Welcome to the world of life insurance, where financial protection meets peace of mind. Today, we delve into the intricacies of term life insurance, a crucial component of any comprehensive financial plan. Understanding the nuances of term life insurance quotes is essential for ensuring you get the right coverage at the best price.

Unraveling the Mystery of Term Life Insurance Quotes

Term life insurance is a popular choice for many individuals and families due to its simplicity and affordability. Unlike permanent life insurance policies, term life offers coverage for a specific period, known as the term. This term can range from 10 to 30 years, depending on your needs and preferences.

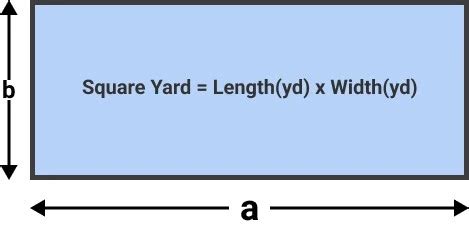

When seeking a term life insurance quote, you're essentially requesting an estimate of the cost of coverage for a specified term. This quote is based on various factors, including your age, health status, lifestyle choices, and the amount of coverage you desire. Here's a deeper dive into the key elements that influence your term life insurance quote.

The Role of Age and Health

Your age and health are two of the most significant factors in determining your term life insurance quote. The younger and healthier you are, the lower your premiums are likely to be. This is because younger individuals are statistically less likely to require significant medical care or pass away during the term of the policy.

Consider the following real-world example: John, a 30-year-old non-smoker with no major health issues, may receive a quote for a 20-year term life insurance policy with monthly premiums of around $25. On the other hand, Sarah, a 55-year-old smoker with a history of heart disease, could expect to pay significantly more, with monthly premiums potentially exceeding $100 for the same coverage period.

| Individual | Age | Health Status | Monthly Premium (Estimated) |

|---|---|---|---|

| John | 30 | Non-Smoker, Healthy | $25 |

| Sarah | 55 | Smoker, Heart Disease | $100+ (Variable) |

Coverage Amount and Term Length

The amount of coverage you desire and the length of the term are also crucial in determining your quote. Generally, higher coverage amounts and longer terms will result in higher premiums. It’s essential to strike a balance between the coverage you need and what you can afford.

Let's illustrate this with an example. Imagine you're a young couple with two children, and you want to ensure your family is financially secure should anything happen to you. You decide on a $1 million coverage amount with a 25-year term. Based on your age and health, your quote could be around $50 per month. However, if you opt for a shorter term, say 10 years, your premiums might decrease to $40 per month.

The Impact of Lifestyle and Occupation

Your lifestyle and occupation can also affect your term life insurance quote. Engaging in high-risk activities like skydiving or having a hazardous occupation, such as being a firefighter, can lead to higher premiums. Insurance companies consider these factors when assessing the risk associated with insuring you.

For instance, consider Mike, a professional rock climber. His passion for the sport might result in higher premiums due to the inherent risks involved. On the other hand, Lisa, a teacher, may enjoy more affordable premiums due to the relatively low-risk nature of her occupation.

Navigating the Quote Process

Obtaining a term life insurance quote is a straightforward process. You can start by comparing quotes from multiple insurance providers to find the best coverage and price for your needs. Many insurance companies offer online quote tools, making it convenient to get an estimate quickly.

Remember, the quote you receive is an estimate, and the actual cost may vary slightly once your application is processed. It's always beneficial to consult with an insurance professional who can guide you through the process and help you make informed decisions.

The Bottom Line

Term life insurance is an essential tool for safeguarding your loved ones’ financial future. By understanding the factors that influence your quote, you can make informed choices and secure the coverage you need at a price that fits your budget. Remember, it’s always better to be over-insured than under-insured when it comes to protecting your family’s financial well-being.

How often should I review my term life insurance policy?

+It’s recommended to review your policy every few years or whenever your circumstances change significantly. This ensures your coverage remains adequate and aligned with your life stage and financial goals.

Can I convert my term life insurance to permanent life insurance later on?

+Yes, many term life insurance policies offer a conversion option, allowing you to switch to a permanent life insurance policy without having to provide additional evidence of insurability.

What happens if I miss a premium payment for my term life insurance policy?

+Missed premium payments can result in your policy lapsing. However, most insurance companies offer a grace period, typically 30 days, during which you can still make the payment and keep your coverage active. It’s crucial to stay on top of your payments to avoid any disruptions in coverage.