In today's fast-paced world, convenience and efficiency are key, and this extends to how we manage our insurance needs. Obtaining online car insurance quotes has become an increasingly popular way for individuals to quickly and easily compare insurance options and find the best coverage for their vehicles. This article delves into the world of online car insurance quotes, exploring their benefits, the process of obtaining them, and the factors that influence the quotes you receive. Whether you're a seasoned driver or a first-time car owner, understanding the ins and outs of online car insurance quotes can empower you to make informed decisions and secure the right coverage for your unique situation.

The Benefits of Online Car Insurance Quotes

Online car insurance quotes offer a plethora of advantages that have contributed to their rising popularity among vehicle owners. One of the primary benefits is the convenience they provide. With just a few clicks, you can access multiple insurance quotes from the comfort of your home, eliminating the need for in-person visits or lengthy phone calls. This efficiency saves time and effort, allowing you to quickly compare a wide range of insurance options and find the best fit for your needs.

Another significant advantage is the transparency and clarity that online quotes offer. Insurance providers are required to disclose detailed information about their policies, including coverage limits, deductibles, and any applicable discounts. This transparency ensures that you understand exactly what you're getting and allows for an apples-to-apples comparison between different providers. You can easily review and analyze the quotes side by side, making it simpler to identify the most suitable and cost-effective option for your vehicle.

Online car insurance quotes also facilitate a competitive marketplace, encouraging insurance providers to offer attractive rates and incentives to stand out. This competition often leads to better deals and discounts for consumers, as providers strive to remain competitive and retain customers. By comparing multiple quotes, you can take advantage of these competitive offerings and potentially save a significant amount on your car insurance premiums.

Furthermore, the online process is flexible and accessible, accommodating various schedules and preferences. Whether you're a busy professional or a student with a packed timetable, you can access quotes at any time that suits you. The process is typically straightforward and user-friendly, allowing you to obtain quotes quickly without the need for extensive paperwork or complex procedures.

The Process of Obtaining Online Car Insurance Quotes

Obtaining online car insurance quotes is a straightforward and user-friendly process that typically involves a few simple steps. Here’s a breakdown of what you can expect:

Step 1: Gather Relevant Information

Before you begin, it’s essential to have the necessary information readily available. This includes details about your vehicle, such as the make, model, year, and vehicle identification number (VIN). You’ll also need your driver’s license number and information about any existing insurance coverage you may have. Additionally, gather details about your driving history, including any accidents, violations, or claims you’ve made in the past.

Step 2: Visit Insurance Provider Websites

Visit the websites of reputable insurance providers that offer online quoting services. You can start with a few well-known providers or use online comparison tools that aggregate quotes from multiple insurers. These platforms often provide a user-friendly interface where you can input your information and instantly receive quotes from various providers.

Step 3: Provide Vehicle and Driver Details

On the insurance provider’s website or comparison tool, you’ll be prompted to enter the required information about your vehicle and yourself. This typically includes the make, model, and year of your car, as well as your personal details, such as your name, date of birth, and driver’s license number. Some providers may also ask for additional information, such as the primary use of your vehicle (e.g., commuting, pleasure driving) and the estimated annual mileage.

Step 4: Receive and Compare Quotes

Once you’ve provided the necessary information, the insurance provider’s system will generate a quote based on the details you’ve entered. This quote will typically include information about the coverage options available, the associated premiums, and any applicable discounts. Take your time to carefully review and compare the quotes from different providers, paying attention to the coverage limits, deductibles, and any exclusions.

Step 5: Consider Additional Factors

While the quotes provide a snapshot of the insurance options, it’s important to consider other factors that may influence your decision. For instance, evaluate the financial stability and reputation of the insurance provider, as well as their customer service and claims handling processes. Consider any additional benefits or perks offered, such as roadside assistance or rental car coverage. It’s also beneficial to read reviews and seek recommendations from trusted sources to ensure you’re choosing a reliable insurer.

Step 6: Select the Right Coverage

After carefully reviewing and comparing the quotes, as well as considering the additional factors, it’s time to make a decision. Choose the insurance provider and coverage option that best aligns with your needs and budget. Keep in mind that while finding the most affordable premium is important, it’s equally crucial to ensure that the coverage is comprehensive and provides adequate protection for your vehicle and yourself.

Factors Influencing Online Car Insurance Quotes

Online car insurance quotes are influenced by a variety of factors, each playing a role in determining the premiums you receive. Understanding these factors can help you navigate the quoting process and potentially secure more favorable rates.

Vehicle Information

The type of vehicle you own is a significant factor in determining your insurance quote. Make, model, and year all come into play, as certain vehicles may be more expensive to insure due to factors like their repair costs, safety ratings, or theft rates. Additionally, the primary use of your vehicle, such as commuting, pleasure driving, or business purposes, can also impact your quote. Insurers may offer lower rates for vehicles primarily used for pleasure driving, as they are considered lower risk.

Driver Profile

Your driving history is a crucial factor in determining your insurance quote. Insurers carefully evaluate your record, taking into account any accidents, violations, or claims you’ve made in the past. A clean driving record typically leads to lower premiums, while a history of accidents or traffic violations may result in higher rates. Additionally, your age, gender, and marital status can also influence your quote, as these factors are statistically linked to risk levels.

