Pet insurance is a rapidly growing industry, offering a safety net for pet owners to manage unexpected veterinary costs. As the demand for comprehensive pet healthcare increases, so does the need for an in-depth understanding of the insurance landscape. This comprehensive guide aims to shed light on the world of pet insurance companies, exploring their unique offerings, key features, and the impact they have on pet owners and their beloved companions.

The Rise of Pet Insurance: A Comprehensive Overview

Pet insurance has witnessed a significant surge in popularity over the past decade, with an increasing number of pet owners recognizing the value of financial protection for their furry friends. This section delves into the historical context, exploring the factors that have contributed to the rise of pet insurance and its evolving role in the pet healthcare industry.

One of the primary drivers of this growth is the rising cost of veterinary care. As medical advancements in veterinary science continue to progress, the treatments available for pets have become increasingly sophisticated and expensive. From specialized surgeries to advanced diagnostic tools, the financial burden on pet owners has grown exponentially. Pet insurance companies stepped in to provide a solution, offering policies that cover a wide range of medical conditions and procedures, ensuring that pets receive the best possible care without placing an undue strain on their owners' finances.

Furthermore, the changing demographics of pet ownership have played a pivotal role in the expansion of the pet insurance market. The traditional image of a pet owner as a middle-aged individual with a stable income and a single pet has evolved. Today, we see a diverse range of pet owners, including millennials, families with children, and even seniors, all embracing the joys of pet ownership. This diverse demographic brings with it a heightened awareness of pet health and a desire for comprehensive healthcare solutions. Pet insurance companies have adapted to cater to these varied needs, offering policies tailored to different life stages, breeds, and health conditions.

Key Trends Shaping the Industry

The pet insurance industry is characterized by several notable trends that are shaping its future trajectory. One of the most prominent trends is the increasing focus on preventative care. Insurance providers are recognizing the importance of proactive healthcare for pets, and as a result, many policies now include coverage for routine check-ups, vaccinations, and even wellness treatments such as dental care and obesity management. This shift towards preventative care not only benefits pet health but also helps to reduce the overall cost of veterinary services by identifying and addressing potential health issues early on.

Another trend gaining momentum is the integration of technology into pet insurance. Insurance companies are leveraging digital platforms and mobile applications to enhance the customer experience. Policyholders can now submit claims, track their reimbursement status, and even consult with veterinary professionals remotely. This digital transformation not only streamlines the insurance process but also provides pet owners with greater convenience and accessibility, ensuring they can access the necessary care for their pets without delay.

| Trend | Impact |

|---|---|

| Emphasis on Preventative Care | Improved long-term pet health and reduced overall veterinary costs. |

| Technology Integration | Enhanced customer experience, streamlined claims process, and improved access to veterinary services. |

Exploring Top Pet Insurance Companies: A Comparative Analysis

The pet insurance market is diverse, with numerous companies offering a range of policies and coverage options. This section provides an in-depth analysis of some of the leading pet insurance providers, highlighting their unique features, coverage options, and the value they bring to pet owners.

Company A: Focus on Innovation and Customization

Company A stands out in the industry for its commitment to innovation and personalized insurance solutions. They offer a range of customizable plans that allow pet owners to tailor their coverage based on their specific needs and budget. One of their standout features is the inclusion of alternative therapies such as acupuncture and hydrotherapy in their policies, recognizing the growing popularity of holistic pet healthcare.

Additionally, Company A has pioneered the use of advanced analytics to predict and manage pet health risks. By analyzing large datasets and leveraging machine learning algorithms, they can identify patterns and trends in pet health, enabling them to offer more accurate and targeted insurance plans. This innovative approach not only benefits pet owners by providing them with more precise coverage but also helps to drive down costs by preventing potential health issues before they arise.

Company B: Comprehensive Coverage and Exceptional Customer Service

Company B prides itself on its comprehensive coverage options and its dedication to exceptional customer service. They offer a wide range of policies, including accident-only plans, comprehensive health plans, and even plans tailored for senior pets. One of their unique selling points is the inclusion of unlimited annual vet visits in their comprehensive plans, ensuring pet owners can access veterinary care without worrying about reaching a coverage limit.

Furthermore, Company B has invested heavily in building a robust customer support network. They provide 24/7 access to a dedicated team of veterinary professionals who can offer advice and support to policyholders. This level of customer service not only enhances the overall experience but also provides peace of mind to pet owners, knowing they have a reliable partner to guide them through any pet health concerns.

