Welcome to an in-depth exploration of the Medical Insurance Marketplace in Texas, a critical component of the state's healthcare system. This article aims to provide an expert-level guide, shedding light on the intricacies of this marketplace, its impact on Texans, and its role in shaping healthcare accessibility and affordability. As we delve into the specifics, we'll uncover the unique features, challenges, and opportunities presented by the Texas Medical Insurance Marketplace, offering valuable insights for both industry professionals and those seeking comprehensive healthcare coverage.

Navigating the Texas Medical Insurance Marketplace: A Comprehensive Guide

The Medical Insurance Marketplace, often referred to as the Health Insurance Marketplace, plays a pivotal role in ensuring Texans have access to a range of health insurance plans. In a state as diverse and populous as Texas, understanding the dynamics of this marketplace is crucial. This section provides an overview, delving into the history, purpose, and key players involved in shaping the Texas Medical Insurance Marketplace.

Texas, known for its vibrant healthcare industry, has a unique approach to healthcare coverage. The Medical Insurance Marketplace, established as a result of the Affordable Care Act (ACA), offers a platform where individuals and small businesses can compare and purchase health insurance plans. This marketplace, while adhering to federal guidelines, has evolved to reflect the specific needs and characteristics of the Texas healthcare landscape.

One of the distinctive features of the Texas marketplace is its emphasis on choice. Texans have access to a wide array of insurance providers, each offering a diverse range of plans. From major national carriers to local insurers, the marketplace presents a spectrum of options, catering to various demographics and healthcare needs. This competition among providers often translates to more affordable premiums and innovative plan designs, benefiting consumers.

However, navigating this marketplace can be daunting, especially for those unfamiliar with the intricacies of health insurance. The complexity arises from the multitude of factors to consider, including plan costs, network providers, prescription drug coverage, and benefits like dental and vision care. Making an informed decision requires a deep understanding of one's healthcare needs and the ability to compare plans effectively.

Key Considerations for Texans

For Texans, the Medical Insurance Marketplace offers both opportunities and challenges. Here are some critical considerations when navigating this marketplace:

- Cost vs. Coverage: Balancing the cost of premiums with the extent of coverage is a delicate task. Texans must carefully evaluate their healthcare needs, considering factors like chronic conditions, family planning, and prescription drug requirements. Plans with lower premiums might have higher deductibles and out-of-pocket costs, making them suitable for those with fewer healthcare needs. Conversely, plans with higher premiums often provide more comprehensive coverage, benefiting those with higher healthcare demands.

- Network Providers: Understanding the network of healthcare providers covered by a plan is essential. Texans should ensure their preferred doctors, hospitals, and specialists are in-network to avoid unexpected costs. Some plans offer a wider network, providing more flexibility, while others may have more limited options.

- Prescription Drug Coverage: Prescription medications can be a significant healthcare expense. Texans should carefully review the prescription drug formulary of each plan, ensuring their essential medications are covered. Plans often categorize drugs into tiers, with lower tiers typically being more affordable.

- Dental and Vision Care: Many health insurance plans do not include dental and vision coverage. Texans must decide if they require these additional benefits and select plans accordingly. Some insurers offer standalone dental and vision plans, providing flexibility in coverage.

To aid in this decision-making process, the Texas Medical Insurance Marketplace provides a wealth of resources, including plan comparison tools, educational materials, and assistance from trained navigators. These resources aim to empower Texans to make informed choices, ensuring they select the plan that best aligns with their healthcare needs and budget.

Performance and Impact Analysis

The Texas Medical Insurance Marketplace has undergone significant transformations since its inception. Let's delve into its performance and the impact it has had on healthcare accessibility and affordability in the state.

One of the primary objectives of the marketplace is to increase the number of insured individuals. By providing a centralized platform for insurance comparison and purchase, the marketplace aims to make healthcare coverage more accessible. Over the years, the marketplace has successfully enrolled a substantial number of Texans, contributing to a decline in the state's uninsured rate. This has had a positive impact on public health, as more individuals have access to preventive care and timely treatment.

