- Financial Protection: Medical expenses can quickly add up, especially for families. A comprehensive insurance plan helps protect your finances by covering a significant portion of these costs, preventing financial strain during difficult times.

- Family-Centric Approach: Family medical insurance plans are designed with the entire household in mind. They offer coverage for all family members, including children, ensuring that everyone receives the care they need to maintain good health.

Performance Analysis: Real-World Scenarios

To illustrate the impact of family medical insurance, let’s explore a few real-life scenarios and how having the right coverage can make a difference:

Scenario 1: Emergency Room Visit

Imagine a situation where your child suddenly develops a high fever and needs immediate medical attention. In this case, having a family medical insurance plan can ensure that you receive the necessary care without worrying about the financial implications. The insurance coverage can help cover the cost of the emergency room visit, any diagnostic tests, and potential medication, providing peace of mind during a stressful situation.

Scenario 2: Chronic Condition Management

If a family member is diagnosed with a chronic condition, such as diabetes or asthma, the cost of ongoing treatment and medication can be substantial. A family medical insurance plan can help manage these expenses, ensuring that your loved one receives the necessary care and medications without putting a strain on your finances. The plan can cover regular check-ups, specialist consultations, and the cost of prescription drugs, making chronic condition management more accessible and affordable.

Scenario 3: Specialized Treatment

In some cases, a family member may require specialized treatment, such as physical therapy or mental health services. Family medical insurance plans often cover a wide range of specialized treatments, ensuring that your loved ones can access the care they need. Whether it’s a short-term rehabilitation program or ongoing therapy sessions, having insurance coverage can make a significant difference in their recovery and overall well-being.

Future Implications: Preparing for the Unexpected

Family medical insurance is not just about managing current healthcare needs; it’s also about preparing for the unexpected. Here’s how having the right coverage can impact your family’s future:

- Long-Term Financial Planning: Medical insurance is a crucial component of long-term financial planning. By investing in a comprehensive family health plan, you can ensure that unexpected medical expenses don't derail your financial goals. This allows you to focus on other aspects of financial planning, such as saving for education, retirement, or other significant life milestones.

- Access to Advanced Medical Technologies: Medical technology is constantly evolving, offering new and innovative treatments. With a family medical insurance plan, you gain access to these advanced technologies, ensuring that your family can benefit from the latest medical advancements. This can be particularly beneficial for families with specific health concerns or those seeking cutting-edge treatments.

- Support for Aging Family Members: As your family members age, their healthcare needs may become more complex. A family medical insurance plan can provide the necessary coverage to support their changing health requirements. Whether it's specialized care for seniors, assisted living facilities, or long-term care, having insurance coverage can ensure that your loved ones receive the care they deserve as they age gracefully.

FAQ

How much does family medical insurance typically cost?

+The cost of family medical insurance can vary widely depending on factors such as the plan type, the number of family members covered, and the geographic location. On average, a family of four can expect to pay between 500 and 1,500 per month for a comprehensive health plan. However, it’s essential to review multiple plans and consider your specific needs to find the most cost-effective option.

Can I include my extended family members in my family medical insurance plan?

+Most family medical insurance plans cover the policyholder, their spouse, and dependent children. However, some plans may offer the option to include extended family members, such as parents, grandparents, or siblings, for an additional cost. It’s important to review the plan’s eligibility criteria and consider whether it aligns with your family’s needs.

What happens if I need to see a specialist outside my insurance network?

+The coverage and cost implications can vary depending on your insurance plan type. With an HMO plan, you typically need a referral from your primary care physician to see a specialist, and care is usually limited to the network. PPO and POS plans offer more flexibility, allowing you to choose out-of-network providers, but you may incur higher out-of-pocket costs. It’s essential to understand your plan’s specific rules and coverage to make informed decisions.