Coverage Options

The coverage limits and deductibles you choose will have a direct impact on your insurance quote. Opting for higher coverage limits and lower deductibles generally results in higher premiums, as you’re asking for more protection and assuming less financial risk. Conversely, choosing lower coverage limits and higher deductibles can lead to more affordable premiums, but it’s important to ensure that you have adequate coverage for your needs.

Discounts and Incentives

Insurance providers often offer a range of discounts and incentives to attract and retain customers. These discounts can significantly reduce your insurance premiums and are worth exploring. Common discounts include multi-policy discounts (if you bundle your car insurance with other policies like homeowners or renters insurance), safe driver discounts (for maintaining a clean driving record), good student discounts (for young drivers with good academic performance), and loyalty discounts (for long-term customers). It’s beneficial to inquire about these discounts when obtaining quotes to see if you’re eligible and how they can impact your overall premium.

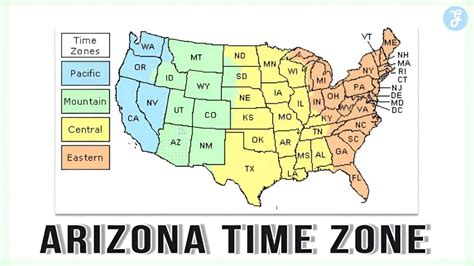

Location and Usage

Your geographic location and annual mileage are also considered when determining your insurance quote. Insurers take into account the specific risks associated with your area, such as the rate of accidents, thefts, or natural disasters. Additionally, the estimated annual mileage you provide can influence your quote, as insurers factor in the risk associated with driving more or less frequently.

| Factor | Impact on Quote |

|---|---|

| Vehicle Type | Make, model, and year influence repair costs and risk. |

| Driver Profile | Clean driving record leads to lower premiums; accidents and violations increase rates. |

| Coverage Options | Higher limits and lower deductibles result in higher premiums. |

| Discounts and Incentives | Discounts can significantly reduce premiums; explore eligibility. |

| Location and Usage | Location-specific risks and annual mileage impact quotes. |

Future Implications and Trends in Online Car Insurance Quotes

The landscape of online car insurance quotes is constantly evolving, with new technologies and trends shaping the way insurance providers operate and engage with customers. Here are some key future implications and trends to consider:

Advanced Data Analytics

Insurance providers are increasingly leveraging advanced data analytics and artificial intelligence to refine their risk assessment processes. By analyzing vast amounts of data, insurers can more accurately predict potential risks and personalize insurance quotes based on individual profiles. This shift towards data-driven decision-making is expected to result in more precise and tailored quotes, benefiting both insurers and consumers.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction, offering drivers the opportunity to influence their insurance rates based on their actual driving behavior. With telematics devices installed in vehicles, insurers can monitor driving habits, such as speeding, harsh braking, and mileage. This real-time data allows insurers to provide more accurate quotes and potentially offer discounts to safe drivers. Usage-based insurance is expected to become more prevalent, empowering drivers to take control of their insurance costs.

Digitalization and Automation

The digitalization and automation of insurance processes are set to continue, further streamlining the quoting and claims handling experiences. Online platforms and mobile apps will become even more user-friendly, allowing customers to obtain quotes, manage policies, and file claims with ease. Additionally, automation will reduce processing times and administrative burdens, resulting in faster and more efficient insurance services.

Personalized Insurance Solutions

Insurers are recognizing the value of personalized insurance solutions that cater to the unique needs and circumstances of individual customers. By leveraging data analytics and understanding customer preferences, insurers can offer tailored coverage options and add-ons. This shift towards personalized insurance reflects a growing emphasis on customer-centric approaches, ensuring that policies align with the specific risks and requirements of each policyholder.

Collaboration and Partnerships

The insurance industry is witnessing increased collaboration and partnerships between insurers and technology companies. These partnerships aim to enhance the insurance experience by integrating innovative technologies and digital solutions. Insurers are exploring collaborations with tech startups and established tech giants to develop new products, improve customer engagement, and streamline operational processes. Such collaborations are expected to drive innovation and enhance the overall insurance ecosystem.

Regulatory Changes and Industry Standards

Regulatory bodies and industry associations are continuously updating standards and guidelines to keep pace with technological advancements and evolving consumer needs. Insurance providers must adhere to these regulations, which may impact the way quotes are calculated and presented. It’s important for consumers to stay informed about any changes in regulations to understand their rights and responsibilities when obtaining insurance quotes online.

Expanding Digital Presence and Accessibility

Insurance providers are expanding their digital presence and accessibility to reach a broader audience. This includes optimizing their websites for mobile devices, offering seamless online quoting processes, and providing comprehensive online resources and educational materials. By embracing digital transformation, insurers aim to improve customer engagement and make insurance more accessible and convenient for all.

Can I get an online car insurance quote without providing personal information?

+No, providing personal information is typically required to obtain an accurate online car insurance quote. Insurance providers need details about your vehicle and driving history to assess your risk and calculate an appropriate premium.

How often should I shop for online car insurance quotes?

+It’s recommended to review and compare online car insurance quotes annually or whenever you experience a significant life change, such as getting married, moving to a new location, or purchasing a new vehicle. Regularly shopping for quotes can help you identify potential savings and ensure you have the most suitable coverage.

What are some common mistakes to avoid when obtaining online car insurance quotes?

+Avoid rushing through the quoting process and ensure you provide accurate and up-to-date information. Double-check your vehicle and driver details, and carefully review the coverage options and any applicable discounts. Also, be cautious of overly low quotes that may indicate inadequate coverage or hidden fees.