The concept of a money multiplier is a fundamental principle in economics, particularly in the realm of monetary policy. It refers to the process by which the injection of new money into the economy by a central bank leads to a multiple expansion of the money supply. This concept is crucial for understanding how central banks influence the economy through their monetary policies. In this article, we will delve into the five ways the money multiplier works, exploring its mechanisms, implications, and the factors that influence its effectiveness.

Key Points

- The money multiplier effect is initiated when a central bank injects new money into the economy, typically through buying government securities from banks.

- This injection increases the reserves of banks, which can then lend out a portion of these increased reserves, thereby multiplying the initial amount of money.

- The money multiplier is influenced by the reserve requirement set by the central bank, the willingness of banks to lend, and the public's preference for holding cash versus depositing it in banks.

- The process of money multiplication continues through successive rounds of lending and depositing, with each round diminishing in amount due to the reserve requirements and cash withdrawals.

- Understanding the money multiplier is essential for central banks to manage inflation, stimulate economic growth, and maintain financial stability.

The Initial Injection of Money

The first step in the money multiplier process involves the central bank injecting new money into the economy. This is typically done through open market operations, where the central bank buys government securities from banks. By doing so, the central bank increases the reserves of these banks. The increase in bank reserves is the catalyst for the money multiplier effect because banks are required to hold only a fraction of their deposits in reserve, known as the reserve requirement. The remainder can be lent out to customers, thus increasing the money supply.

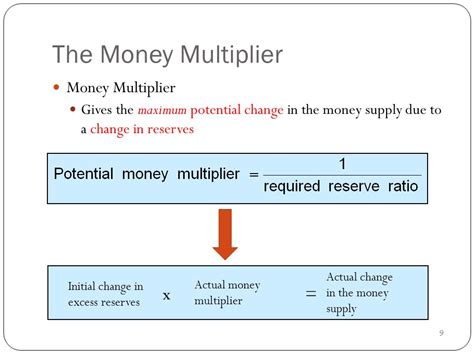

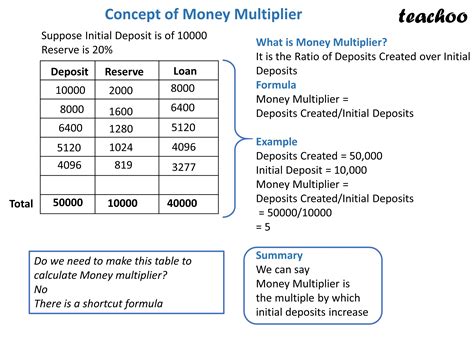

Reserve Requirements and Money Creation

The reserve requirement, set by the central bank, plays a crucial role in determining the potential magnitude of the money multiplier. If the reserve requirement is high, banks are required to hold more of their deposits in reserve and, consequently, have less to lend out. Conversely, a lower reserve requirement means banks can lend out a larger portion of their deposits, leading to a greater expansion of the money supply. For instance, if the reserve requirement is 10%, for every 100 increase in reserves, a bank can lend out 90, which, when deposited in another bank, can lead to further lending, and so on.

| Reserve Requirement | Potential Lending |

|---|---|

| 10% | $90 for every $100 in reserves |

| 20% | $80 for every $100 in reserves |

| 5% | $95 for every $100 in reserves |

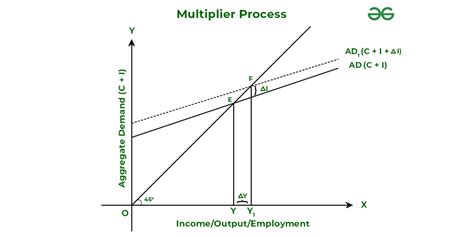

The Successive Rounds of Lending and Deposit

After the initial round of lending, the process of money creation continues through successive rounds. Each time a bank lends money, the borrower deposits the funds into another bank, increasing that bank’s reserves and enabling it to make new loans. This cycle continues, with each round resulting in a smaller increase in the money supply due to the reserve requirements and the public’s preference for holding some of their wealth as cash. The money multiplier effect diminishes with each successive round until the increments become negligible, at which point the process is considered complete.

Factors Influencing the Money Multiplier

Besides the reserve requirement, other factors can influence the money multiplier’s effectiveness. The public’s desire to hold cash, known as the currency drain, can reduce the amount of money available for lending. Similarly, if banks are cautious and decide to hold excess reserves beyond the required amount, this can also limit the expansion of the money supply. The willingness of borrowers to take on debt and the overall economic conditions play critical roles in determining how effectively the money multiplier operates.

The money multiplier is a powerful tool for central banks, offering a way to influence the money supply and, by extension, economic activity. However, its effectiveness can be influenced by a variety of factors, including reserve requirements, public behavior, and bank lending practices. Understanding these dynamics is crucial for crafting effective monetary policies that can stimulate economic growth, control inflation, and maintain financial stability.

What is the primary mechanism through which the money multiplier works?

+The primary mechanism involves central banks injecting money into the economy, typically by buying government securities from banks, which increases bank reserves and leads to successive rounds of lending and depositing.

How does the reserve requirement affect the money multiplier?

+A higher reserve requirement reduces the amount banks can lend, thereby decreasing the potential expansion of the money supply, while a lower reserve requirement allows for more lending and a greater expansion.

What factors can limit the effectiveness of the money multiplier?

+Factors such as the public’s preference for holding cash, banks’ willingness to lend, and overall economic conditions can limit the money multiplier’s effectiveness by reducing the amount of money available for lending and the willingness of borrowers to take on debt.