Managing finances effectively is crucial in today's fast-paced world, where bills seem to pile up from every direction. One of the most significant challenges many individuals face is paying their bills on time. Late payments can lead to additional fees, negative impacts on credit scores, and even service disruptions. However, with the advancement of technology and the variety of payment methods available, paying bills has become more convenient and accessible than ever. Here, we will explore five ways to pay bills, each with its unique benefits and considerations.

Understanding the Importance of Timely Bill Payments

Before diving into the various payment methods, it’s essential to understand why paying bills on time is so critical. Timely payments help maintain a good credit score, which is vital for future loan applications, credit card approvals, and even some employment opportunities. Moreover, avoiding late fees can save individuals a significant amount of money over time. Given the importance of timely payments, selecting the most suitable payment method is not just about convenience but also about ensuring that bills are paid promptly and efficiently.

Key Points

- Online payments offer convenience and speed, reducing the risk of late payments.

- Mobile payments provide on-the-go bill payment capabilities, enhancing flexibility.

- Automatic bank drafts ensure timely payments, eliminating the risk of forgetfulness.

- Phone payments are useful for those who prefer verbal communication or have issues with digital platforms.

- In-person payments at retail locations or bank branches offer a tangible experience, suitable for individuals who prefer human interaction or have limited digital access.

1. Online Payments

Online payments have become one of the most popular methods for paying bills due to their convenience and speed. Most service providers have websites or mobile applications through which customers can log in and make payments using their credit/debit cards or bank accounts. This method reduces the risk of late payments, as payments are processed immediately, and it also provides a record of the transaction for future reference. For example, a study by the American Bankers Association found that 73% of consumers prefer online banking for bill payments due to its ease and efficiency.

Benefits and Considerations of Online Payments

While online payments offer numerous benefits, including convenience, speed, and the ability to pay bills at any time, there are also considerations to keep in mind. Security is a primary concern, as individuals need to ensure they are using secure, reputable websites to avoid potential fraud. Moreover, being aware of any fees associated with online payments, such as convenience fees for certain types of payments, is crucial.

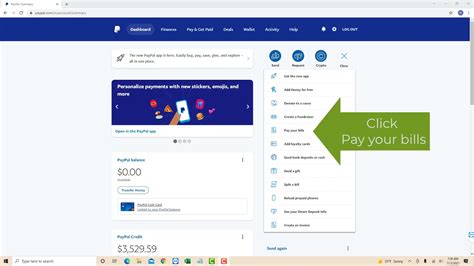

2. Mobile Payments

Mobile payments have revolutionized the way bills are paid, providing users with the flexibility to pay bills from anywhere at any time using their smartphones. Mobile banking apps and third-party payment services like PayPal and Venmo have made it possible to pay bills with just a few taps on the screen. This method is particularly useful for individuals with busy schedules or those who are frequently on the move.

Enhancing Flexibility with Mobile Payments

The flexibility offered by mobile payments is unparalleled, allowing individuals to manage their finances effectively even when they are not near a computer. However, it’s essential to ensure that the mobile device and the payment app being used are secure to protect against unauthorized transactions. Regularly updating the operating system and using strong, unique passwords can significantly enhance security.

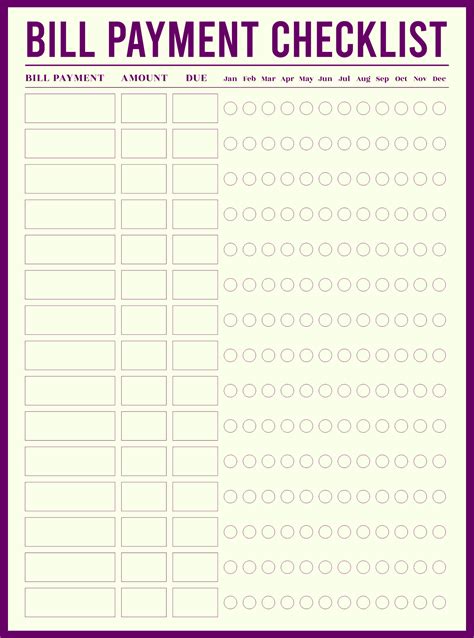

3. Automatic Bank Drafts

For individuals who want to ensure that their bills are paid on time without having to remember due dates, automatic bank drafts are an excellent option. This method involves authorizing the service provider to automatically deduct the bill amount from the individual’s bank account on the due date. It eliminates the risk of late payments and associated fees, providing peace of mind and helping to maintain a good credit score.

Ensuring Timely Payments with Automatic Bank Drafts

The key benefit of automatic bank drafts is the assurance of timely payments. However, it’s crucial to ensure that the bank account has sufficient funds on the due date to avoid overdraft fees. Setting up account alerts for low balances can help prevent such issues, making this method both convenient and reliable.

4. Phone Payments

Phone payments are another convenient method for paying bills, especially for those who prefer speaking directly with a representative or have difficulty navigating digital platforms. Many service providers offer phone payment options, allowing customers to call in and make payments over the phone using their credit/debit cards or by authorizing a transfer from their bank account.

Accessibility of Phone Payments

Phone payments are particularly beneficial for individuals who are not tech-savvy or prefer the personal touch of speaking with a customer service representative. However, it’s essential to be cautious when making payments over the phone, ensuring that the call is with an authorized representative of the service provider to avoid potential scams.

5. In-Person Payments

In-person payments at retail locations, bank branches, or the service provider’s office are still a viable option for many individuals. This method provides a tangible experience, allowing individuals to interact with customer service representatives face-to-face. It’s particularly useful for those who have limited access to digital payment methods or prefer the assurance of handing over payments directly.

Personal Interaction with In-Person Payments

The personal interaction offered by in-person payments can be comforting for some, especially for complex billing issues that require explanation or resolution. However, this method may require more time and effort, as it involves physically visiting a location. Considering the time and potential travel costs, it’s essential to weigh the benefits of personal interaction against the convenience of digital payment methods.

| Payment Method | Convenience Level | Security Considerations |

|---|---|---|

| Online Payments | High | Website security, password protection |

| Mobile Payments | Very High | App security, device protection |

| Automatic Bank Drafts | High | Authorization security, fund sufficiency |

| Phone Payments | Moderate | Caller verification, privacy |

| In-Person Payments | Low | Physical security, staff verification |

What is the most secure way to pay bills online?

+Using a secure, reputable website with HTTPS encryption and two-factor authentication is the most secure way to pay bills online. Additionally, ensuring that the computer or mobile device being used is free from malware and has up-to-date antivirus software can further enhance security.

Can I set up automatic payments for all my bills?

+Yes, most service providers offer the option to set up automatic payments. However, it's essential to review and understand the terms and conditions, including any potential fees for late or missed payments, before setting up automatic drafts.

What happens if I forget to pay a bill and it becomes overdue?

+If a bill becomes overdue, it's crucial to contact the service provider as soon as possible to discuss payment options and avoid additional late fees. In some cases, setting up a payment plan may be an option. It's also important to make timely payments going forward to prevent negative impacts on credit scores.

In conclusion, the method of paying bills that works best for an individual depends on their personal preferences, financial situation, and access to technology. By understanding the benefits and considerations of each payment method, individuals can make informed decisions that help them manage their finances more effectively, ensuring timely payments and avoiding unnecessary fees.