The Power of Group Health Insurance for Small Businesses: A Comprehensive Guide

In today's competitive business landscape, offering comprehensive health insurance plans to employees is not just a perk but a strategic advantage for small businesses. This guide will delve into the world of small business group health insurance, exploring its benefits, key considerations, and the transformative impact it can have on both your business and your employees.

As a small business owner, you understand the unique challenges and opportunities that come with managing a compact workforce. One of the most crucial decisions you'll make is selecting the right health insurance plan for your team. Group health insurance is a powerful tool that can boost employee satisfaction, attract top talent, and foster a culture of well-being, all while providing essential coverage for your valued staff.

Understanding Group Health Insurance for Small Businesses

Group health insurance plans are designed to cover a group of individuals, typically employees and their dependents, under a single policy. These plans are offered by insurance carriers and are tailored to meet the specific needs of small businesses, providing a cost-effective and efficient way to ensure comprehensive healthcare coverage for your team.

By pooling resources and negotiating as a group, small businesses can access more affordable premiums and a wider range of coverage options compared to individual plans. This collective approach not only benefits your employees but also strengthens your business's position in the market, as a competitive benefits package can attract and retain skilled professionals.

The Benefits of Group Health Insurance for Small Businesses

Implementing a group health insurance plan brings a multitude of advantages to small businesses. Here's a glimpse into some of the key benefits:

- Cost Efficiency: Group plans often offer lower premiums compared to individual policies, making healthcare coverage more accessible for both the business and its employees.

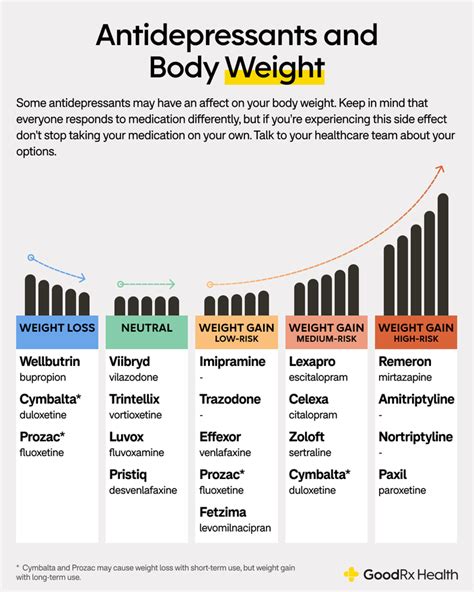

- Comprehensive Coverage: These plans typically include a wide range of medical services, prescriptions, and specialized care, ensuring your employees receive the necessary healthcare without financial strain.

- Employee Retention and Attraction: A robust health insurance plan is a powerful tool for retaining top talent and attracting new, skilled employees. It demonstrates your commitment to their well-being and can be a deciding factor in job choices.

- Risk Pooling: By insuring a group, the risk is spread across a larger population, which can lead to more stable premiums and better overall coverage.

- Tax Benefits: Small businesses may be eligible for tax credits and deductions when offering group health insurance, further reducing the financial burden.

With these advantages, group health insurance becomes a cornerstone of a successful small business, fostering a healthy and productive workforce.

Navigating the Landscape of Small Business Group Health Insurance

When it comes to selecting the right group health insurance plan, there are several key considerations to keep in mind. Understanding these factors will help you make an informed decision that aligns with your business's unique needs and goals.

Coverage Options

Group health insurance plans offer a variety of coverage options, including:

- HMO (Health Maintenance Organization): HMO plans typically require members to choose a primary care physician and obtain referrals for specialist care. They often have lower out-of-pocket costs but may have more limited provider networks.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility, allowing members to choose any healthcare provider, though costs may be lower when using in-network providers. These plans often have higher premiums but provide broader coverage.

- EPO (Exclusive Provider Organization): EPO plans are similar to PPOs but with a more restricted network. Members must use in-network providers, or they may face higher out-of-pocket costs.

- POS (Point of Service): POS plans combine elements of HMO and PPO plans. Members typically start with a primary care physician but can choose between in-network and out-of-network providers, with varying cost structures.

