Optum Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. The Optum HSA is designed to help individuals and families save for healthcare costs while also providing a tax-advantaged way to invest for the future. In this article, we will delve into the details of the Optum HSA, its benefits, and how it can be used to manage healthcare expenses.

Introduction to Optum Health Savings Account

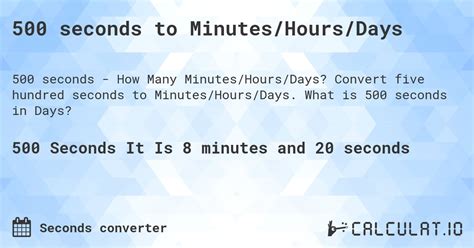

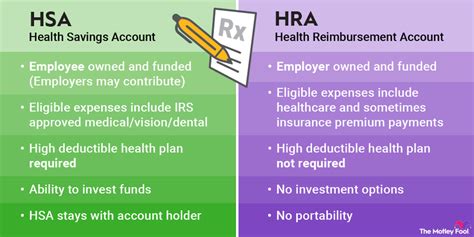

The Optum HSA is a consumer-directed healthcare account that allows individuals to contribute a portion of their income to a savings account on a pre-tax basis. The funds in the account can be used to pay for qualified medical expenses, such as doctor visits, hospital stays, and prescription medications. The Optum HSA is designed to be a flexible and portable account, meaning that individuals can take it with them if they change jobs or retire.

Key Points

- The Optum HSA is a type of savings account that allows individuals to set aside pre-tax dollars for medical expenses.

- The account is designed for individuals with high-deductible health plans (HDHPs).

- Funds in the account can be used to pay for qualified medical expenses, such as doctor visits and prescription medications.

- The Optum HSA is a flexible and portable account that can be taken with you if you change jobs or retire.

- Contributions to the account are tax-deductible, and earnings on the account are tax-free.

Benefits of the Optum Health Savings Account

The Optum HSA offers several benefits to individuals and families, including:

- Tax advantages: Contributions to the account are tax-deductible, and earnings on the account are tax-free.

- Flexibility: The account can be used to pay for a wide range of qualified medical expenses, including doctor visits, hospital stays, and prescription medications.

- Portability: The account is portable, meaning that individuals can take it with them if they change jobs or retire.

- Investment opportunities: The account offers investment opportunities, allowing individuals to grow their savings over time.

According to the Internal Revenue Service (IRS), individuals can contribute up to $3,600 in 2023 to an HSA if they have self-only coverage, and up to $7,200 if they have family coverage. Additionally, individuals 55 and older can contribute an extra $1,000 per year.

| Contribution Limits | 2023 |

|---|---|

| Self-only coverage | $3,600 |

| Family coverage | $7,200 |

| Catch-up contribution (55 and older) | $1,000 |

How to Use the Optum Health Savings Account

To use the Optum HSA, individuals must first open an account and fund it with contributions. The account can be funded through payroll deductions or by making a lump-sum contribution. Once the account is funded, individuals can use the funds to pay for qualified medical expenses.

Qualified medical expenses include:

- Doctor visits

- Hospital stays

- Prescription medications

- Medical equipment

- Dental and vision care

Individuals can access their account funds using a debit card or by submitting a claim for reimbursement. The Optum HSA also offers online tools and resources to help individuals manage their account and track their expenses.

Investment Opportunities with the Optum Health Savings Account

The Optum HSA offers investment opportunities, allowing individuals to grow their savings over time. The account offers a range of investment options, including:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

Individuals can choose to invest their account funds in one or more of these options, depending on their investment goals and risk tolerance. The Optum HSA also offers online tools and resources to help individuals manage their investments and track their performance.

Conclusion

In conclusion, the Optum Health Savings Account is a valuable tool for individuals and families to manage their healthcare expenses. The account offers tax advantages, flexibility, and portability, making it an attractive option for those with high-deductible health plans. By understanding the benefits and rules surrounding the Optum HSA, individuals can make informed decisions about their healthcare expenses and take control of their financial well-being.

What is the Optum Health Savings Account?

+The Optum Health Savings Account is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses.

How do I contribute to the Optum HSA?

+Individuals can contribute to the Optum HSA through payroll deductions or by making a lump-sum contribution.

What are the investment opportunities with the Optum HSA?

+The Optum HSA offers a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

Meta description: “Learn about the Optum Health Savings Account, a tax-advantaged account for individuals with high-deductible health plans. Discover the benefits, rules, and investment opportunities of the Optum HSA.” (149 characters)