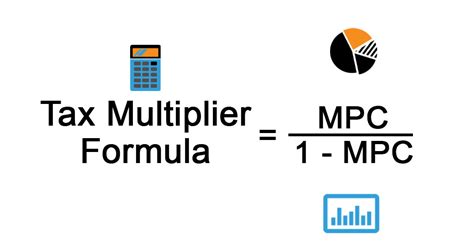

The concept of a tax multiplier is a crucial aspect of tax planning, as it can significantly impact an individual's or business's financial situation. Essentially, a tax multiplier refers to the idea that every dollar saved on taxes can have a multiplier effect on one's overall financial well-being. In this article, we will delve into the world of tax multipliers, exploring what they are, how they work, and providing five expert tips on how to maximize their benefits.

Understanding Tax Multipliers

A tax multiplier is a strategy used to amplify the impact of tax savings. By leveraging tax-advantaged accounts, deductions, and credits, individuals and businesses can reduce their tax liability, freeing up more funds for investment, savings, or other financial goals. The key to maximizing tax multipliers lies in understanding the various tax planning opportunities available and implementing them effectively. For instance, contributing to a retirement account can not only reduce taxable income but also provide a potential long-term investment growth, thereby amplifying the initial tax savings.

Key Points

- Understanding the concept of tax multipliers and their potential impact on financial planning

- Identifying and leveraging tax-advantaged accounts and investments

- Maximizing deductions and credits to reduce tax liability

- Implementing a strategic tax planning approach to amplify financial benefits

- Regularly reviewing and adjusting tax strategies to ensure alignment with changing financial goals and tax laws

Tip 1: Leverage Tax-Advantaged Accounts

Tax-advantaged accounts such as 401(k), IRA, or Roth IRA for individuals, and similar accounts for businesses, offer a powerful way to reduce tax liability while saving for the future. Contributions to these accounts are often made with pre-tax dollars, reducing taxable income for the year. Moreover, the funds grow tax-deferred or tax-free, depending on the account type, providing a substantial tax multiplier effect over time. For example, an individual contributing 10,000 to a traditional IRA might save 2,500 in taxes in the first year (assuming a 25% tax bracket), and the account could grow to $20,000 or more over the next decade, depending on investment returns, resulting in a significant multiplier effect on the initial tax savings.

Tip 2: Maximize Tax Deductions and Credits

Tax deductions and credits are another critical component of tax multiplier strategies. Deductions reduce taxable income, while credits directly reduce the amount of tax owed. Maximizing these can significantly enhance the tax multiplier effect. For businesses, this might include deductions for operational expenses, equipment, and payroll. Individuals can benefit from deductions like mortgage interest, charitable donations, and medical expenses. Credits, such as the Earned Income Tax Credit (EITC) for low-income workers or the Child Tax Credit for families, can provide substantial tax savings. Understanding and claiming all eligible deductions and credits can amplify the initial tax savings, allowing for more funds to be allocated towards investments or savings.

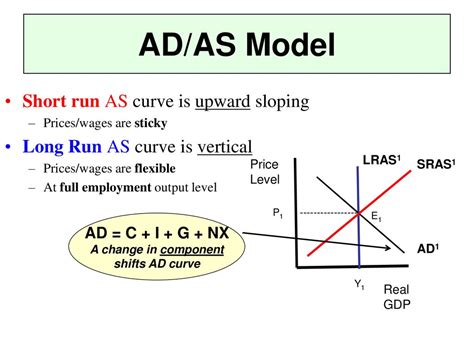

Tip 3: Invest in Tax-Efficient Investments

Investments can also play a crucial role in tax multiplier strategies. Tax-efficient investments, such as index funds or municipal bonds, are designed to minimize tax liabilities. Index funds, for example, tend to have lower turnover rates, which means fewer capital gains are distributed to investors, reducing tax liabilities. Municipal bonds, on the other hand, offer tax-free income, which can be particularly beneficial for investors in higher tax brackets. By focusing on tax-efficient investments, individuals and businesses can reduce their tax burden, thereby enhancing the tax multiplier effect and retaining more of their investment gains.

| Investment Type | Tax Efficiency | Potential Tax Savings |

|---|---|---|

| Index Funds | High | 5-10% of investment gains |

| Municipal Bonds | Very High | 100% of income from bonds |

| Dividend-paying Stocks | Medium | 2-5% of dividend income |

Tip 4: Utilize Tax Loss Harvesting

Tax loss harvesting is a strategy that involves selling securities that have declined in value to realize losses, which can then be used to offset gains from other investments. This approach can help reduce tax liabilities on investment gains, thereby amplifying the tax multiplier effect. By offsetting gains with losses, investors can minimize their tax burden, retaining more of their investment returns. It’s essential to conduct tax loss harvesting strategically, ensuring that the overall investment portfolio remains aligned with long-term financial goals.

Tip 5: Regularly Review and Adjust Tax Strategies

Tax laws and personal financial situations can change frequently, making it crucial to regularly review and adjust tax strategies. This includes reassessing investments, deductions, and credits to ensure they remain optimal. Tax planning is not a one-time event but an ongoing process that requires continuous monitoring and adaptation. By staying informed about tax law changes and adjusting strategies accordingly, individuals and businesses can maximize their tax multipliers, ensuring they are always leveraging the most effective tax savings opportunities available to them.

What is the primary benefit of using tax multipliers in financial planning?

+The primary benefit of using tax multipliers is the potential to amplify the impact of tax savings, allowing for more funds to be allocated towards investments, savings, or other financial goals, thereby enhancing overall financial well-being.

How can tax-advantaged accounts contribute to a tax multiplier strategy?

+Tax-advantaged accounts, such as 401(k) or IRA, can contribute to a tax multiplier strategy by reducing taxable income, allowing for tax-deferred or tax-free growth, and potentially lowering tax liability in retirement, thereby amplifying the initial tax savings over time.

What role does tax loss harvesting play in maximizing tax multipliers?

+Tax loss harvesting plays a significant role in maximizing tax multipliers by allowing investors to offset gains from other investments with losses, thereby reducing tax liabilities on investment gains and retaining more of their investment returns.

In conclusion, tax multipliers offer a powerful tool for enhancing financial planning and investment strategies. By understanding and leveraging tax-advantaged accounts, maximizing deductions and credits, investing in tax-efficient investments, utilizing tax loss harvesting, and regularly reviewing and adjusting tax strategies, individuals and businesses can significantly amplify the impact of their tax savings. As with any financial strategy, it’s essential to approach tax multipliers with a deep understanding of their implications and a commitment to ongoing learning and adaptation, ensuring that tax planning remains a dynamic and effective component of overall financial management.