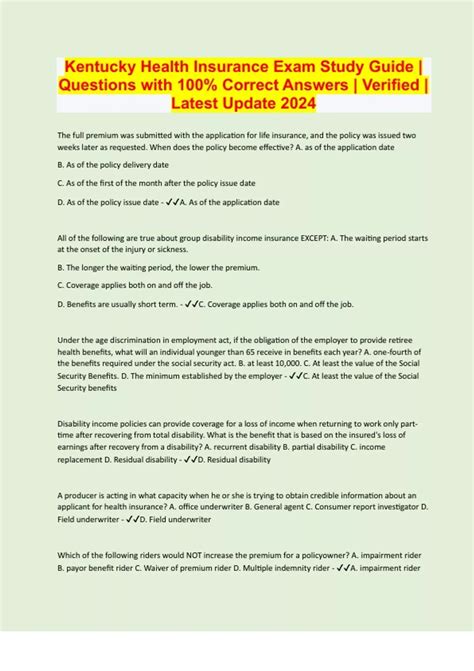

As the healthcare landscape continues to evolve, understanding the intricacies of medical insurance has become increasingly important for individuals, families, and businesses alike. In the state of Kentucky, residents have access to a variety of medical insurance options, each with its unique set of benefits, drawbacks, and requirements. This article aims to provide a comprehensive overview of medical insurance in Kentucky, delving into the key aspects that consumers need to be aware of to make informed decisions about their health coverage.

Key Points

- Kentucky residents can choose from various medical insurance plans, including those offered through the Affordable Care Act (ACA) marketplace, employer-sponsored plans, and private insurance companies.

- The state expanded Medicaid in 2014, providing health coverage to thousands of low-income individuals and families.

- Understanding the different types of medical insurance plans, such as HMOs, PPOs, and EPOs, is crucial for selecting the most appropriate coverage.

- Consumers should be aware of the open enrollment period for ACA plans and the potential for special enrollment periods due to qualifying life events.

- Comparing plan benefits, deductibles, copays, and coinsurance is essential for choosing a plan that meets individual or family health needs and budget constraints.

Overview of Medical Insurance in Kentucky

Kentucky’s medical insurance landscape is characterized by a mix of public and private options. The Affordable Care Act (ACA), also known as Obamacare, has played a significant role in shaping the state’s health insurance market. The ACA marketplace offers plans from various insurance companies, categorized into different metal tiers (Bronze, Silver, Gold, and Platinum), each representing a different level of coverage and cost. Additionally, many Kentuckians obtain health insurance through their employers, which often offer group plans with negotiated rates and benefits. Private insurance companies also sell plans directly to consumers, both on and off the ACA marketplace.

Types of Medical Insurance Plans

Understanding the different types of medical insurance plans available is vital for making an informed decision. Health Maintenance Organization (HMO) plans, for example, require policyholders to receive medical care and services from a specific network of providers, except in emergency situations. Preferred Provider Organization (PPO) plans offer more flexibility, allowing consumers to see any healthcare provider, both in-network and out-of-network, although out-of-network care typically comes at a higher cost. Exclusive Provider Organization (EPO) plans combine elements of HMOs and PPOs, covering care from providers within the network, with the exception of emergency care. Each type of plan has its advantages and disadvantages, and the choice between them should be based on individual health needs, budget, and preferences.

| Plan Type | Description | Network Restrictions |

|---|---|---|

| HMO | Lower costs, primary care physician required for referrals | Strict network restrictions, except for emergencies |

| PPO | Higher costs, more flexibility in choosing healthcare providers | Less restrictive, covers both in-network and out-of-network care |

| EPO | Balances cost and flexibility, covers in-network care and emergency out-of-network care | Covers care from in-network providers, with exceptions for emergencies |

Medicaid Expansion in Kentucky

Kentucky’s decision to expand Medicaid under the ACA in 2014 significantly impacted the state’s uninsured rate. Medicaid expansion provided health coverage to thousands of low-income adults, improving their access to essential health services, including preventive care, hospitalizations, and prescriptions. This expansion has been associated with various positive outcomes, including better health status, reduced financial burden due to medical expenses, and increased economic activity within the state. However, the Medicaid program and its expansion have also faced challenges and controversies, including debates over funding, eligibility, and the role of work requirements.

Impact of Medicaid Expansion

The expansion of Medicaid in Kentucky has had a profound impact on the health and well-being of its residents. Studies have shown that expansion states, including Kentucky, have experienced significant reductions in their uninsured rates compared to non-expansion states. Moreover, Medicaid expansion has been linked to improved health outcomes, such as better management of chronic conditions, increased access to preventive services, and reduced mortality rates. The economic benefits of Medicaid expansion, including the creation of jobs and the injection of federal funds into local economies, have also been substantial. Despite these positive outcomes, discussions around the future of Medicaid expansion and its sustainability continue, highlighting the need for ongoing evaluation and refinement of the program to ensure it meets the evolving health needs of Kentucky’s population.

What is the open enrollment period for ACA plans in Kentucky?

+The open enrollment period for ACA plans typically runs from November to December each year, although special enrollment periods may be available for individuals experiencing qualifying life events, such as marriage, divorce, or the loss of employer-sponsored coverage.

How do I apply for Medicaid in Kentucky?

+Applications for Medicaid in Kentucky can be submitted online through the state's benefits portal, by phone, or in person at a local Department for Community Based Services office. Eligibility is based on income and family size, among other factors.

What should I consider when choosing a medical insurance plan in Kentucky?

+When selecting a medical insurance plan, consider the plan's network, including whether your current healthcare providers are part of the network, the plan's benefits, such as coverage for prescription drugs, mental health services, and dental care, and the out-of-pocket costs, including premiums, deductibles, copays, and coinsurance.

In conclusion, navigating the medical insurance landscape in Kentucky requires a deep understanding of the available options, their benefits, and their limitations. Whether considering plans through the ACA marketplace, employer-sponsored coverage, or private insurance, consumers must prioritize their health needs and financial situation. The expansion of Medicaid has been a significant development in increasing access to healthcare for low-income individuals and families. As the healthcare system continues to evolve, staying informed about changes in medical insurance options and policies will be crucial for Kentuckians to make the best decisions for their health and well-being.