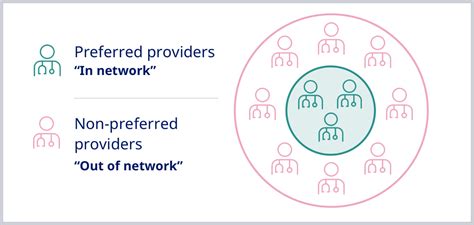

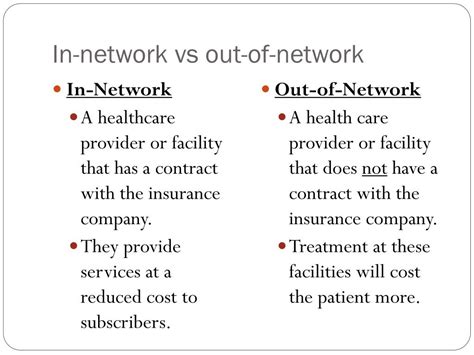

When navigating the complex landscape of healthcare, understanding the nuances of insurance coverage is crucial. One concept that often sparks confusion is the term "provider out of network." This phrase refers to a healthcare provider who does not participate in the network of providers that have contracted with a specific health insurance plan. In simpler terms, if your doctor or hospital is not part of your insurance company's approved list of providers, they are considered out of network.

Implications of Out-of-Network Providers

The implications of seeking care from an out-of-network provider can be significant. Typically, health insurance plans negotiate discounted rates with in-network providers, which helps keep costs lower for both the insurance company and the patient. However, when a patient sees an out-of-network provider, these negotiated discounts do not apply. As a result, the provider can charge their full rates, leading to higher costs for the patient.

Cost Differences: In-Network vs. Out-of-Network

To illustrate the potential cost difference, consider a scenario where a patient needs a surgical procedure. If the patient chooses an in-network surgeon, the insurance might cover 80% of the procedure’s cost after deductibles, with the patient responsible for the remaining 20%. However, if the patient opts for an out-of-network surgeon, the insurance might only cover 50% of the costs, or in some cases, not cover the costs at all, leaving the patient with a much larger bill. This is because out-of-network providers have not agreed to the insurance company’s payment terms and can bill patients directly for the difference between their full charge and what the insurance pays, a practice known as balance billing.

| Provider Type | Insurance Coverage | Patient Responsibility |

|---|---|---|

| In-Network | 80% of negotiated rate | 20% of negotiated rate |

| Out-of-Network | Varies (e.g., 50% of billed charges) | Higher, includes potential balance billing |

Reasons for Choosing Out-of-Network Providers

Despite the potential for higher costs, there are scenarios where patients might prefer or need to see an out-of-network provider. For instance, a patient might require specialized care that is not available within their network, or they might have a long-standing relationship with a provider who is not part of their current insurance plan. In emergencies, patients may not have the luxury of choosing an in-network provider, as the priority is receiving immediate care.

Emergency Situations and Out-of-Network Care

In emergency situations, the Affordable Care Act (ACA) and other laws protect patients from being charged higher out-of-network rates for emergency services. These protections ensure that patients receive necessary care without facing financial penalties for not using in-network providers during emergencies. However, these protections may not apply for non-emergency follow-up care.

Key Points

- Out-of-network providers do not have a contract with the patient's insurance company, leading to higher costs.

- In-network providers offer discounted rates due to contracts with insurance companies.

- Emergency protections under the law safeguard patients from higher out-of-network charges for emergency care.

- Patients should verify a provider's network status before receiving non-emergency care to manage costs effectively.

- Specialized care needs or long-standing provider relationships might necessitate choosing an out-of-network provider.

Strategies for Managing Out-of-Network Costs

While seeing an out-of-network provider can be more expensive, there are strategies patients can employ to manage these costs. Firstly, understanding the insurance plan’s out-of-network benefits and any associated costs is essential. Some plans may offer better out-of-network coverage than others. Secondly, patients can negotiate with out-of-network providers, especially if they are paying out-of-pocket. Providers may be willing to offer discounts for cash payments or establish payment plans.

Negotiation and Financial Assistance

Before receiving care from an out-of-network provider, patients should inquire about any available discounts, financial assistance programs, or sliding scale fees based on income. Being proactive and communicating with both the provider and the insurance company can help mitigate unexpected costs. Additionally, some states have laws that protect consumers from surprise medical bills, which can be a significant concern when dealing with out-of-network care.

What is the primary difference between in-network and out-of-network providers in terms of cost?

+The primary difference lies in the negotiated rates. In-network providers have agreed to discounted rates with the insurance company, while out-of-network providers can charge their full rates, leading to higher costs for patients.

Are there any protections for patients who receive emergency care from out-of-network providers?

+Yes, laws such as the Affordable Care Act protect patients from being charged higher out-of-network rates for emergency services, ensuring they receive necessary care without financial penalty.

How can patients manage costs when they need to see an out-of-network provider for non-emergency care?

+Patients can manage costs by understanding their insurance plan's out-of-network benefits, negotiating with providers, inquiring about discounts or financial assistance programs, and being proactive in communicating with both the provider and the insurance company.

In conclusion, while the term “provider out of network” might seem straightforward, its implications for healthcare costs and patient choice are complex. By understanding the differences between in-network and out-of-network care, being aware of legal protections, and employing strategies to manage costs, patients can navigate the healthcare system more effectively. As healthcare continues to evolve, staying informed about these dynamics will remain essential for making the best decisions regarding one’s health and financial well-being.