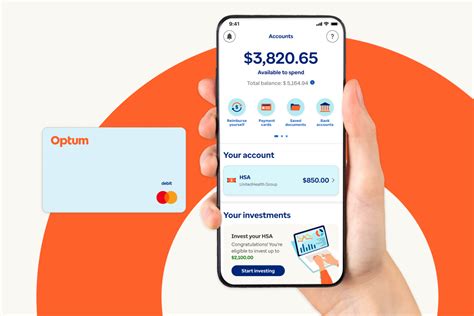

Optum Health Savings is a comprehensive approach to managing healthcare expenses, offered by Optum, a leading health services company. As a key player in the healthcare industry, Optum provides innovative solutions to help individuals and families navigate the complexities of healthcare financing. With the rising costs of medical care, health savings options have become increasingly important for those seeking to optimize their healthcare spending. In this article, we will delve into the details of Optum Health Savings, exploring its features, benefits, and how it can help individuals make the most of their healthcare dollars.

Key Points

- Optum Health Savings offers a range of tools and resources to manage healthcare expenses

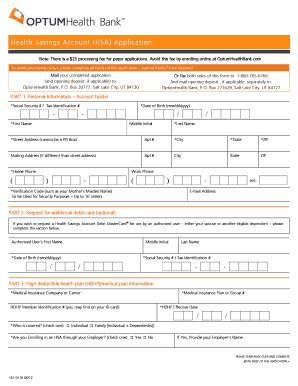

- Flexible spending accounts (FSAs) and health savings accounts (HSAs) are available options

- Optum's platform provides personalized recommendations for maximizing health savings

- Integration with existing health plans and insurance coverage is seamless

- Expert guidance and support are available to help individuals make informed decisions

Understanding Health Savings Options

Health savings options, such as flexible spending accounts (FSAs) and health savings accounts (HSAs), are designed to help individuals set aside pre-tax dollars for qualified medical expenses. These accounts can be used to cover a wide range of healthcare costs, including deductibles, copayments, and prescription medications. By utilizing health savings options, individuals can reduce their taxable income, while also building a safety net for unexpected medical expenses. Optum Health Savings offers a variety of tools and resources to help individuals navigate these options and make informed decisions about their healthcare spending.

Flexible Spending Accounts (FSAs)

FSAs are a type of health savings account that allows individuals to set aside pre-tax dollars for qualified medical expenses. These accounts are typically offered through an employer-sponsored benefits plan and can be used to cover expenses such as medical copayments, prescription medications, and dental care. FSAs are subject to certain rules and limitations, including a “use it or lose it” provision, which requires individuals to use their FSA funds within a specified timeframe or risk forfeiting the remaining balance. Optum Health Savings provides expert guidance and support to help individuals navigate the complexities of FSAs and maximize their healthcare savings.

| Account Type | Contribution Limit | Eligible Expenses |

|---|---|---|

| Flexible Spending Account (FSA) | $2,850 (2022) | Medical copayments, prescription medications, dental care |

| Health Savings Account (HSA) | $3,650 (2022) individual, $7,300 (2022) family | Qualified medical expenses, including deductibles, copayments, and prescription medications |

Health Savings Accounts (HSAs)

HSAs are a type of health savings account that allows individuals to set aside pre-tax dollars for qualified medical expenses. These accounts are designed to be used in conjunction with a high-deductible health plan (HDHP) and offer a range of benefits, including tax-free growth and withdrawals for qualified medical expenses. HSAs are a popular option for individuals who want to take control of their healthcare spending and build a long-term safety net for future medical expenses. Optum Health Savings provides a range of resources and tools to help individuals navigate the complexities of HSAs and maximize their healthcare savings.

Maximizing Health Savings with Optum

Optum Health Savings offers a range of tools and resources to help individuals maximize their healthcare savings. From personalized recommendations to expert guidance and support, Optum’s platform is designed to help individuals make informed decisions about their healthcare spending. With Optum Health Savings, individuals can take control of their healthcare expenses, reduce their taxable income, and build a long-term safety net for future medical expenses.

What is the difference between a flexible spending account (FSA) and a health savings account (HSA)?

+FSAs and HSAs are both health savings accounts, but they have distinct differences. FSAs are typically offered through an employer-sponsored benefits plan and are subject to a "use it or lose it" provision, while HSAs are designed to be used in conjunction with a high-deductible health plan (HDHP) and offer tax-free growth and withdrawals for qualified medical expenses.

How do I contribute to a health savings account (HSA)?

+To contribute to an HSA, you must have a high-deductible health plan (HDHP) and meet certain eligibility requirements. You can contribute to an HSA through payroll deductions or by making individual contributions. The annual contribution limit for HSAs is $3,650 for individual coverage and $7,300 for family coverage in 2022.

Can I use my health savings account (HSA) to pay for non-medical expenses?

+No, HSAs are designed to be used for qualified medical expenses only. If you use your HSA to pay for non-medical expenses, you may be subject to penalties and taxes. It's essential to understand the rules and regulations surrounding HSAs to ensure you're using your account correctly.

In conclusion, Optum Health Savings offers a comprehensive approach to managing healthcare expenses, providing individuals with the tools and resources they need to make informed decisions about their healthcare spending. By understanding the features and benefits of health savings options, such as FSAs and HSAs, individuals can take control of their healthcare expenses, reduce their taxable income, and build a long-term safety net for future medical expenses. With Optum Health Savings, individuals can optimize their healthcare spending and achieve a better financial future.