The post-closing trial balance is a crucial step in the accounting cycle, serving as a snapshot of a company's financial position after all adjustments and closing entries have been made. It is prepared after the closing entries have been posted to the general ledger, which means that all temporary accounts, such as revenue and expense accounts, have been closed to the permanent equity account, Retained Earnings. The primary purpose of the post-closing trial balance is to ensure that the debits equal the credits, confirming that the accounting equation (Assets = Liabilities + Equity) is in balance and that the general ledger is ready for the new accounting period.

Preparing the Post-Closing Trial Balance

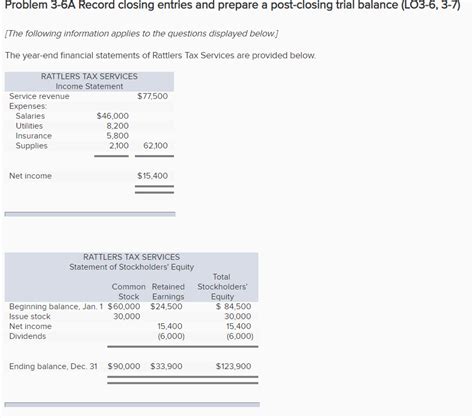

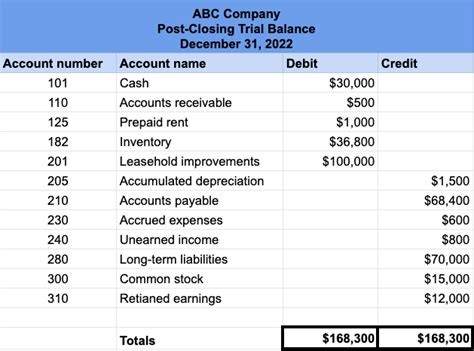

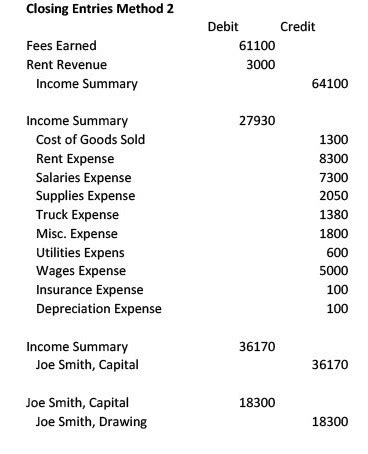

Preparing the post-closing trial balance involves listing all general ledger accounts and their respective balances, but only after the closing process has been completed. This process includes closing all temporary accounts, which are the revenue and expense accounts, as well as the dividends account, to the retained earnings account. The post-closing trial balance will only include permanent accounts, such as assets, liabilities, and equity accounts, because the temporary accounts have been closed. The steps to prepare the post-closing trial balance include:

- Identify all permanent accounts in the general ledger.

- Extract the current balances of these accounts after all closing entries have been posted.

- Classify each account as either a debit or a credit balance.

- Sum the total debit balances and the total credit balances.

- Verify that the total debit balance equals the total credit balance, ensuring that the accounting records are in balance.

Understanding the Components

The post-closing trial balance consists of three main components: assets, liabilities, and equity. Assets represent what the company owns or is due to receive, liabilities represent what the company owes, and equity represents the company’s net worth or the amount of money that would be left if the company were to pay off all its liabilities. The equity section in the post-closing trial balance includes the retained earnings account, which now reflects the impact of the closing entries made during the closing process.

| Account Type | Example Accounts | Debit/Credit Balance |

|---|---|---|

| Assets | Cash, Accounts Receivable, Inventory | Debit |

| Liabilities | Accounts Payable, Notes Payable | Credit |

| Equity | Common Stock, Retained Earnings | Credit |

Importance of the Post-Closing Trial Balance

The post-closing trial balance is essential for several reasons. Firstly, it confirms that the accounting system is in balance after the closing process, which is a fundamental principle of accounting. Secondly, it provides a starting point for the new accounting period, ensuring that the financial statements will accurately reflect the company’s financial position and performance. Lastly, it aids in the preparation of the company’s financial statements by providing the necessary balances for the balance sheet.

Addressing Discrepancies

If the post-closing trial balance does not balance, it indicates an error in the accounting records. This could be due to a mistake in the closing entries, an incorrect posting of a transaction, or an error in the preparation of the trial balance itself. In such cases, the accountant must trace the error, correct it, and then prepare a revised post-closing trial balance to ensure that the accounting records are accurate and reliable.

Key Points

- The post-closing trial balance is prepared after all closing entries have been posted to the general ledger.

- It only includes permanent accounts, as temporary accounts are closed to Retained Earnings.

- The purpose is to verify that debits equal credits after the closing process.

- It serves as a starting point for the new accounting period and aids in preparing financial statements.

- Any discrepancies must be investigated and corrected to ensure the accuracy of the accounting records.

In conclusion, the post-closing trial balance is a critical component of the accounting cycle, ensuring the accuracy and balance of the accounting records at the end of an accounting period. It is a tool that helps accountants verify that all temporary accounts have been properly closed and that the company's financial records are ready for the new accounting period. By understanding the purpose and process of preparing the post-closing trial balance, accountants can better manage a company's financial health and provide reliable financial information to stakeholders.

What is the primary purpose of the post-closing trial balance?

+The primary purpose of the post-closing trial balance is to ensure that the debits equal the credits after all closing entries have been made, confirming that the accounting equation is in balance and the general ledger is ready for the new accounting period.

Which accounts are included in the post-closing trial balance?

+The post-closing trial balance includes only permanent accounts, such as assets, liabilities, and equity accounts, because temporary accounts (revenue, expense, and dividends accounts) have been closed to the retained earnings account.

What should be done if the post-closing trial balance does not balance?

+If the post-closing trial balance does not balance, the accountant should trace the error, correct it, and then prepare a revised post-closing trial balance to ensure the accuracy and reliability of the accounting records.