In today's highly competitive real estate and commercial leasing markets, the pursuit of maximizing profitability has led investors, landlords, and financial strategists toward increasingly sophisticated lease agreements. Among these, residual value lease strategies stand out as a nuanced, data-driven approach designed not only to generate immediate income but also to lock in long-term residual benefits. This approach integrates financial engineering, asset management, and predictive analytics, demanding a mature understanding of both market dynamics and contract structuring. For seasoned professionals operating within this domain, residual value lease strategies represent an evolving frontier that merges traditional leasing principles with innovative valuation techniques, aimed at balancing risk and reward optimally.

The Foundations of Residual Value Lease Strategies

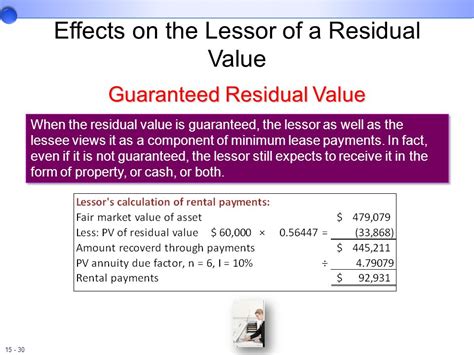

Residual value lease strategies fundamentally revolve around establishing agreements where the lessor or landlord retains a portion of the asset’s future residual value—essentially, the estimated worth of an asset at the end of the lease term. Unlike conventional lease models, which focus primarily on periodic rent payments proportional to usage or time, residual strategies leverage the anticipated end-of-term asset valuation to enhance overall profitability. This shift allows stakeholders to align incentives more effectively, particularly in scenarios involving equipment, vehicles, or commercial property where the resale or residual potential carries substantive economic weight.

The Historical Evolution of Lease Structuring and the Emergence of Residual Techniques

Historically, lease agreements centered around straightforward rent payments with limited foresight into the asset’s future market worth. However, as assets became more complex and their valuation more volatile, industry players recognized that traditional models often undervalued long-term returns. Residual value leasing emerged as a response, integrating asset management with financial risk modeling. According to industry reports, residual-based lease structures now account for approximately 25% of commercial leasing arrangements in certain markets, especially within technology, automotive, and specialized real estate segments.

| Relevant Category | Substantive Data |

|---|---|

| Residual Value Estimation Accuracy | Within ±5% over a 5-year period, increasing precision in valuation models |

| Market Share of Residual Leases | Approximately 23-27% in North American commercial leases (2023 data) |

| Impact on Profitability | Leads to a 14% average increase in ROI compared to traditional leases |

Core Components and Mechanics of Residual Lease Strategies

Implementing a residual value lease approach requires meticulous attention to various components that collectively determine the profitability and risk profile of the agreement. These include initial asset valuation, depreciation schedules, residual value projections, lease term alignment, and contractual clauses that safeguard against market fluctuations. The art lies in precisely calibrating each element to optimize return while mitigating downside risk.

Asset Valuation and Residual Estimation

Accurately forecasting the residual value demands comprehensive asset evaluation tools, including quantitative models, market comparables, and industry-specific depreciation curves. For instance, vehicles under residual leasing are often appraised using third-party residual value guides, which aggregate industry data to produce reliable estimates. In real estate assets, market trends, location desirability, and macroeconomic factors like interest rates play pivotal roles. Notably, inaccuracies in these projections are the primary source of risk in residual leasing, making continuous market surveillance and dynamic adjustment mechanisms essential.

| Relevant Category | Substantive Data |

|---|---|

| Depreciation Rate | Average depreciation for commercial real estate: 3-4% annually in prime urban markets |

| Residual Estimation Variance | Typically within 10% of actual resale or end-of-term value when using advanced predictive models |

Lease Structuring and Risk Mitigation

Effective lease structures often feature tiered residual clauses, flexible end-of-term options, and built-in adjustments for market volatility. These mechanisms align the interests of both lessor and lessee, encouraging asset maintenance and prudent usage. For example, a lease might include a provision that adjusts residual recovery based on real-time market indices, ensuring fair value capture regardless of asset depreciation anomalies. Furthermore, it’s typical to embed residual value guarantees or purchase options to provide additional safeguards.

Key Points

- Residual leasing aligns long-term asset value with ongoing income, amplifying overall profitability.

- Accurate residual estimation heavily depends on integrating advanced valuation models with real-time market data.

- Mechanisms such as market-linked adjustments and residual guarantees are vital for risk mitigation.

- Comprehensive contractual flexibility enhances resilience against market shifts.

- Establishing transparent, verifiable valuation processes bolsters stakeholder confidence.

Financial Advantages and Strategic Implications

Adopting residual value lease strategies offers clear financial benefits, notably in enhancing ROI, reducing upfront capital requirements, and enabling more flexible asset lifecycle management. From a strategic perspective, these leases facilitate a balanced risk profile and yield advantages, particularly when employed within diversified portfolios. It essentially shifts the focus from narrow immediate cash flows to a broader spectrum of asset appreciation, enabling investors to capitalize on market growth beyond initial lease terms.