Company C: Specializing in Breed-Specific Coverage

Company C takes a unique approach by specializing in breed-specific insurance plans. Recognizing that certain breeds are predisposed to specific health conditions, they have developed policies tailored to address these unique needs. For example, they offer specialized coverage for breeds prone to joint issues, such as hip dysplasia, ensuring that pet owners have access to the necessary treatments without financial strain.

In addition to their breed-specific focus, Company C also provides resources and educational materials to help pet owners better understand their pet's health risks. They offer breed-specific health guides and regular webinars hosted by veterinary experts, empowering pet owners to make informed decisions about their pet's healthcare and providing valuable insights into preventative measures.

| Company | Unique Features | Coverage Highlights |

|---|---|---|

| Company A | Customizable plans, alternative therapy coverage, predictive analytics | Tailored coverage, holistic healthcare options |

| Company B | Comprehensive plans, 24/7 customer support | Unlimited vet visits, broad coverage options |

| Company C | Breed-specific plans, educational resources | Targeted coverage for breed-related health issues |

Understanding Pet Insurance Policies: Key Considerations

Navigating the world of pet insurance policies can be daunting, with a myriad of coverage options and terms to decipher. This section aims to demystify the process, providing a comprehensive guide to understanding the key components of pet insurance policies and the factors to consider when selecting the right coverage for your furry companion.

Policy Types and Coverage Options

Pet insurance policies can generally be categorized into three main types: accident-only plans, illness-only plans, and comprehensive plans. Accident-only plans provide coverage for injuries resulting from accidents, such as fractures or lacerations. Illness-only plans, as the name suggests, cover a range of medical conditions, including chronic illnesses and injuries. Comprehensive plans offer the most extensive coverage, combining both accident and illness coverage into a single policy.

Within these policy types, there are further variations in coverage options. Some policies offer lifetime coverage, where the policy renews annually with no time limits on the benefits, while others provide annual coverage with a set benefit limit that resets each year. Additionally, policies may include coverage for routine care, such as vaccinations and spaying/neutering, or focus solely on unexpected medical emergencies.

Key Factors to Consider

When selecting a pet insurance policy, several key factors should be taken into consideration:

- Breed and Age: Different breeds and ages of pets may have varying health risks and predispositions. It's essential to choose a policy that caters to these specific needs.

- Coverage Limits: Understand the policy's coverage limits, including annual and lifetime limits, to ensure they align with your pet's potential healthcare needs.

- Deductibles and Co-pays: Be aware of the deductibles (the amount you pay before insurance coverage kicks in) and co-pays (your share of the cost after the deductible is met) to manage your out-of-pocket expenses effectively.

- Pre-existing Conditions: Clarify the policy's stance on pre-existing conditions to avoid any surprises. Some policies may exclude coverage for conditions that existed prior to enrollment.

- Wellness Coverage: Consider whether you require coverage for routine care and wellness treatments. Not all policies include these, so choose one that aligns with your pet's healthcare needs.

The Impact of Pet Insurance: A Transformative Force in Veterinary Medicine

The introduction and growth of pet insurance has had a profound impact on the veterinary medicine industry, transforming the way pet healthcare is delivered and perceived. This section explores the ways in which pet insurance has shaped the veterinary landscape and the benefits it brings to both pet owners and veterinary professionals.

Enhanced Accessibility to Veterinary Care

One of the most significant impacts of pet insurance is the increased accessibility to veterinary care. With insurance coverage, pet owners are more likely to seek veterinary attention for their pets, whether it’s for routine check-ups or emergency treatments. This early detection and intervention can lead to more effective treatment outcomes and improved long-term pet health.

Furthermore, pet insurance has made it possible for pet owners to access specialized veterinary services that may have been previously out of reach due to cost constraints. From advanced imaging technologies to specialized surgeries, pet insurance coverage ensures that pets can receive the highest standard of care, regardless of their owners' financial situation.

Promoting Preventative Healthcare

The focus on preventative care in pet insurance policies has had a positive influence on veterinary medicine. By encouraging regular check-ups, vaccinations, and wellness treatments, pet insurance providers are helping to shift the industry towards a more proactive approach to pet healthcare. This preventative mindset not only improves pet health outcomes but also reduces the overall cost of veterinary care by addressing potential issues before they become critical.

