Converting months to years is a common task in various aspects of life, including finance, project management, and personal planning. Understanding the relationship between months and years is essential for making informed decisions and creating accurate timelines. In this article, we will delve into the world of time conversion, exploring the intricacies of converting months to years and providing practical tips and examples to make this process easier.

Key Points

- Understanding the basics of time conversion is crucial for accurate calculations

- Using a conversion factor can simplify the process of converting months to years

- Real-world applications of month-to-year conversions include finance, project management, and personal planning

- Online tools and calculators can aid in time conversions, but understanding the underlying principles is essential

- Common pitfalls in time conversion include neglecting leap years and not accounting for fractional months

Understanding the Basics of Time Conversion

Before diving into the specifics of converting months to years, it is essential to understand the basic units of time and their relationships. A year is typically considered to be 12 months, but this can vary depending on the context. For example, in financial calculations, a year is often assumed to be 360 days, while in calendar calculations, a year can be 365 or 366 days, depending on whether it is a leap year or not. Accurate time conversion requires consideration of these variations.

Conversion Factors and Formulas

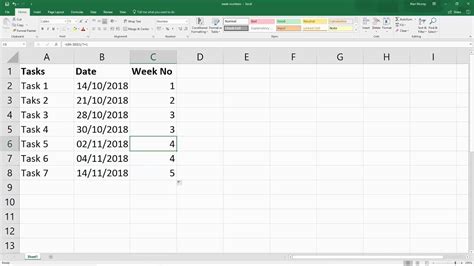

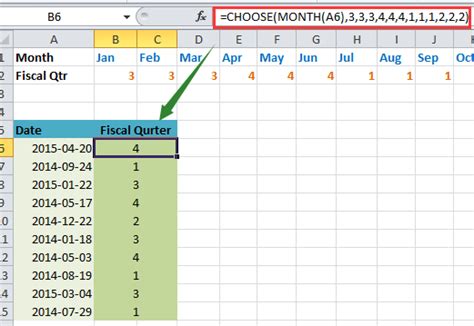

To convert months to years, a conversion factor can be used. The most common conversion factor is 1 year = 12 months. This can be expressed as a formula: years = months / 12. However, this formula assumes a non-leap year and does not account for fractional months. In real-world applications, it is often necessary to consider these factors to ensure accuracy. For instance, when calculating the duration of a project that spans several years, accounting for leap years can make a significant difference in the overall timeline.

| Conversion Scenario | Calculation | Result |

|---|---|---|

| 24 months to years | 24 / 12 | 2 years |

| 36 months to years | 36 / 12 | 3 years |

| 48 months to years, considering leap years | (48 * 365.25) / (12 * 365.25) | 4 years |

Real-World Applications of Month-to-Year Conversions

Converting months to years has numerous real-world applications. In finance, understanding the duration of investments or loans in years is essential for calculating interest rates and returns. In project management, accurately converting project timelines from months to years helps in planning resources and setting realistic milestones. For personal planning, such as saving for retirement or a down payment on a house, converting long-term goals from months to years provides a clearer perspective on progress and requirements.

Common Pitfalls in Time Conversion

Despite the simplicity of the conversion formula, there are common pitfalls to watch out for. Neglecting leap years can lead to inaccuracies, especially in calculations spanning several years. Not accounting for fractional months can also cause discrepancies, particularly in financial calculations where precision is key. Furthermore, assuming a uniform month length can lead to errors, as months vary in length from 28 to 31 days.

How do I convert months to years accurately, considering leap years?

+To convert months to years accurately, considering leap years, you should first determine if the year in question is a leap year. Then, calculate the total number of days in the months you are converting, using 365.25 days as the average length of a year to account for leap years. Finally, divide this total by 365.25 to find the equivalent in years.

What is the importance of understanding time conversion in personal finance?

+Understanding time conversion is crucial in personal finance because it helps individuals accurately calculate interest on savings or loans, plan for long-term goals like retirement, and make informed decisions about investments. Accurate time conversion ensures that financial plans are realistic and achievable.

In conclusion, converting months to years is a fundamental skill with wide-ranging applications. By understanding the basics of time conversion, using appropriate conversion factors, and being mindful of potential pitfalls like leap years and fractional months, individuals can make more accurate calculations and better decisions in various aspects of life. Whether in finance, project management, or personal planning, the ability to convert months to years with precision is a valuable tool for achieving goals and navigating complex timelines.