Medical insurance for the unemployed is a critical topic of discussion, especially during times of economic uncertainty. The loss of a job often means the loss of employer-sponsored health insurance, leaving individuals and families without access to necessary medical care. In the United States, for example, it is estimated that over 27 million people lack health insurance, with a significant portion of this group consisting of unemployed individuals. The need for affordable and comprehensive health insurance options for the unemployed has never been more pressing, with the COVID-19 pandemic highlighting the vulnerabilities of the uninsured population.

The financial burden of medical expenses can be overwhelming, especially for those without a steady income. A single hospital visit or medical procedure can result in thousands of dollars in medical bills, leading to financial ruin for many families. Furthermore, the lack of health insurance can have severe consequences on one's health, as untreated medical conditions can lead to more severe and costly health problems down the line. It is essential, therefore, to explore the various medical insurance options available to the unemployed, including government-sponsored programs, private insurance plans, and non-profit organizations offering financial assistance.

Key Points

- The Affordable Care Act (ACA) provides subsidies for low-income individuals and families to purchase health insurance through state and federal marketplaces.

- Medicaid expansion has increased access to health insurance for low-income individuals, including the unemployed, in participating states.

- Short-term limited-duration insurance (STLDI) plans offer temporary coverage for up to 12 months, but often come with limited benefits and pre-existing condition exclusions.

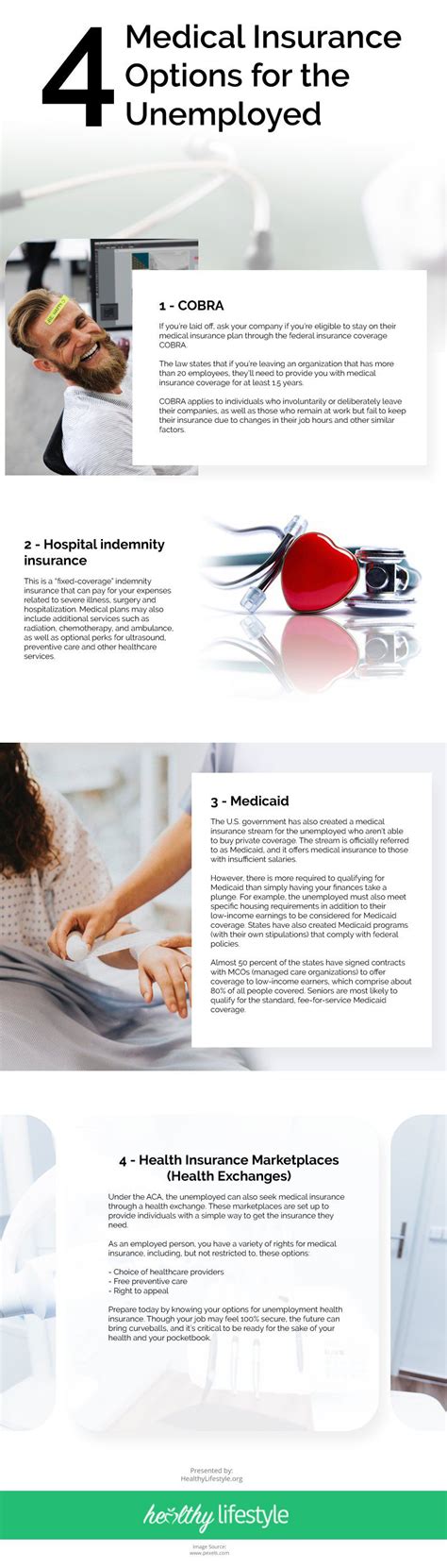

- COBRA allows eligible employees to continue their employer-sponsored health insurance for a limited time after job loss, but can be expensive.

- Non-profit organizations, such as the HealthWell Foundation and the Patient Access Network Foundation, offer financial assistance for medical expenses, including premiums, copays, and deductibles.

Government-Sponsored Programs

The United States government offers several programs to help the unemployed access medical insurance. The Affordable Care Act (ACA), also known as Obamacare, provides subsidies for low-income individuals and families to purchase health insurance through state and federal marketplaces. These subsidies can significantly reduce the cost of premiums, making health insurance more affordable for those who need it most. Additionally, Medicaid expansion has increased access to health insurance for low-income individuals, including the unemployed, in participating states. As of 2022, 38 states and the District of Columbia have expanded Medicaid, providing coverage to over 14 million low-income adults.

Medicaid Expansion and the Unemployed

Medicaid expansion has been particularly beneficial for the unemployed, as it provides comprehensive health insurance coverage, including doctor visits, hospital stays, and prescription medications. To be eligible for Medicaid, individuals must meet certain income and resource requirements, which vary by state. In general, Medicaid eligibility is limited to individuals with incomes at or below 138% of the federal poverty level (FPL), although some states have expanded eligibility to higher income levels. According to the Kaiser Family Foundation, Medicaid expansion has resulted in a 43% reduction in uninsured rates among low-income adults, highlighting the program’s effectiveness in increasing access to health insurance.

| State | Medicaid Expansion Status | Uninsured Rate (2020) |

|---|---|---|

| California | Expanded | 7.3% |

| Texas | Not Expanded | 18.4% |

| New York | Expanded | 5.4% |

| Florida | Not Expanded | 13.2% |

Private Insurance Plans

Private insurance plans are another option for the unemployed to consider. Short-term limited-duration insurance (STLDI) plans, for example, offer temporary coverage for up to 12 months. These plans often come with lower premiums than major medical plans but may have limited benefits and pre-existing condition exclusions. Additionally, STLDI plans may not provide essential health benefits, such as maternity care, mental health services, or prescription medication coverage. It’s crucial to carefully review the plan’s terms and conditions before enrolling, as these plans may not provide the comprehensive coverage needed.

Cobra and the Unemployed

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows eligible employees to continue their employer-sponsored health insurance for a limited time after job loss. This can be an attractive option for those who have recently lost their job and want to maintain their existing health insurance coverage. However, COBRA can be expensive, as individuals must pay the full premium, including the portion previously paid by their employer. According to the U.S. Department of Labor, the average monthly COBRA premium for a single person is over $500, highlighting the financial burden of this option.

In conclusion, medical insurance for the unemployed is a complex and multifaceted issue. While government-sponsored programs, such as Medicaid expansion and the ACA, have increased access to health insurance for low-income individuals, more work needs to be done to address the remaining uninsured population. Private insurance plans, including STLDI and COBRA, offer alternative options, but often come with limitations and higher costs. It's essential for individuals to carefully review their options and seek professional guidance to ensure they receive the comprehensive coverage they need.

What is the difference between Medicaid and Medicare?

+Medicaid is a state and federal program that provides health insurance coverage to low-income individuals and families, while Medicare is a federal program that provides health insurance coverage to individuals 65 and older, as well as certain younger individuals with disabilities.

Can I purchase private health insurance if I’m unemployed?

+Yes, you can purchase private health insurance if you’re unemployed. However, you may need to provide proof of income or other documentation to qualify for certain plans. It’s essential to shop around and compare prices and benefits to find the best plan for your needs and budget.

How do I apply for Medicaid if I’m unemployed?

+To apply for Medicaid, you can visit your state’s Medicaid website or contact your local Medicaid office. You will need to provide documentation, such as proof of income, residency, and citizenship, to determine your eligibility. You can also apply through the Health Insurance Marketplace or with the help of a certified application counselor.