Strengthening the Veterinary-Client Relationship

Pet insurance has also played a role in strengthening the bond between veterinary professionals and their clients. With insurance coverage, pet owners are more likely to establish long-term relationships with their veterinarians, leading to improved continuity of care and a deeper understanding of their pet’s health needs. This collaboration between owners and veterinarians can result in more personalized and effective treatment plans, benefiting both the pet and the veterinary practice.

| Impact | Benefits |

|---|---|

| Increased Accessibility | Improved pet health outcomes, early detection of health issues |

| Promoting Preventative Care | Improved long-term pet health, reduced veterinary costs |

| Strengthened Veterinary-Client Relationship | Enhanced continuity of care, personalized treatment plans |

Future Trends and Innovations in Pet Insurance

As the pet insurance industry continues to evolve, several emerging trends and innovations are shaping its future. This section explores the latest developments and their potential impact on the industry and pet owners.

Telemedicine and Remote Care

The integration of telemedicine and remote care services is poised to revolutionize the pet insurance landscape. With the rise of digital technology, pet owners can now access veterinary advice and even receive remote consultations through video conferencing platforms. This trend not only provides greater convenience for pet owners but also allows for more efficient triage and initial assessments, ensuring that pets receive the appropriate level of care.

Furthermore, telemedicine can play a crucial role in managing chronic conditions and providing ongoing support for pets with long-term illnesses. Through regular virtual check-ins, veterinary professionals can monitor the pet's progress, adjust treatment plans, and provide timely interventions, all while reducing the need for frequent in-person visits.

Data-Driven Personalization

The increasing availability of pet health data and the advancements in data analytics are driving a shift towards more personalized insurance policies. Insurance providers are leveraging this data to develop tailored plans based on individual pet health risks and needs. By analyzing factors such as breed, age, and medical history, insurance companies can offer policies that provide the most relevant and cost-effective coverage.

This data-driven approach not only benefits pet owners by providing them with more precise coverage but also helps insurance providers to manage their risk more effectively. By identifying potential health issues early on, they can offer preventative care solutions and potentially reduce the overall cost of veterinary services.

Incorporating AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are set to play a significant role in the future of pet insurance. These technologies can be utilized to enhance the accuracy of risk assessments, streamline claims processing, and even predict potential health issues before they occur. By analyzing large datasets and identifying patterns, AI and ML algorithms can provide valuable insights to insurance providers, helping them to develop more efficient and effective policies.

Conclusion

The world of pet insurance companies is a dynamic and rapidly evolving landscape, offering a range of innovative solutions to protect pet health and provide financial security for pet owners. From customized coverage plans to breed-specific policies, the industry is adapting to meet the diverse needs of pet owners. As we’ve explored, pet insurance has a profound impact on veterinary medicine, enhancing accessibility, promoting preventative care, and strengthening the bond between veterinary professionals and pet owners.

Looking ahead, the future of pet insurance is bright, with emerging trends such as telemedicine, data-driven personalization, and AI/ML integration poised to further revolutionize the industry. These innovations will not only improve the customer experience but also drive down costs and enhance pet health outcomes. As pet insurance continues to evolve, it will remain an essential component of responsible pet ownership, ensuring that pets receive the care they deserve, regardless of their owners' financial circumstances.

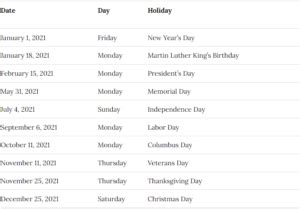

What are the average costs of pet insurance policies?

+

The cost of pet insurance policies can vary significantly depending on factors such as the pet’s breed, age, and the level of coverage chosen. On average, accident-only plans may cost around 10-20 per month, while comprehensive plans can range from 30-60 per month or more. It’s important to note that these are general estimates, and actual costs can vary widely based on individual circumstances.

Are there any exclusions or limitations to pet insurance coverage?

+

Yes, most pet insurance policies have exclusions and limitations. Common exclusions include pre-existing conditions, breeding-related issues, and certain behavioral problems. Additionally, some policies may have limits on the number of annual claims or the total lifetime coverage amount. It’s crucial to carefully review the policy’s terms and conditions to understand any potential exclusions or limitations.

How do I choose the right pet insurance company and policy for my pet?

+

Selecting the right pet insurance company and policy involves considering several factors. First, evaluate your pet’s unique health needs and choose a policy that provides adequate coverage. Consider the breed-specific risks, age-related considerations, and any pre-existing conditions. Compare multiple policies, paying attention to coverage limits, deductibles, and co-pays. Read reviews and seek recommendations from fellow pet owners to get an idea of the company’s reputation and customer service.