Penn State, one of the largest and most reputable universities in the United States, offers a wide range of financial aid options to help students and their families manage the cost of higher education. With a strong commitment to making education accessible and affordable, Penn State provides various forms of assistance, including grants, scholarships, loans, and work-study programs. In this article, we will delve into the different types of financial aid available at Penn State, exploring the eligibility criteria, application processes, and benefits of each option.

Types of Financial Aid at Penn State

Penn State offers several types of financial aid to cater to the diverse needs of its students. These include:

- Grants: Need-based grants, such as the Federal Pell Grant and the Pennsylvania State Grant, are available to undergraduate students who demonstrate financial need.

- Scholarships: Merit-based and need-based scholarships are offered by Penn State, as well as by external organizations and private donors.

- Loans: Federal Direct Loans, such as the Subsidized and Unsubsidized Loans, are available to undergraduate and graduate students, while the Federal PLUS Loan is available to graduate students and parents of undergraduate students.

- Work-Study Programs: The Federal Work-Study (FWS) program provides part-time jobs to undergraduate and graduate students, allowing them to earn money to help cover educational expenses.

Key Points

- Penn State offers various types of financial aid, including grants, scholarships, loans, and work-study programs.

- Eligibility for financial aid is determined by the Free Application for Federal Student Aid (FAFSA).

- The FAFSA should be submitted by the priority deadline of February 15 for the upcoming academic year.

- Grant and scholarship awards are typically awarded on a first-come, first-served basis.

- Loan and work-study awards are also subject to funding availability and eligibility criteria.

Eligibility Criteria and Application Process

To be eligible for financial aid at Penn State, students must complete the Free Application for Federal Student Aid (FAFSA) by the priority deadline of February 15 for the upcoming academic year. The FAFSA is used to determine a student’s Expected Family Contribution (EFC), which is then used to determine eligibility for need-based financial aid. Students who complete the FAFSA will be considered for all types of financial aid, including grants, scholarships, loans, and work-study programs.

The FAFSA requires students to provide detailed financial information, including income, assets, and family size. The application process typically takes several weeks to complete, and students can track the status of their application online. It is essential to submit the FAFSA as early as possible, as some types of financial aid are awarded on a first-come, first-served basis.

