In today's digital age, obtaining auto insurance has evolved significantly, with an increasing number of individuals turning to online platforms for their insurance needs. This shift towards digital insurance services offers unparalleled convenience and a streamlined process, allowing you to secure comprehensive coverage for your vehicle with just a few clicks. However, with the abundance of online options available, navigating this landscape can be daunting. This guide aims to demystify the process of acquiring auto insurance online, providing you with the knowledge and tools to make informed decisions and secure the best coverage for your unique circumstances.

The rise of online auto insurance platforms has revolutionized the way we approach vehicle protection, offering a more efficient and accessible alternative to traditional insurance methods. These platforms leverage advanced technologies to provide a seamless and personalized experience, tailoring insurance plans to the specific needs of each driver. By understanding the key aspects of online auto insurance and the benefits it offers, you can make an informed decision that not only meets your insurance requirements but also provides an optimal balance between coverage and cost.

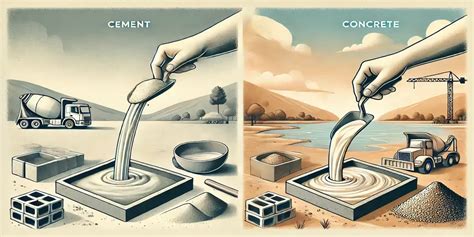

Understanding the Basics of Online Auto Insurance

Online auto insurance operates on a straightforward premise: it is a digital platform that enables you to compare and purchase car insurance policies from various providers. This approach offers several advantages, primarily the convenience of accessing a wide range of insurance options from the comfort of your home. Additionally, online insurance often provides more competitive pricing due to the reduced overhead costs associated with traditional insurance agencies.

When you embark on the journey of obtaining online auto insurance, you'll discover a wealth of information and tools designed to simplify the process. Most online platforms provide user-friendly interfaces that guide you through the steps of obtaining a quote. This typically involves inputting basic details about yourself, your vehicle, and your driving history. Based on this information, the platform generates quotes from multiple insurance providers, allowing you to compare coverage, premiums, and other important factors side by side.

One of the standout features of online auto insurance is the ability to customize your policy to fit your specific needs. Whether you require comprehensive coverage, liability-only insurance, or something in between, online platforms offer a range of options to choose from. Furthermore, many providers offer additional coverage enhancements and endorsements to further tailor your policy to your unique circumstances.

Online auto insurance platforms also provide a wealth of resources to help you make informed decisions. From detailed explanations of coverage options to helpful articles and guides, these platforms ensure you have the knowledge to select the right policy. Additionally, many offer customer support channels, such as live chat or phone assistance, to address any queries or concerns you may have during the process.

Key Considerations When Choosing an Online Auto Insurance Provider

When selecting an online auto insurance provider, several factors should be taken into consideration to ensure you're making the best choice for your needs. Firstly, evaluate the range of coverage options offered. While price is an important consideration, it's equally crucial to ensure you're obtaining the right level of coverage for your vehicle and driving habits. Look for a provider that offers a comprehensive range of coverage types, including liability, collision, comprehensive, and additional options such as rental car reimbursement or roadside assistance.

Secondly, assess the provider's reputation and customer service track record. Online reviews and ratings can provide valuable insights into the experiences of other policyholders. Look for providers with a strong track record of prompt claim processing and fair settlements. Additionally, consider the availability and accessibility of customer support. A responsive and knowledgeable support team can make a significant difference, especially in the event of an emergency or when you have questions about your policy.

Lastly, don't overlook the convenience and user-friendliness of the provider's online platform. A well-designed interface can streamline the process of obtaining a quote, comparing options, and purchasing your policy. Look for platforms that offer clear and concise explanations of coverage options, easy-to-use quote generators, and straightforward purchase processes. Additionally, consider the availability of mobile apps, which can provide added convenience and accessibility for managing your policy on the go.

The Benefits of Online Auto Insurance: A Comparative Analysis

Online auto insurance platforms offer a host of benefits that set them apart from traditional insurance agencies. Firstly, the convenience factor cannot be overstated. With online insurance, you can obtain quotes, compare policies, and purchase coverage without ever leaving your home. This level of convenience is particularly appealing to busy individuals or those who prefer the efficiency of digital services.

Another significant advantage is the potential for cost savings. Online insurance providers often pass on the savings from reduced overhead costs to their customers, resulting in more competitive premiums. Additionally, the ability to compare multiple quotes side by side empowers you to make informed decisions and negotiate better rates with your current provider. This competitive pricing environment can lead to substantial savings on your auto insurance premiums.

