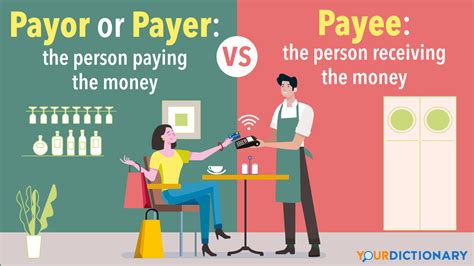

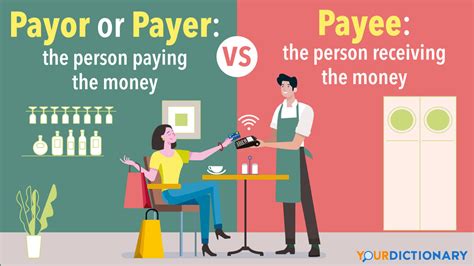

The terms payor and payee are fundamental concepts in finance, commerce, and everyday transactions. Understanding the distinction between these two roles is essential for navigating the complex world of payments, settlements, and financial obligations. In this article, we will delve into the definitions, roles, and implications of payors and payees, providing clarity on their functions and responsibilities within various transactional contexts.

Key Points

- The payor is the entity that initiates a payment or settlement, transferring funds to fulfill an obligation or purchase.

- The payee is the recipient of the payment, receiving the funds transferred by the payor to settle a debt, provide goods or services, or fulfill a contractual agreement.

- Payors and payees can be individuals, businesses, organizations, or government entities, depending on the context of the transaction.

- Understanding the roles of payors and payees is crucial for managing financial risks, ensuring compliance with regulations, and maintaining healthy business relationships.

- Effective communication and clear agreements between payors and payees are essential for preventing disputes and facilitating smooth transactions.

Defining Payor and Payee Roles

A payor, also known as the payer, is an individual or entity that makes a payment to another party, known as the payee. The payor’s primary responsibility is to initiate the payment, ensuring that the funds are transferred accurately and efficiently. This role involves not only the physical act of making the payment but also the associated administrative tasks, such as recording the transaction, updating accounts, and ensuring compliance with relevant laws and regulations.

In contrast, the payee is the recipient of the payment, who receives the funds transferred by the payor. The payee's role is to acknowledge the payment, update their records, and provide any necessary documentation or services as agreed upon in the transaction. Payees must also ensure that they comply with all relevant laws, regulations, and contractual obligations related to the receipt of payments.

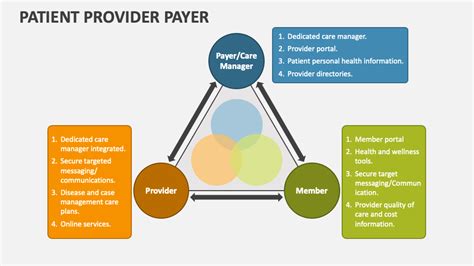

Payor and Payee Relationships in Different Contexts

The payor-payee relationship can manifest in various contexts, including business-to-business (B2B) transactions, business-to-consumer (B2C) transactions, and person-to-person (P2P) transactions. In each context, the roles and responsibilities of payors and payees may vary, but the fundamental principles of initiating and receiving payments remain the same.

For instance, in a B2B transaction, a company (payor) might purchase goods or services from another company (payee). The payor would initiate the payment, and the payee would receive the funds, providing the agreed-upon goods or services. In a B2C transaction, an individual (payor) might purchase a product or service from a business (payee), with the payor making the payment and the payee delivering the product or service.

| Transaction Type | Payor | Payee |

|---|---|---|

| B2B | Company A | Company B |

| B2C | Individual | Business |

| P2P | Person A | Person B |

Implications of Payor and Payee Roles

Understanding the roles of payors and payees has significant implications for individuals and businesses alike. Effective management of payor and payee relationships can help mitigate financial risks, ensure compliance with regulations, and foster healthy business relationships. Conversely, misunderstandings or miscommunications between payors and payees can lead to disputes, delayed payments, or even legal issues.

Moreover, the payor-payee relationship is often subject to various laws, regulations, and industry standards, which can vary depending on the context and jurisdiction. Payors and payees must be aware of these requirements and ensure that their transactions comply with all relevant rules and guidelines.

Best Practices for Payors and Payees

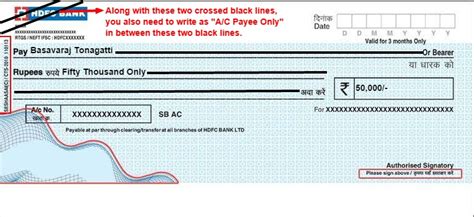

To navigate the complexities of payor and payee relationships, it’s essential to establish clear agreements, maintain open communication, and ensure transparency throughout the transaction process. Payors should verify the identity and legitimacy of payees, while payees should provide accurate and timely information about their payment requirements and processing procedures.

Additionally, payors and payees should be aware of potential risks and take steps to mitigate them. This may include implementing security measures to prevent fraud, using trusted payment systems, and monitoring transactions for any discrepancies or anomalies.

What is the primary responsibility of a payor in a transaction?

+The primary responsibility of a payor is to initiate the payment, ensuring that the funds are transferred accurately and efficiently.

What is the role of a payee in a transaction?

+The payee is the recipient of the payment, who receives the funds transferred by the payor and provides any necessary documentation or services as agreed upon in the transaction.

What are some best practices for payors and payees to ensure smooth transactions?

+Best practices include establishing clear agreements, maintaining open communication, ensuring transparency, verifying identities, and implementing security measures to prevent fraud.

In conclusion, the payor and payee roles are fundamental components of any transaction, and understanding their responsibilities and implications is crucial for navigating the complex world of finance and commerce. By recognizing the importance of clear communication, transparency, and compliance with regulations, individuals and businesses can mitigate risks, foster healthy relationships, and ensure efficient transactions.