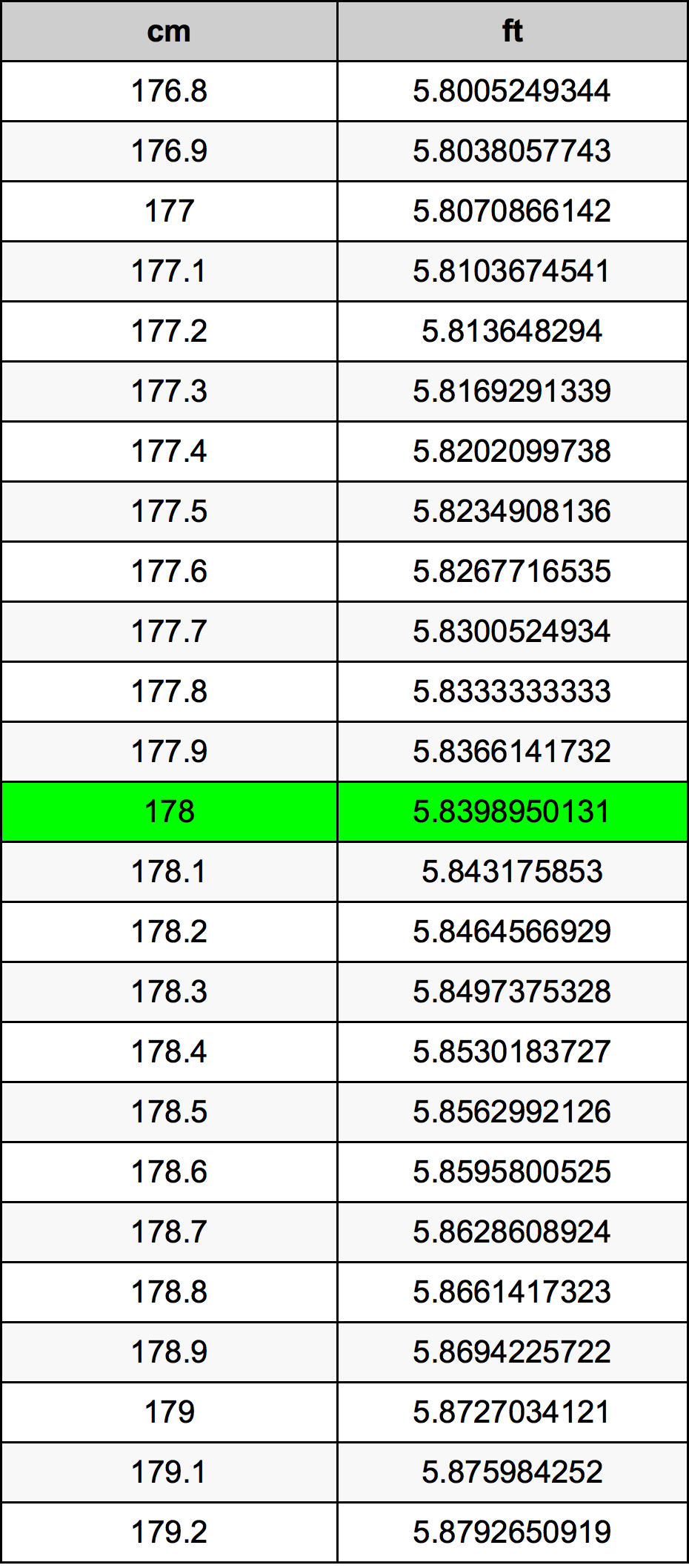

| Financial Aid Type | Eligibility Criteria | Award Amount |

|---|---|---|

| Federal Pell Grant | Undergraduate students with demonstrated financial need | Up to $6,345 for the 2022-2023 academic year |

| Pennsylvania State Grant | Undergraduate students who are Pennsylvania residents | Up to $4,370 for the 2022-2023 academic year |

| Federal Direct Loan | Undergraduate and graduate students who are enrolled at least half-time | Up to $12,500 for undergraduate students and up to $20,500 for graduate students |

Additional Financial Aid Resources

In addition to the types of financial aid mentioned earlier, Penn State offers several other resources to help students manage the cost of education. These include:

- Tuition Payment Plans: Penn State offers a tuition payment plan that allows students to pay tuition and fees in installments, rather than all at once.

- Emergency Loans: Emergency loans are available to students who experience unexpected financial difficulties, such as a family emergency or unexpected medical expenses.

- Financial Counseling: Penn State offers financial counseling services to help students and their families manage debt and develop a plan to pay for education expenses.

Strategic Considerations for Financial Aid

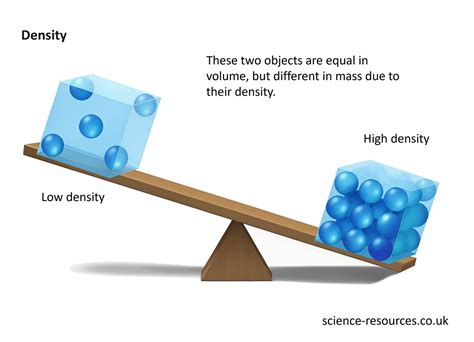

When considering financial aid options, it is essential to think strategically about the types of aid that will be most beneficial in the long run. For example, grants and scholarships are typically preferred over loans, as they do not need to be repaid. However, loans can be a necessary component of a comprehensive financial aid package, especially for students who require additional funding to cover educational expenses.

Work-study programs can also be a valuable resource, as they provide students with the opportunity to earn money to help cover educational expenses while gaining valuable work experience. By considering the various types of financial aid available and developing a strategic plan, students can maximize their eligibility for financial aid and minimize their debt burden.

What is the deadline for submitting the FAFSA?

+The priority deadline for submitting the FAFSA is February 15 for the upcoming academic year.

What types of financial aid are available to graduate students?

+Graduate students are eligible for Federal Direct Loans, as well as private loans and scholarships.

How do I apply for a work-study program?

+To apply for a work-study program, students must complete the FAFSA and indicate their interest in work-study on the application.

In conclusion, Penn State offers a comprehensive range of financial aid options to help students and their families manage the cost of higher education. By understanding the different types of financial aid available and developing a strategic plan, students can maximize their eligibility for financial aid and minimize their debt burden. Whether you are an undergraduate or graduate student, it is essential to explore the various financial aid resources available at Penn State and to seek guidance from financial aid experts to ensure that you are making informed decisions about your financial aid package.