Furthermore, online auto insurance platforms offer enhanced customization options. With a wide range of coverage types and add-ons available, you can tailor your policy to fit your specific needs. Whether you require comprehensive coverage for a new vehicle or liability-only insurance for an older model, online providers offer flexibility and choice. This level of customization ensures you're not paying for coverage you don't need while still maintaining the protection you desire.

Lastly, online auto insurance platforms provide a wealth of educational resources and tools to help you make informed decisions. From detailed explanations of coverage options to interactive quote generators and helpful articles, these platforms ensure you have the knowledge to select the right policy. Additionally, many providers offer customer support channels, such as live chat or phone assistance, to address any queries or concerns you may have during the process.

Maximizing Your Online Auto Insurance Experience

To make the most of your online auto insurance journey, there are several strategies you can employ. Firstly, take the time to thoroughly understand your coverage needs. Assess your vehicle, driving habits, and potential risks to determine the right level of coverage. Consider factors such as the age and value of your vehicle, your driving record, and any additional coverage needs, such as rental car reimbursement or roadside assistance.

Secondly, shop around and compare quotes from multiple providers. Online insurance platforms make this process effortless, allowing you to quickly compare coverage, premiums, and additional benefits. Take advantage of this feature to negotiate better rates with your current provider or find a more affordable policy that meets your needs. Remember, insurance providers often offer discounts for various reasons, so be sure to inquire about any available discounts that could lower your premium.

Additionally, consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many providers offer multi-policy discounts, which can lead to significant savings. By combining your insurance needs, you not only save money but also simplify your insurance management, as you'll only have one provider and one policy to manage.

Lastly, don't hesitate to reach out to customer support if you have any questions or concerns. Online insurance providers typically offer multiple channels of communication, such as live chat, email, or phone support. Utilize these resources to clarify any doubts you may have about coverage options, policy terms, or the claims process. A well-informed decision is crucial to ensuring you obtain the right insurance for your needs.

Performance Analysis: Real-World Examples of Online Auto Insurance

To illustrate the effectiveness and benefits of online auto insurance, let's delve into a few real-world examples. These case studies showcase how individuals have successfully navigated the online insurance landscape to secure the best coverage for their vehicles.

Case Study 1: John's Journey to Affordable Coverage

John, a recent college graduate, was in the market for his first car insurance policy. With a limited budget and a need for comprehensive coverage, he turned to online insurance platforms for assistance. John began by comparing quotes from multiple providers, taking into account factors such as coverage limits, deductibles, and additional benefits.

After careful consideration, John opted for a policy that offered excellent liability coverage, comprehensive and collision coverage with a reasonable deductible, and added roadside assistance for extra peace of mind. The online platform he used provided a seamless process, allowing him to purchase his policy in a matter of minutes. John was impressed by the platform's user-friendly interface and the ability to customize his coverage to fit his specific needs.

Furthermore, the platform's educational resources proved invaluable. John utilized the platform's articles and guides to gain a deeper understanding of auto insurance, including common terms, coverage types, and factors that influence premiums. This knowledge empowered him to make an informed decision and negotiate with his provider to obtain the best rate possible.

Case Study 2: Sarah's Experience with Customization and Convenience

Sarah, a busy professional with a tight schedule, needed to renew her auto insurance policy. She valued both convenience and customization, so she opted to explore online insurance platforms. Sarah was impressed by the range of coverage options and the ability to tailor her policy to her specific needs.

After assessing her coverage needs, Sarah chose a policy that provided comprehensive coverage for her vehicle, including liability, collision, and comprehensive coverage. She also added rental car reimbursement and personal injury protection to her policy, ensuring she had the protection she needed for various scenarios. The online platform she used offered a straightforward purchase process, allowing her to complete the entire transaction in just a few clicks.

Sarah was particularly pleased with the platform's mobile app, which provided added convenience for managing her policy. With the app, she could easily access her policy details, make payments, and report any claims. The app's intuitive design and push notifications ensured Sarah remained informed and in control of her insurance needs, even while on the go.

Evidence-Based Future Implications of Online Auto Insurance

The rise of online auto insurance platforms has had a significant impact on the insurance industry, and its future implications are poised to be even more transformative. As more individuals embrace digital insurance services, the industry is likely to witness several key developments.