Premium Costs and Employee Contributions

Premiums for group health insurance plans can vary based on several factors, including the type of plan, the level of coverage, and the number of employees enrolled. Small businesses often have the flexibility to negotiate premium rates with insurance carriers, especially when working with an experienced broker.

Additionally, consider the contribution structure. Some businesses cover the full premium cost, while others may require employees to contribute a portion. The latter approach can be more cost-effective for the business but may impact employee take-home pay.

Network of Providers

The network of healthcare providers associated with a group health insurance plan is a critical consideration. Ensure that the plan's network includes a sufficient number of providers in your area, including specialists and hospitals, to meet the diverse healthcare needs of your employees.

Additional Benefits and Perks

Beyond basic medical coverage, many group health insurance plans offer additional benefits such as dental, vision, and prescription drug coverage. Some plans may also include wellness programs, mental health services, and flexible spending accounts (FSAs) to further enhance employee well-being and financial security.

Implementing and Communicating Your Group Health Insurance Plan

Once you've selected the right group health insurance plan for your small business, effective communication and implementation are essential to ensure a smooth transition and maximize the benefits for your employees.

Open Enrollment and Communication

During open enrollment, clearly communicate the details of the new group health insurance plan to your employees. Provide them with comprehensive information about the coverage, including any changes from previous plans, and highlight the benefits they can expect.

Consider hosting informational sessions or workshops to address any questions or concerns and ensure that employees understand the value of the plan. This transparency can build trust and encourage engagement with the new healthcare coverage.

Employee Education and Engagement

Educating your employees about their healthcare coverage is crucial for maximizing the benefits of the group health insurance plan. Provide resources and materials that explain the coverage, including any deductibles, copays, and out-of-pocket maximums.

Encourage employees to utilize the plan's preventive care services and take advantage of any wellness programs or incentives offered. By fostering a culture of health and well-being, you can not only improve the overall health of your workforce but also potentially reduce healthcare costs over time.

Regular Review and Adjustment

Group health insurance plans are not static; they should be regularly reviewed and adjusted to align with your business's evolving needs and the changing healthcare landscape. Stay informed about market trends, new coverage options, and any changes in employee demographics or healthcare requirements.

Conduct annual reviews of your plan, assessing its performance, utilization, and employee satisfaction. Based on these insights, you can make informed decisions about renewing, modifying, or switching plans to ensure that your small business and its employees continue to receive the best possible healthcare coverage.

The Impact of Group Health Insurance on Your Small Business

Implementing a group health insurance plan can have a profound impact on your small business, extending beyond the immediate benefits of providing comprehensive healthcare coverage. Here's a deeper look at the transformative effects on your business and its employees:

Employee Satisfaction and Retention

Offering a robust group health insurance plan demonstrates your commitment to your employees' well-being. This can lead to higher levels of satisfaction and loyalty, as employees feel valued and supported by their employer. As a result, you may experience reduced turnover rates and a more stable, productive workforce.

Attracting Top Talent

In today's competitive job market, a strong benefits package can be a deciding factor for job seekers. By providing group health insurance, your small business becomes more attractive to potential employees, especially those with specific healthcare needs or families to consider. This can help you recruit and retain the best talent, ensuring a skilled and dedicated workforce.

Building a Culture of Well-Being

Group health insurance is not just about coverage; it's also about promoting a culture of health and wellness within your small business. By encouraging employees to utilize preventive care, manage chronic conditions, and take advantage of wellness programs, you can create a workplace that values and supports overall well-being.

This culture of well-being can lead to improved employee morale, reduced absenteeism, and increased productivity. It also sends a powerful message to your employees that their health and happiness are priorities for your business.

Financial Stability and Risk Management

Group health insurance plans provide a measure of financial stability for both your business and your employees. By spreading the risk across a larger group, premiums can be more stable and predictable, reducing the financial burden on your business. Additionally, employees can access necessary healthcare services without worrying about unaffordable out-of-pocket costs.

