Managing health savings accounts (HSAs) efficiently is crucial for individuals looking to optimize their healthcare expenses and savings. For those enrolled in health plans through Optum, a leading health services and technology company, understanding the Optum login HSA process is essential. This article delves into the world of Optum's HSA management, exploring the login process, benefits of using an HSA through Optum, and tips for maximizing the utility of these accounts.

Understanding Optum and HSAs

Optum, part of the UnitedHealth Group, offers a variety of health financial services, including health savings accounts. HSAs are designed for individuals with high-deductible health plans (HDHPs), allowing them to set aside pre-tax dollars for medical expenses. The funds in an HSA are yours to keep, even if you change jobs or retire, making them a valuable tool for long-term health care savings.

Benefits of Using an HSA through Optum

Optum’s HSA platform provides users with a convenient and secure way to manage their health savings. Key benefits include:

- Tax Advantages: Contributions to an HSA are tax-deductible, and the funds grow tax-free. Withdrawals for qualified medical expenses are also tax-free.

- Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire.

- Investment Options: Many HSA plans, including those offered through Optum, allow you to invest your HSA funds, potentially growing your savings over time.

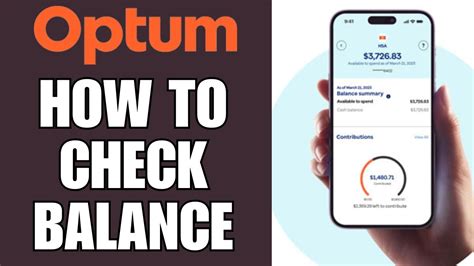

- Convenience: Optum’s online platform and mobile app make it easy to manage your HSA, check balances, and make payments.

Optum Login HSA Process

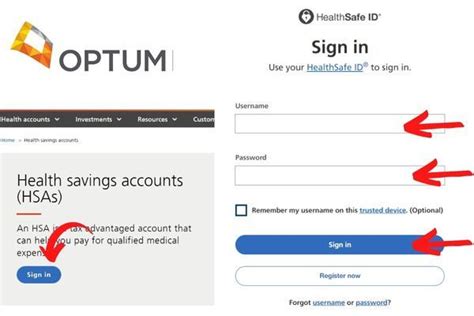

To log in to your Optum HSA account, follow these steps:

- Visit the Optum website and navigate to the login section.

- Enter your username and password. If you’re a first-time user, you may need to register and create an account.

- Once logged in, you can view your account balance, manage investments, make contributions, or reimburse yourself for qualified medical expenses.

Tips for Maximizing Your HSA

To get the most out of your Optum HSA, consider the following tips:

- Contribute Regularly: Take advantage of the tax benefits by contributing to your HSA regularly, even if it’s a small amount each month.

- Keep Receipts: Always keep receipts for medical expenses, as you’ll need these to reimburse yourself from your HSA.

- Invest Wisely: If your plan allows investments, consider consulting with a financial advisor to make informed decisions that align with your risk tolerance and long-term goals.

| Feature | Benefit |

|---|---|

| Pre-tax Contributions | Reduces taxable income |

| Tax-free Growth | Increases savings over time without tax liability |

| Tax-free Withdrawals for Qualified Expenses | Reduces out-of-pocket medical expenses |

Key Points

- Optum's HSA platform offers a secure and convenient way to manage health savings.

- HSAs provide tax advantages, portability, and potential for investment growth.

- Regular contributions, keeping receipts, and wise investment decisions can maximize HSA benefits.

- Understanding the Optum login HSA process is essential for managing your account effectively.

- Consulting with financial advisors can help in making informed investment decisions.

In conclusion, managing your health savings through an Optum HSA can be a strategic move for your financial and health well-being. By understanding the benefits, login process, and tips for maximizing your HSA, you can make the most out of this valuable health financial tool. Remember, the key to benefiting from an HSA is consistent management and informed decision-making.

What are the eligibility criteria for opening an HSA through Optum?

+To be eligible for an HSA, you must have a high-deductible health plan (HDHP) and not be enrolled in any other health coverage, such as Medicare or a general health plan. You also cannot be claimed as a dependent on someone else’s tax return.

Can I use my HSA funds for non-medical expenses?

+Yes, but be aware that using HSA funds for non-medical expenses before age 65 will result in a 20% penalty and the amount will be subject to income tax. After age 65, you can use your HSA funds for non-medical expenses without the penalty, but the amount will still be subject to income tax.

How do I invest my HSA funds through Optum?

+Optum offers various investment options for HSA funds. You can log in to your account, navigate to the investments section, and choose from the available options. It’s recommended to consult with a financial advisor to make informed decisions based on your financial goals and risk tolerance.