Miami, known for its vibrant culture, beautiful beaches, and thriving business landscape, is a city where understanding sales tax can significantly impact both businesses and consumers. The sales tax rate in Miami, like the rest of Florida, is composed of a state and a local component. As of the last update, the state sales tax rate is 6%, and Miami-Dade County adds a local surtax of 1%, bringing the total sales tax rate in Miami to 7%. Understanding how sales tax works and navigating its intricacies can be crucial for businesses looking to operate efficiently and for consumers wanting to make informed purchasing decisions. Here are five Miami sales tax tips to help you navigate the system more effectively.

Key Points

- Understanding the total sales tax rate in Miami, which includes both state and local components.

- Knowing which items are exempt from sales tax to avoid unnecessary payments.

- Registering your business for a sales tax permit if you plan to sell taxable goods or services.

- Keeping accurate records of sales and sales tax collected to ensure compliance with state and local regulations.

- Staying updated on any changes in sales tax laws or rates that could affect your business or purchasing decisions.

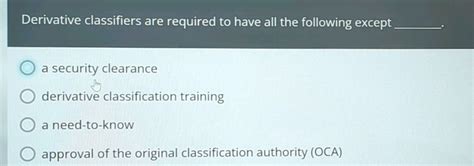

Understanding Sales Tax Rates

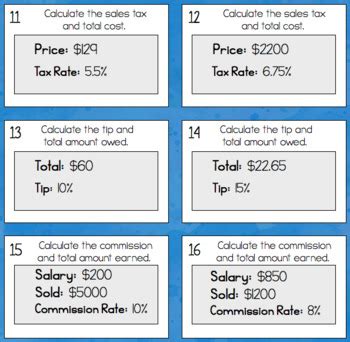

One of the most fundamental aspects of dealing with sales tax in Miami is understanding the current rate and how it applies to different goods and services. The 7% total sales tax rate (6% state + 1% local) applies to most taxable items, including retail sales of tangible personal property and certain services. However, not all goods and services are subject to sales tax. For instance, groceries and certain medical products are exempt, which can help consumers save money on essential items.

Registering Your Business

If you’re starting or operating a business in Miami that sells taxable goods or services, it’s crucial to register for a sales tax permit. This permit, also known as a sales and use tax permit, allows you to collect sales tax from customers and remit it to the state. Registering for a sales tax permit involves applying through the Florida Department of Revenue, providing necessary business information, and understanding your filing frequency, which could be monthly, quarterly, or annually, depending on the volume of your sales.

| Category | Rate |

|---|---|

| State Sales Tax | 6% |

| Local Surtax (Miami-Dade County) | 1% |

| Total Sales Tax Rate in Miami | 7% |

Exemptions and Reductions

While the general sales tax rate in Miami applies to most goods and services, there are exemptions and potential reductions that businesses and consumers should be aware of. For example, certain agricultural equipment, renewable energy sources, and items sold to qualified organizations or for specific purposes may be exempt from sales tax. Understanding these exemptions can help businesses reduce their tax liability and consumers save on purchases.

Record Keeping and Compliance

Compliance with sales tax regulations involves more than just collecting and remitting sales tax. It also requires keeping detailed records of all transactions, including those that are exempt from sales tax. Accurate record-keeping is essential for audits and for ensuring that businesses are in compliance with all sales tax laws. This includes maintaining records of sales tax collected, exemptions, and any adjustments or refunds made.

Furthermore, staying informed about any changes in sales tax laws, rates, or regulations is crucial. The Florida Department of Revenue provides updates and guidance on sales tax, including changes to rates, exemptions, and filing requirements. Businesses and consumers alike should regularly check for updates to ensure they are in compliance and taking advantage of all available exemptions and reductions.

What is the current total sales tax rate in Miami?

+The current total sales tax rate in Miami is 7%, which includes a 6% state sales tax rate and a 1% local surtax.

Are there any items that are exempt from sales tax in Miami?

+Yes, certain items such as groceries and specific medical products are exempt from sales tax in Miami.

How do I register my business for a sales tax permit in Florida?

+You can register your business for a sales tax permit through the Florida Department of Revenue's website, providing necessary business information and understanding your filing frequency.

In conclusion, navigating the sales tax landscape in Miami requires a solid understanding of the current rates, exemptions, and regulations. By staying informed, maintaining accurate records, and ensuring compliance with all sales tax laws, businesses can operate efficiently, and consumers can make informed purchasing decisions. As the business environment and tax laws evolve, it’s essential to stay updated on any changes that could impact your operations or purchases in Miami.