Risk management is a crucial aspect of any organization, as it helps to identify, assess, and mitigate potential risks that could impact the company's operations, finances, and reputation. There are various risk management jobs available, each with its own set of responsibilities and requirements. In this article, we will explore five risk management jobs, including their job descriptions, required skills, and average salaries.

Key Points

- Risk management jobs are essential for identifying and mitigating potential risks in an organization.

- The five risk management jobs discussed in this article are Risk Manager, Compliance Officer, Internal Auditor, Operational Risk Manager, and Cybersecurity Risk Manager.

- These jobs require a combination of technical skills, business acumen, and soft skills, such as communication and problem-solving.

- The average salaries for these jobs vary, but they are generally competitive and range from $60,000 to over $150,000 per year.

- Risk management professionals must stay up-to-date with industry trends, regulations, and best practices to be effective in their roles.

Risk Manager

A Risk Manager is responsible for identifying, assessing, and mitigating risks that could impact an organization’s operations, finances, or reputation. This includes conducting risk assessments, developing risk management strategies, and implementing controls to mitigate risks. Risk Managers must have strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills.

The average salary for a Risk Manager is around $115,000 per year, although this can vary depending on the industry, location, and level of experience. A bachelor’s degree in a related field, such as business or finance, is typically required, and professional certifications like the Certified Risk Manager (CRM) or the Certified Financial Risk Manager (CFRM) are often preferred.

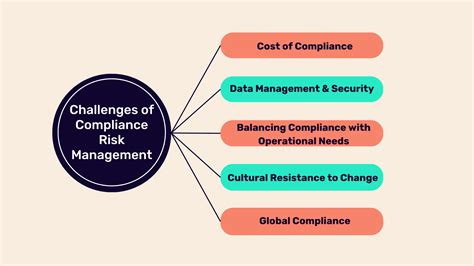

Compliance Officer

A Compliance Officer is responsible for ensuring that an organization is complying with relevant laws, regulations, and industry standards. This includes monitoring and reporting on compliance issues, developing and implementing compliance policies and procedures, and providing training to employees on compliance matters. Compliance Officers must have strong knowledge of relevant laws and regulations, as well as excellent analytical and communication skills.

The average salary for a Compliance Officer is around $85,000 per year, although this can vary depending on the industry, location, and level of experience. A bachelor’s degree in a related field, such as law or business, is typically required, and professional certifications like the Certified Compliance Professional (CCP) or the Certified Anti-Money Laundering Specialist (CAMS) are often preferred.

Internal Auditor

An Internal Auditor is responsible for conducting audits and reviews of an organization’s internal controls, processes, and procedures to ensure that they are operating effectively and efficiently. This includes identifying and reporting on control weaknesses, providing recommendations for improvement, and monitoring the implementation of audit recommendations. Internal Auditors must have strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills.

The average salary for an Internal Auditor is around $75,000 per year, although this can vary depending on the industry, location, and level of experience. A bachelor’s degree in a related field, such as accounting or finance, is typically required, and professional certifications like the Certified Internal Auditor (CIA) or the Certified Information Systems Auditor (CISA) are often preferred.

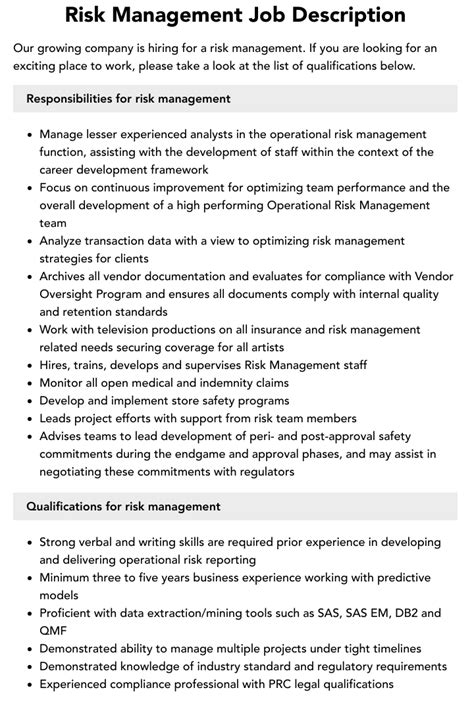

Operational Risk Manager

An Operational Risk Manager is responsible for identifying, assessing, and mitigating operational risks that could impact an organization’s operations, finances, or reputation. This includes developing and implementing risk management strategies, conducting risk assessments, and monitoring and reporting on operational risk metrics. Operational Risk Managers must have strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills.

The average salary for an Operational Risk Manager is around $100,000 per year, although this can vary depending on the industry, location, and level of experience. A bachelor’s degree in a related field, such as business or operations management, is typically required, and professional certifications like the Certified Operational Risk Professional (CORP) or the Certified Business Continuity Professional (CBCP) are often preferred.

Cybersecurity Risk Manager

A Cybersecurity Risk Manager is responsible for identifying, assessing, and mitigating cybersecurity risks that could impact an organization’s operations, finances, or reputation. This includes developing and implementing cybersecurity risk management strategies, conducting risk assessments, and monitoring and reporting on cybersecurity risk metrics. Cybersecurity Risk Managers must have strong technical skills, as well as excellent analytical and problem-solving skills.

The average salary for a Cybersecurity Risk Manager is around $125,000 per year, although this can vary depending on the industry, location, and level of experience. A bachelor’s degree in a related field, such as computer science or cybersecurity, is typically required, and professional certifications like the Certified Information Systems Security Professional (CISSP) or the Certified Cybersecurity Risk Manager (CCRM) are often preferred.

| Job Title | Average Salary | Required Education | Required Certifications |

|---|---|---|---|

| Risk Manager | $115,000 | Bachelor's degree in business or finance | CRM or CFRM |

| Compliance Officer | $85,000 | Bachelor's degree in law or business | CCP or CAMS |

| Internal Auditor | $75,000 | Bachelor's degree in accounting or finance | CIA or CISA |

| Operational Risk Manager | $100,000 | Bachelor's degree in business or operations management | CORP or CBCP |

| Cybersecurity Risk Manager | $125,000 | Bachelor's degree in computer science or cybersecurity | CISSP or CCRM |

In conclusion, risk management jobs are essential for identifying and mitigating potential risks in an organization. The five risk management jobs discussed in this article - Risk Manager, Compliance Officer, Internal Auditor, Operational Risk Manager, and Cybersecurity Risk Manager - require a combination of technical skills, business acumen, and soft skills, such as communication and problem-solving. By understanding the responsibilities, required skills, and average salaries for these jobs, individuals can make informed decisions about their careers and pursue roles that align with their interests and strengths.

What is the primary responsibility of a Risk Manager?

+The primary responsibility of a Risk Manager is to identify, assess, and mitigate risks that could impact an organization’s operations, finances, or reputation.

What is the average salary for a Compliance Officer?

+The average salary for a Compliance Officer is around 85,000 per year, although this can vary depending on the industry, location, and level of experience.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the difference between an Internal Auditor and an Operational Risk Manager?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>An Internal Auditor is responsible for conducting audits and reviews of an organization's internal controls, processes, and procedures, while an Operational Risk Manager is responsible for identifying, assessing, and mitigating operational risks that could impact an organization's operations, finances, or reputation.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the average salary for a Cybersecurity Risk Manager?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The average salary for a Cybersecurity Risk Manager is around 125,000 per year, although this can vary depending on the industry, location, and level of experience.

What skills are required for a risk management professional to be effective in their role?

+Risk management professionals require a combination of technical skills, business acumen, and soft skills, such as communication and problem-solving, to be effective in their roles.