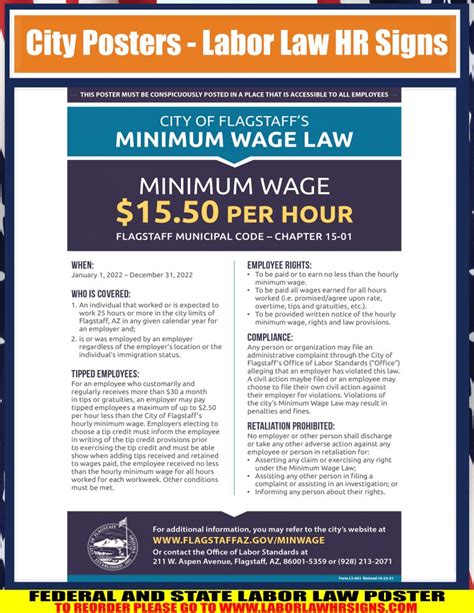

The state of Arizona has its own set of minimum wage requirements that employers must adhere to. As of January 1, 2022, the minimum wage in Arizona is $12.80 per hour, which is higher than the federal minimum wage of $7.25 per hour. This increase is a result of the passage of Proposition 206 in 2016, which aimed to gradually raise the minimum wage in Arizona to $12 per hour by 2020, with annual adjustments for inflation thereafter.

Arizona's minimum wage law applies to all employers who employ one or more employees, with some exceptions. For example, employers who are exempt from the Fair Labor Standards Act (FLSA) are also exempt from Arizona's minimum wage law. Additionally, some employees, such as those who are under the age of 20 or are employed in certain industries, such as agriculture or construction, may be subject to different minimum wage requirements.

It is essential for employers in Arizona to understand the minimum wage requirements and ensure that they are complying with the law. Failure to do so can result in penalties, fines, and even lawsuits. Employers must also provide employees with written notice of their wage rates, including any changes to their wages, and maintain accurate records of employee wages and hours worked.

Key Points

- Arizona's minimum wage is $12.80 per hour as of January 1, 2022

- The minimum wage applies to all employers who employ one or more employees, with some exceptions

- Employers must provide employees with written notice of their wage rates and maintain accurate records of employee wages and hours worked

- Failure to comply with the minimum wage law can result in penalties, fines, and lawsuits

- Some employees, such as those under the age of 20 or employed in certain industries, may be subject to different minimum wage requirements

History of Arizona’s Minimum Wage Law

Arizona’s minimum wage law has undergone significant changes over the years. Prior to 2016, the minimum wage in Arizona was 8.05 per hour, which was higher than the federal minimum wage at the time. However, with the passage of Proposition 206, the minimum wage increased to 10 per hour in 2017, 10.50 per hour in 2018, 11 per hour in 2019, and 12 per hour in 2020. The annual adjustments for inflation have resulted in further increases, with the current minimum wage of 12.80 per hour.

The passage of Proposition 206 was a significant victory for workers' rights advocates in Arizona, who had been pushing for a higher minimum wage for years. The proposition was supported by a coalition of labor unions, community organizations, and businesses that recognized the importance of a living wage for workers. The increase in the minimum wage has had a positive impact on the state's economy, with many workers seeing an increase in their take-home pay and a subsequent increase in consumer spending.

Exceptions to the Minimum Wage Law

While the minimum wage law applies to most employers in Arizona, there are some exceptions. For example, employers who are exempt from the FLSA are also exempt from Arizona’s minimum wage law. This includes employers who are engaged in certain industries, such as agriculture or construction, or who have fewer than 10 employees. Additionally, some employees, such as those who are under the age of 20 or are employed in certain occupations, such as babysitting or newspaper delivery, may be subject to different minimum wage requirements.

It is essential for employers to understand these exceptions and ensure that they are complying with the law. Employers who are unsure about their obligations under the minimum wage law should consult with an attorney or contact the Arizona Industrial Commission for guidance.

| Minimum Wage Rate | Effective Date |

|---|---|

| $10.00 per hour | January 1, 2017 |

| $10.50 per hour | January 1, 2018 |

| $11.00 per hour | January 1, 2019 |

| $12.00 per hour | January 1, 2020 |

| $12.80 per hour | January 1, 2022 |

Impact of the Minimum Wage Law on Employers and Employees

The minimum wage law has had a significant impact on both employers and employees in Arizona. For employers, the increase in the minimum wage has resulted in increased labor costs, which can be challenging for small businesses or those with tight profit margins. However, many employers have found that the increase in the minimum wage has also resulted in increased productivity and reduced employee turnover, as employees are more motivated and engaged when they are paid a living wage.

For employees, the increase in the minimum wage has resulted in a significant increase in take-home pay, which can have a positive impact on their overall well-being and quality of life. Many employees have reported that the increase in the minimum wage has allowed them to better provide for their families and meet their basic needs, such as housing and food. Additionally, the increase in the minimum wage has also resulted in increased consumer spending, which can have a positive impact on the state's economy as a whole.

Best Practices for Employers

To ensure compliance with the minimum wage law, employers should follow best practices, such as providing accurate written notice to employees of their wage rates and maintaining accurate records of employee wages and hours worked. Employers should also ensure that they are paying employees at least the minimum wage for all hours worked, including overtime hours. Additionally, employers should be aware of the exceptions to the minimum wage law and ensure that they are complying with the law for all employees.

Employers should also consider the impact of the minimum wage law on their business and make adjustments as necessary. For example, employers may need to adjust their pricing or budget to account for the increased labor costs. However, many employers have found that the benefits of paying a living wage, such as increased productivity and reduced employee turnover, outweigh the costs.

What is the current minimum wage in Arizona?

+The current minimum wage in Arizona is $12.80 per hour, effective January 1, 2022.

Who is exempt from the minimum wage law in Arizona?

+Employers who are exempt from the FLSA are also exempt from Arizona's minimum wage law. This includes employers who are engaged in certain industries, such as agriculture or construction, or who have fewer than 10 employees.

What are the penalties for non-compliance with the minimum wage law in Arizona?

+Failure to comply with the minimum wage law in Arizona can result in penalties, fines, and lawsuits. Employers who are found to be in non-compliance may be required to pay back wages to employees, as well as fines and penalties to the state.

Meta description: Learn about Arizona’s minimum wage requirements, including the current minimum wage rate, exceptions to the law, and best practices for employers. Ensure compliance with the law and understand the impact on employers and employees. (150 characters)