This financial stability can be especially crucial for small businesses, as it helps mitigate the risk of unexpected healthcare expenses and allows for better long-term financial planning.

Long-Term Success and Growth

Investing in group health insurance is an investment in the long-term success and growth of your small business. By providing comprehensive healthcare coverage, you create a solid foundation for your business's future. Healthy, satisfied employees are more likely to be engaged, productive, and committed to your company's goals, driving your business forward.

Furthermore, as your business grows and expands, having a strong group health insurance plan in place can help you scale your operations while maintaining a happy and healthy workforce.

Future Implications and Trends in Small Business Group Health Insurance

The landscape of small business group health insurance is continually evolving, shaped by advancements in healthcare technology, changes in government policies, and shifting employee expectations. Staying informed about these trends is essential to ensure your small business remains competitive and adaptable.

Telehealth and Virtual Care

The rise of telehealth and virtual care services has been a significant development in the healthcare industry, and it's becoming increasingly integrated into group health insurance plans. These services offer convenient and accessible healthcare options, allowing employees to consult with healthcare professionals remotely.

Consider the potential benefits of incorporating telehealth into your group health insurance plan, such as improved access to care, reduced wait times, and cost savings for both your business and employees.

Wellness Programs and Incentives

Wellness programs and incentives are gaining traction in group health insurance plans as a means to promote healthy behaviors and reduce healthcare costs. These programs often include initiatives like gym memberships, weight loss challenges, smoking cessation programs, and mental health support.

By offering incentives for employees to participate in wellness programs, you can encourage a culture of health and potentially reduce the risk of chronic conditions, leading to lower healthcare costs for your business over time.

Personalized Healthcare and Precision Medicine

Advancements in technology and genomics are paving the way for more personalized healthcare approaches, known as precision medicine. This field of medicine uses an individual's genetic makeup, lifestyle, and environment to tailor medical treatment and prevention strategies.

As precision medicine continues to evolve, it's likely that group health insurance plans will incorporate more personalized healthcare options, offering targeted treatments and preventive measures based on an individual's unique health profile.

Employee Empowerment and Engagement

In the future, group health insurance plans may place a greater emphasis on employee empowerment and engagement. This could involve providing employees with more control over their healthcare decisions, such as choosing their own healthcare providers or selecting specific coverage options based on their individual needs.

By involving employees in the decision-making process and providing them with the tools and resources to actively manage their health, you can foster a sense of ownership and engagement, leading to better overall health outcomes.

Technology Integration and Digital Health Solutions

Technology is playing an increasingly significant role in healthcare, and group health insurance plans are likely to continue integrating digital health solutions. This includes the use of health tracking apps, wearable devices, and artificial intelligence to monitor and improve employee health.

For example, health tracking apps can provide employees with personalized health insights and recommendations, while wearable devices can collect real-time health data, allowing for early detection of potential health issues. These digital health solutions can enhance the overall effectiveness of your group health insurance plan and improve employee well-being.

Conclusion

Group health insurance is a powerful tool for small businesses, offering a wide range of benefits that extend beyond basic healthcare coverage. By implementing a well-designed group health insurance plan, you can create a healthy, satisfied, and productive workforce, while also positioning your business for long-term success and growth.

Stay informed about the latest trends and advancements in group health insurance to ensure your small business remains at the forefront of employee well-being and satisfaction. With a strategic and thoughtful approach to healthcare coverage, you can build a thriving and resilient business that values the health and happiness of its employees.

How do small businesses choose the right group health insurance plan?

+Small businesses should consider factors such as the level of coverage, premium costs, network of providers, and additional benefits. Working with an experienced broker can help navigate these choices and find the best fit.

What are the tax benefits of offering group health insurance to employees?

+Small businesses may be eligible for tax credits and deductions when offering group health insurance, which can significantly reduce the financial burden of providing healthcare coverage.

How can small businesses encourage employee engagement with their group health insurance plan?

+Conducting informational sessions, providing clear and comprehensive resources, and fostering a culture of health and well-being can all encourage employee engagement with their group health insurance plan.