As one of the most prestigious institutions in the City University of New York (CUNY) system, Queens College offers a world-class education at an affordable price. However, with the rising costs of higher education, many students and families are looking for ways to reduce the financial burden of Queens College tuition. In this article, we will explore five ways to make Queens College more affordable, from scholarships and grants to payment plans and budgeting strategies.

Key Points

- Queens College offers various scholarships and grants to help students reduce their tuition costs

- Payment plans and budgeting strategies can help students manage their expenses more effectively

- Federal and state financial aid programs can provide significant assistance to eligible students

- Tuition waivers and exemptions are available for certain categories of students, such as veterans and senior citizens

- Students can also explore external scholarship opportunities to help fund their education

Understanding Queens College Tuition

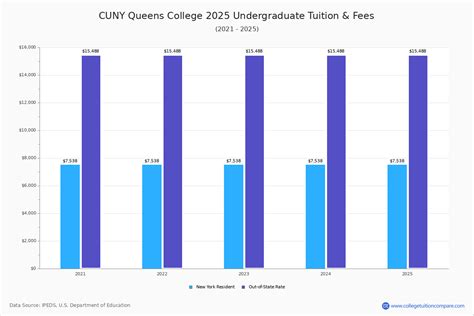

Before we dive into the ways to reduce Queens College tuition, it’s essential to understand the current tuition rates. As of the 2022-2023 academic year, the tuition for in-state undergraduate students is 6,930 per year, while out-of-state undergraduate students pay 18,600 per year. Graduate students pay 11,130 per year for in-state tuition and 23,202 per year for out-of-state tuition. These rates are subject to change, so it’s crucial to check the Queens College website for the most up-to-date information.

Scholarships and Grants

One of the most effective ways to reduce Queens College tuition is by applying for scholarships and grants. Queens College offers various merit-based and need-based scholarships, including the Queens College Scholarship, the Presidential Scholarship, and the Queens College Grant. Students can also apply for external scholarships, such as the National Merit Scholarship or the Fulbright Scholarship. Additionally, the Federal Pell Grant and the New York State Tuition Assistance Program (TAP) can provide significant assistance to eligible students.

| Tuition Assistance Program | Award Amount |

|---|---|

| Federal Pell Grant | up to $6,495 per year |

| New York State TAP | up to $5,165 per year |

| Queens College Scholarship | up to $5,000 per year |

Payment Plans and Budgeting Strategies

Another way to manage Queens College tuition is by utilizing payment plans and budgeting strategies. Queens College offers a payment plan that allows students to pay their tuition in installments, rather than all at once. This can help reduce the financial burden and make it more manageable. Students can also create a budget that accounts for all their expenses, including tuition, room and board, and other living expenses. By prioritizing their spending and making smart financial decisions, students can reduce their debt and make their education more affordable.

Federal and State Financial Aid Programs

In addition to Queens College scholarships and grants, students can also apply for federal and state financial aid programs. The Free Application for Federal Student Aid (FAFSA) is the primary application for federal financial aid, including the Federal Pell Grant, the Federal Supplemental Educational Opportunity Grant (FSEOG), and federal student loans. New York State also offers several financial aid programs, including the Tuition Assistance Program (TAP) and the New York State Aid for Part-Time Study (APTS) program.

Tuition Waivers and Exemptions

Certain categories of students may be eligible for tuition waivers or exemptions, which can significantly reduce their tuition costs. For example, veterans and their dependents may be eligible for tuition waivers under the GI Bill, while senior citizens may be eligible for tuition exemptions under the New York State Senior Citizen Tuition Waiver Program. Students should check with the Queens College financial aid office to see if they qualify for any of these programs.

External Scholarship Opportunities

Finally, students can also explore external scholarship opportunities to help fund their education. There are many private organizations, foundations, and companies that offer scholarships to students pursuing higher education. Some popular external scholarship opportunities include the National Merit Scholarship, the Fulbright Scholarship, and the Gates Millennium Scholars Program. Students can search for external scholarships using online databases, such as Fastweb or Scholarships.com.

What is the current tuition rate for in-state undergraduate students at Queens College?

+The current tuition rate for in-state undergraduate students at Queens College is $6,930 per year.

What types of scholarships and grants are available to Queens College students?

+Queens College offers various merit-based and need-based scholarships, including the Queens College Scholarship, the Presidential Scholarship, and the Queens College Grant. Students can also apply for external scholarships and federal and state financial aid programs.

How can students apply for federal and state financial aid programs?

+Students can apply for federal and state financial aid programs by completing the Free Application for Federal Student Aid (FAFSA) and the New York State Tuition Assistance Program (TAP) application.

In conclusion, while Queens College tuition can be a significant expense, there are many ways to reduce the financial burden. By exploring scholarships, grants, payment plans, and budgeting strategies, students can make their education more affordable. Additionally, federal and state financial aid programs, tuition waivers, and external scholarship opportunities can provide significant assistance to eligible students. By taking advantage of these options, students can achieve their academic goals and make their education more affordable.