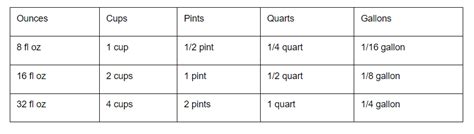

| Year | Uninsured Rate in Texas |

|---|---|

| 2013 | 24.3% |

| 2017 | 17.8% |

| 2021 | 13.4% |

However, challenges persist. The marketplace has faced criticism for its complexity, particularly for those who are less tech-savvy or have limited access to digital resources. Additionally, the availability and affordability of plans vary across the state, with certain regions experiencing a limited selection of insurers and higher premiums.

Despite these challenges, the marketplace has brought about significant improvements in healthcare accessibility. It has facilitated the expansion of Medicaid, ensuring more low-income individuals and families have access to essential healthcare services. Moreover, the marketplace has driven innovation in insurance plan design, with insurers offering more tailored and affordable options to cater to diverse healthcare needs.

Looking Ahead: Future Implications and Innovations

As we look to the future, the Texas Medical Insurance Marketplace is poised for further evolution. Here are some key trends and developments to watch:

- Telehealth Integration: The pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. The marketplace is likely to see an increase in plans that integrate telehealth benefits, providing Texans with convenient and affordable access to healthcare from the comfort of their homes.

- Value-Based Insurance Design: Insurers are increasingly adopting value-based insurance designs, which incentivize consumers to seek preventive care and manage chronic conditions effectively. These designs can lead to better health outcomes and lower overall healthcare costs.

- Digital Innovation: The marketplace is expected to leverage digital technologies to enhance the consumer experience. This includes the development of user-friendly platforms, improved plan comparison tools, and personalized recommendations based on individual healthcare needs.

- Expanding Coverage Options: Efforts are underway to expand coverage options, particularly for those who fall into the "coverage gap" – earning too much to qualify for Medicaid but not enough to receive premium tax credits. Initiatives to bridge this gap can significantly improve healthcare accessibility for vulnerable populations.

Frequently Asked Questions

What is the Texas Medical Insurance Marketplace, and how does it work?

+The Texas Medical Insurance Marketplace, also known as the Health Insurance Marketplace, is a platform established by the Affordable Care Act (ACA) to help individuals and small businesses compare and purchase health insurance plans. It operates as a centralized hub, allowing users to browse and select from a range of insurance options offered by various providers. The marketplace aims to simplify the process of finding and enrolling in suitable health insurance plans, ensuring Texans have access to affordable and comprehensive healthcare coverage.

How do I know if I qualify for premium tax credits or other financial assistance on the Texas Medical Insurance Marketplace?

+To determine if you qualify for premium tax credits or other financial assistance, you need to consider your income level and family size. Generally, if your household income is between 100% and 400% of the federal poverty level, you may be eligible for premium tax credits. These credits can significantly reduce your monthly insurance premiums. Additionally, those with lower incomes may qualify for Medicaid or the Children’s Health Insurance Program (CHIP). It’s recommended to use the Marketplace’s eligibility tool or consult with a trained navigator to accurately assess your eligibility.

Are there any special enrollment periods in Texas for those who miss the regular open enrollment deadline?

+Yes, Texas does offer special enrollment periods for individuals who miss the regular open enrollment deadline. These periods are typically triggered by qualifying life events, such as losing job-based coverage, getting married, having a baby, or moving to a new area. During these special enrollment periods, you can enroll in a health insurance plan outside of the regular open enrollment timeframe. It’s important to note that you must have a qualifying event and provide documentation to support your eligibility for the special enrollment period.

What should I consider when comparing health insurance plans on the Texas Medical Insurance Marketplace?

+When comparing health insurance plans on the Texas Medical Insurance Marketplace, there are several key factors to consider. First, assess your healthcare needs, including any ongoing medical conditions, prescription drug requirements, and potential future needs. Next, evaluate the plan’s coverage, including network providers, prescription drug formulary, and benefits like dental and vision care. Consider the plan’s cost, including premiums, deductibles, and out-of-pocket maximums. Additionally, review the plan’s customer satisfaction ratings and reviews to ensure you’re selecting a reputable insurer. Finally, don’t hesitate to seek assistance from trained navigators or insurance brokers to guide you through the decision-making process.