State Farm Insurance is a prominent name in the world of insurance, offering a wide range of coverage options to protect individuals and businesses. With a focus on customer satisfaction and comprehensive coverage, State Farm has built a solid reputation in the industry. In the bustling city of New York, State Farm Insurance NYC provides tailored insurance solutions to meet the unique needs of its residents and businesses.

Comprehensive Coverage Options in New York City

State Farm Insurance NYC understands that the Big Apple presents its own set of challenges and opportunities when it comes to insurance. From busy streets to high-rise buildings, the city’s vibrant culture and fast-paced lifestyle require specialized insurance solutions. Let’s delve into the various coverage options that State Farm offers to NYC residents and businesses.

Auto Insurance: Navigating the City’s Streets

State Farm’s auto insurance policies are designed to provide peace of mind to NYC drivers. With a dense urban environment and a reputation for traffic congestion, having robust auto insurance is crucial. Here’s an overview of the key features:

- Collision Coverage: Covers damage to your vehicle in the event of an accident, regardless of fault. This is especially important in NYC, where accidents can happen frequently due to the high volume of traffic.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, and natural disasters. In a city like New York, where theft and vandalism are more prevalent, this coverage is essential.

- Liability Insurance: Provides financial protection if you’re found at fault in an accident, covering medical expenses and property damage of others. In a densely populated city, the risk of causing an accident is higher, making liability insurance a must-have.

- Uninsured/Underinsured Motorist Coverage: Offers protection in the event of an accident with a driver who doesn’t have sufficient insurance. This is a critical coverage option in NYC, where the risk of encountering uninsured drivers is relatively high.

Home Insurance: Protecting Your NYC Haven

State Farm’s home insurance policies are tailored to meet the specific needs of NYC homeowners and renters. The city’s unique challenges, such as extreme weather conditions and the potential for property damage, require specialized coverage. Here’s what State Farm’s home insurance offers:

- Dwelling Coverage: Provides financial protection for the structure of your home, covering repairs or rebuilding costs in the event of damage or destruction.

- Personal Property Coverage: Covers the cost of replacing or repairing your personal belongings, including furniture, electronics, and clothing, in the event of a covered loss.

- Liability Protection: Offers financial protection if you’re sued for bodily injury or property damage caused to others while on your property. This is crucial in a city with a high population density.

- Additional Living Expenses: Covers the cost of temporary housing and additional expenses if your home becomes uninhabitable due to a covered loss. This is particularly important in NYC, where finding suitable temporary housing can be challenging and costly.

Life Insurance: Securing Your Family’s Future

State Farm’s life insurance policies are designed to provide financial security to your loved ones in the event of your untimely demise. In a city like New York, where the cost of living is high and financial obligations can be significant, life insurance is a vital component of any financial plan. Here’s an overview:

- Term Life Insurance: Offers coverage for a specified period, typically 10, 20, or 30 years. It’s ideal for covering short-term financial obligations like mortgage payments or children’s education expenses.

- Permanent Life Insurance: Provides lifelong coverage, with the added benefit of a cash value component that grows over time. This type of insurance is suitable for long-term financial planning and can be used for retirement income, estate planning, or leaving a legacy.

- Universal Life Insurance: Offers flexibility in terms of premium payments and coverage amounts. It combines the protection of term life insurance with the cash value growth of permanent life insurance, making it a versatile option.

| Coverage Type | Policy Features |

|---|---|

| Auto Insurance | Collision, Comprehensive, Liability, Uninsured/Underinsured Motorist |

| Home Insurance | Dwelling, Personal Property, Liability, Additional Living Expenses |

| Life Insurance | Term, Permanent, Universal |

Personalized Service and Customer Satisfaction

At State Farm Insurance NYC, customer satisfaction is a top priority. The company understands that insurance needs are unique to each individual and business, and they strive to provide personalized service to meet those needs. Here’s how State Farm delivers exceptional customer service in the Big Apple:

Local Agents: Building Strong Relationships

State Farm’s network of local agents in NYC is a key differentiator. These agents are deeply rooted in the community and understand the specific challenges and opportunities that NYC residents and businesses face. With their extensive knowledge and experience, they can tailor insurance policies to meet individual needs.

State Farm’s agents are committed to building long-lasting relationships with their clients. They take the time to understand their clients’ lifestyles, financial goals, and insurance requirements. This personalized approach ensures that clients receive coverage that is not only comprehensive but also cost-effective.