Firstly, the competitive nature of the online insurance market is expected to drive continued innovation and improved services. Providers will increasingly focus on enhancing their online platforms, offering more user-friendly interfaces, streamlined processes, and enhanced customization options. This competitive environment will benefit consumers, who will have access to a wider range of choices and more competitive pricing.

Secondly, the integration of advanced technologies, such as artificial intelligence and machine learning, is set to revolutionize the online insurance experience. These technologies will enable more accurate risk assessments, personalized coverage recommendations, and efficient claim processing. For example, AI-powered chatbots and virtual assistants could provide instant support and guidance, enhancing the overall customer experience.

Additionally, the increasing adoption of telematics and usage-based insurance is expected to play a significant role in the future of online auto insurance. Telematics devices and smartphone apps can track driving behavior, offering real-time data on factors such as mileage, speed, and driving habits. This data can be used to provide more accurate insurance quotes and encourage safer driving practices, leading to potential premium discounts for policyholders.

Lastly, the expansion of online insurance platforms into new markets and regions is likely to increase accessibility and convenience for consumers. As these platforms continue to evolve and cater to diverse needs, they will become a go-to option for individuals seeking affordable and tailored insurance coverage. This expansion will contribute to a more inclusive and accessible insurance landscape, benefiting individuals and businesses alike.

Conclusion: Embracing the Future of Auto Insurance

The world of auto insurance is undergoing a digital transformation, and online insurance platforms are at the forefront of this evolution. By embracing these digital services, individuals can access a wealth of benefits, including convenience, cost savings, enhanced customization, and educational resources. The case studies presented in this guide demonstrate the real-world impact of online auto insurance, showcasing how individuals can successfully navigate this landscape to obtain the best coverage for their needs.

As we look to the future, the continued growth and innovation of online auto insurance platforms are set to revolutionize the industry. With advanced technologies, improved services, and expanded accessibility, these platforms will play a pivotal role in shaping the insurance landscape. By staying informed and leveraging the tools and resources available, individuals can make informed decisions and secure the right coverage to protect their vehicles and themselves.

In conclusion, the journey towards obtaining auto insurance has become more accessible and streamlined thanks to the advent of online insurance platforms. These platforms offer a convenient, efficient, and personalized approach to securing comprehensive coverage for your vehicle. By understanding the key aspects of online auto insurance and leveraging the benefits it provides, you can make informed decisions and secure the best coverage for your unique circumstances.

Frequently Asked Questions

What are the key benefits of online auto insurance?

+Online auto insurance offers several key benefits, including convenience, competitive pricing, enhanced customization, and educational resources. It provides a seamless process for obtaining quotes, comparing policies, and purchasing coverage from the comfort of your home. Additionally, online platforms often offer more competitive rates due to reduced overhead costs. The ability to customize your policy to fit your specific needs is another significant advantage, ensuring you're not paying for coverage you don't require.

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right online auto insurance provider?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When selecting an online auto insurance provider, consider factors such as coverage options, reputation, customer service, and user-friendliness. Evaluate the range of coverage types offered and ensure the provider aligns with your specific needs. Assess the provider's reputation and customer service track record through online reviews and ratings. Look for a provider with a responsive and knowledgeable support team. Lastly, consider the convenience and ease of use of the provider's online platform, ensuring it meets your expectations for a seamless insurance experience.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my online auto insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! One of the standout features of online auto insurance is the ability to customize your policy to fit your specific needs. Whether you require comprehensive coverage, liability-only insurance, or additional coverage enhancements, online platforms offer a range of options to choose from. You can tailor your policy to cover your vehicle, driving habits, and potential risks, ensuring you have the protection you desire without paying for unnecessary coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts available for online auto insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many online auto insurance providers offer a variety of discounts to their policyholders. These discounts can include multi-policy discounts (when you bundle your auto insurance with other policies like homeowners or renters insurance), safe driver discounts, good student discounts, and loyalty discounts for long-term customers. It's worth inquiring about these discounts when comparing quotes and negotiating with your provider to ensure you're getting the best rate possible.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the claims process like for online auto insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The claims process for online auto insurance policies is designed to be straightforward and efficient. Most providers offer multiple channels for reporting claims, including online forms, phone calls, and mobile apps. You'll typically be guided through the process, providing details about the incident and any relevant documentation. The provider will then assess the claim and provide a resolution, which could include repairs, replacement costs, or compensation. Many online platforms also offer resources and guides to help you navigate the claims process smoothly.</p>

</div>

</div>