Roth options have become a cornerstone of retirement planning in the United States, offering individuals a unique opportunity to save for their future with potential tax benefits. A Roth option, whether it's a Roth IRA (Individual Retirement Account) or a Roth 401(k), allows contributions to be made with after-tax dollars, meaning that the money has already been taxed. In return for using after-tax dollars, the money in a Roth account grows tax-free and can be withdrawn tax-free if certain conditions are met. This makes Roth options particularly appealing for those who expect to be in a higher tax bracket during retirement or for individuals who want to minimize their tax liability in the future.

Key Points

- Contributions to Roth accounts are made with after-tax dollars, providing potential tax-free growth and withdrawals.

- Roth IRAs and Roth 401(k)s have different contribution limits and eligibility requirements.

- The five-year rule and income limits can impact Roth IRA contributions and conversions.

- Roth options can be particularly beneficial for those expecting to be in a higher tax bracket during retirement.

- Conversions from traditional IRAs or 401(k)s to Roth accounts can provide a strategic way to manage taxes in retirement.

Understanding Roth Options

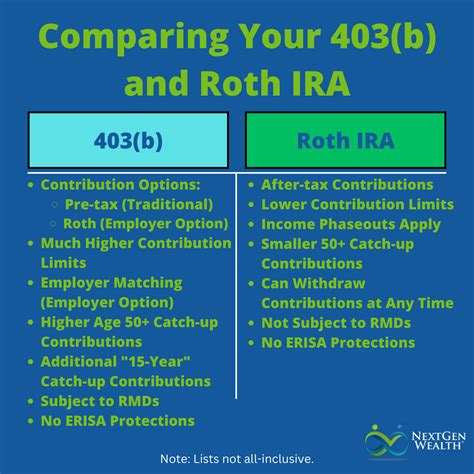

Roth options are designed to provide individuals with flexibility in their retirement savings. There are primarily two types of Roth accounts: the Roth IRA and the Roth 401(k). Each has its own set of rules, benefits, and considerations. For instance, Roth IRAs have income limits that affect who can contribute and how much they can contribute, whereas Roth 401(k)s do not have income limits for contributions but may have limits on who can participate based on the employer’s plan. Understanding these differences is crucial for making informed decisions about retirement savings.

Roth IRA vs. Roth 401(k)

A Roth IRA is an individual account that can be opened by anyone with earned income from a job, provided their income is below certain thresholds. The annual contribution limit for Roth IRAs is 6,000 in 2022, or 7,000 if the individual is 50 or older, thanks to the catch-up contribution. However, these contributions are subject to income limits, which can reduce or eliminate the ability to contribute for higher-income individuals. On the other hand, a Roth 401(k) is an employer-sponsored plan that allows employees to contribute to a Roth account through their company’s 401(k) plan. The contribution limits for Roth 401(k)s are significantly higher, with an annual limit of 19,500 in 2022, or 26,000 for those 50 or older, including the catch-up contribution. Unlike Roth IRAs, Roth 401(k) contributions are not subject to income limits, but the employer must offer a Roth 401(k) option as part of their plan for employees to participate.

| Account Type | Contribution Limit | Income Limits |

|---|---|---|

| Roth IRA | $6,000 ($7,000 if 50+) | Subject to income limits |

| Roth 401(k) | $19,500 ($26,000 if 50+) | No income limits for contributions |

Strategic Considerations for Roth Options

Individuals considering Roth options should also be aware of the strategic implications of these accounts. For instance, converting a traditional IRA or 401(k) to a Roth IRA or 401(k) can be a tax-efficient move for some, especially if done during a year when income is lower. This conversion involves paying taxes on the converted amount, which can then grow tax-free in the Roth account. Additionally, Roth accounts can be used as part of an estate planning strategy, as they do not have required minimum distributions (RMDs) during the lifetime of the original account owner, allowing the account to grow tax-free for beneficiaries.

Five-Year Rule and Income Limits

It’s essential to understand the five-year rule and income limits associated with Roth IRAs. The five-year rule states that to avoid penalties and taxes on earnings, a Roth IRA must have been open for at least five years, and the account owner must be 59 1⁄2 or older for qualified distributions. Income limits affect who can contribute to a Roth IRA and how much they can contribute. For 2022, individuals with incomes below 129,000 for single filers or 204,000 for joint filers can make a full contribution to a Roth IRA, while those with incomes above these thresholds may be subject to reduced contribution limits or may not be eligible to contribute directly to a Roth IRA.

Roth options offer a powerful tool for retirement savings, providing the potential for tax-free growth and withdrawals. By understanding the differences between Roth IRAs and Roth 401(k)s, the strategic considerations for these accounts, and the rules governing them, individuals can make informed decisions about their retirement planning. Whether through direct contributions or conversions, Roth options can play a critical role in securing a more tax-efficient retirement.

What are the primary benefits of contributing to a Roth IRA or Roth 401(k)?

+The primary benefits include tax-free growth and withdrawals, which can significantly reduce tax liability in retirement. Additionally, Roth accounts do not have required minimum distributions (RMDs) during the lifetime of the original account owner, making them useful for estate planning.

How do income limits affect contributions to a Roth IRA?

+Income limits can reduce or eliminate the ability to contribute to a Roth IRA. For 2022, individuals with incomes above $137,500 for single filers or $208,500 for joint filers cannot contribute directly to a Roth IRA, while those with incomes between $129,000 and $137,500 for single filers or $204,000 and $208,500 for joint filers may be subject to reduced contribution limits.

Can I convert a traditional IRA or 401(k) to a Roth IRA or Roth 401(k)?

+Yes, conversions are possible. This involves paying taxes on the converted amount, which can then grow tax-free in the Roth account. Conversions can be a strategic move for managing taxes in retirement, especially during years with lower income.

What is the five-year rule for Roth IRAs, and how does it affect withdrawals?

+The five-year rule requires a Roth IRA to have been open for at least five years, and the account owner must be 59 1/2 or older for qualified distributions to avoid penalties and taxes on earnings. This rule is crucial for planning tax-free withdrawals from a Roth IRA.

How do employer matching contributions work in a Roth 401(k) plan?

+Employer matching contributions in a 401(k) plan are made to a traditional 401(k) account, not a Roth 401(k) account. This means that while the employee contributes to a Roth 401(k) with after-tax dollars, any employer match is contributed on a pre-tax basis to a traditional 401(k) account, affecting the overall tax strategy.

Meta Description: Explore the benefits and rules of Roth options for retirement savings, including Roth IRAs and Roth 401(k)s, to make informed decisions about your financial future.