Digital Convenience: Meeting Modern Needs

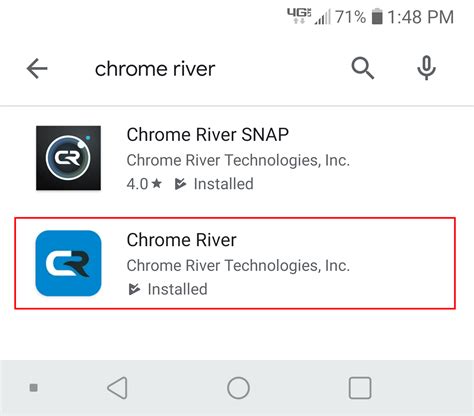

In today’s fast-paced world, convenience is key. State Farm recognizes this and has invested in digital platforms to make insurance services easily accessible. NYC residents and businesses can manage their policies, file claims, and communicate with their agents through the State Farm mobile app and online portal.

The State Farm app offers a range of features, including policy management, digital ID cards, and the ability to pay bills and track claim progress. This level of convenience ensures that policyholders can take care of their insurance needs quickly and efficiently, without having to navigate the hustle and bustle of the city.

Claims Handling: Efficient and Reliable

State Farm’s claims handling process is designed to be efficient and reliable. In the event of an insured loss, policyholders can expect a swift and professional response. State Farm’s claims adjusters are trained to handle a wide range of claims, from auto accidents to property damage, with expertise and compassion.

The company’s commitment to timely claims handling is evident in its industry-leading claims satisfaction ratings. Policyholders in NYC can rest assured that State Farm will be there to support them when they need it most, providing financial protection and peace of mind during challenging times.

Community Involvement and Giving Back

State Farm Insurance NYC is not just about providing insurance services; it’s also about giving back to the community. The company actively participates in and supports various initiatives that benefit NYC residents.

Community Partnerships

State Farm partners with local organizations and charities to support causes that are important to the NYC community. Whether it’s sponsoring local events, supporting educational initiatives, or contributing to disaster relief efforts, State Farm demonstrates its commitment to making a positive impact.

One notable partnership is with Habitat for Humanity NYC. State Farm agents and employees volunteer their time and skills to help build and renovate homes for low-income families in the city. This partnership not only provides much-needed housing but also empowers families to build a better future.

Educational Initiatives

State Farm believes in the power of education and financial literacy. The company offers various educational programs and resources to help NYC residents understand their insurance options and make informed decisions. These initiatives include financial workshops, insurance seminars, and online resources that are easily accessible to the community.

By investing in educational initiatives, State Farm empowers NYC residents to take control of their financial future and make wise insurance choices. This aligns with the company’s values of transparency and customer education.

Disaster Relief and Support

New York City is no stranger to natural disasters and emergencies. State Farm is prepared to respond quickly and effectively in times of crisis. The company has a dedicated team that works closely with local authorities and relief organizations to provide support and assistance to affected residents.

State Farm’s disaster relief efforts include offering temporary housing solutions, providing financial assistance for emergency repairs, and helping policyholders navigate the claims process. This level of support demonstrates the company’s commitment to being there for its customers during their most vulnerable times.

What sets State Farm Insurance NYC apart from other insurance providers in the city?

+State Farm Insurance NYC stands out for its comprehensive coverage options, personalized service, and community involvement. With a network of local agents who understand the unique needs of NYC residents and businesses, State Farm offers tailored insurance solutions. Additionally, their commitment to customer satisfaction, digital convenience, and community initiatives sets them apart as a trusted insurance provider in the city.

How can I find a State Farm agent in my NYC neighborhood?

+State Farm has a user-friendly online agent locator tool. You can visit their website and enter your NYC zip code or neighborhood name to find a list of local agents. Each agent’s profile provides contact information and details about their services, making it easy to connect with an agent near you.

What are the benefits of choosing State Farm’s life insurance policies in NYC?

+State Farm’s life insurance policies offer financial protection and peace of mind to NYC residents. With a range of policy options, including term, permanent, and universal life insurance, you can choose the coverage that best suits your needs and budget. Additionally, State Farm’s local agents can provide personalized guidance to help you make informed decisions about your life insurance coverage.

How does State Farm handle claims in NYC, especially in cases of natural disasters or emergencies?

+State Farm is committed to providing efficient and reliable claims handling in NYC, including during natural disasters and emergencies. Their dedicated team works closely with local authorities and relief organizations to offer timely support and assistance. Policyholders can expect a swift response, financial assistance, and guidance throughout the claims process.