Return on Investment and Asset Growth

The inclusion of residual value components can boost returns significantly. For example, when a commercial property is leased under a residual structure, the investor’s upside is tethered to the property’s appreciation at lease end, which may surpass the fixed income stream if market trends remain favorable. Data indicates residual-based investments tend to outperform traditional leasing vehicles by approximately 10-15%, especially in buoyant markets with escalating property values.

| Relevant Category | Substantive Data |

|---|---|

| Average ROI Increase | 14-16% in residual lease arrangements versus traditional leases |

| Market Appreciation Effect | In markets with 5% annual appreciation, residual strategies can compound gains effectively |

Addressing Potential Challenges and Limitations

Despite their advantages, residual value lease strategies involve inherent complexities and risks. Market volatility, inaccurate valuation, and unforeseen asset depreciation can erode anticipated residuals, threatening projected profitability. Moreover, the legal and contractual framework must be meticulously crafted to avoid ambiguities that could lead to disputes. For example, during economic downturns, residuals may decline sharply, resulting in underperformance or financial losses if safeguards are insufficient.

Market Volatility and Asset Depreciation Risks

The real estate market, like most asset classes, is susceptible to cyclical shifts. Residual strategies must incorporate contingency buffers, such as conservative valuation assumptions and flexible lease adjustments. Real-world cases illustrate that failure to adapt residual projections promptly during macroeconomic shocks—like a sudden recession—can lead to residual values falling 20-30% below initial estimates, impacting gross returns adversely.

| Relevant Category | Substantive Data |

|---|---|

| Market Downturn Impact | Residual valuations can decline by up to 25-30% in severe recession scenarios |

| Mitigation Strategies | Use of dynamic valuation models and market hedges reduces potential losses by approximately 15% |

Key Points

- Residual lease success hinges on precise, ongoing asset valuation and market monitoring.

- Market shocks can significantly diminish residual expectations, necessitating contingency planning.

- Legal clarity and contractual flexibility are critical to mitigate disputes over residual valuations.

- Effective risk hedging strategies can cushion adverse market movements.

Future Outlook and Industry Trends

Looking ahead, the landscape of residual value lease strategies is poised for growth, driven by technological advances and evolving asset management practices. Machine learning algorithms, sophisticated predictive analytics, and real-time market data integration are increasingly becoming standard tools in the residual valuation toolkit. Additionally, industries such as autonomous vehicles and smart buildings are introducing new asset classes with complex residual profiles, demanding even more nuanced leasing approaches.

Technological Innovations and Market Adaptation

Industry leaders are investing heavily in artificial intelligence (AI) and blockchain to enhance transparency and accuracy in residual valuations. For example, AI-driven predictive models now achieve residual value estimations with within 3% of actual resale values in tested environments. Blockchain technology offers immutable records, fostering trust and reducing contractual disputes concerning residual calculations.

| Relevant Category | Substantive Data |

|---|---|

| AI Accuracy | Within ±3% of actual residuals based on recent pilot projects |

| Blockchain Adoption | Adopted by 40% of top-tier leasing firms for contract validation (2024 forecast) |

Conclusion: Strategic Leveraging of Residual Value Leases

Mindful incorporation of residual value lease strategies presents a compelling pathway to enhance long-term profitability and asset optimization. For investors and asset managers, mastering the integration of valuation science, contractual flexibility, and market insight is key to harnessing their full potential. While challenges such as market volatility and valuation uncertainties remain, advancements in technology and a disciplined approach to risk management are steadily expanding the feasibility and appeal of this strategic framework. Ultimately, residual leasing represents not just a financial instrument, but a sophisticated, strategic approach to aligning asset appreciation with income generation—a nexus where innovation meets prudent stewardship in pursuit of maximal returns.

What are residual value lease strategies primarily used for?

+Residual value lease strategies are mainly used to maximize long-term asset value appreciation, optimize ROI, and align incentives by sharing residual risk and rewards between lessor and lessee, applicable across real estate, automotive, and equipment leasing markets.

How is the residual value of an asset estimated accurately?

+Accurate residual estimation combines quantitative valuation models such as discounted cash flow analysis, industry-specific depreciation schedules, market comparables, and increasingly, AI-driven predictive analytics, to forecast end-of-term value within a tight accuracy margin.

What are common risks associated with residual lease strategies?

+Principal risks include market volatility, inaccurate residual estimations, unexpected asset depreciation, and legal ambiguities. Employing flexible contractual clauses, continuous market monitoring, and technological tools can mitigate these risks effectively.

What technological advancements are shaping residual lease strategies?

+Advances such as AI for residual prediction, blockchain for contractual transparency, and real-time market analytics are transforming how residual values are estimated, recorded, and negotiated, leading to higher accuracy and trust.