With the rise of mobile banking, depositing checks has become easier than ever. TD Mobile Deposit is a convenient feature offered by TD Bank that allows users to deposit checks remotely using their mobile devices. This feature has revolutionized the way people bank, saving them time and effort. In this article, we will provide 5 tips for using TD Mobile Deposit, ensuring a seamless and secure experience for users.

Key Points

- Ensure your mobile device meets the system requirements for TD Mobile Deposit

- Use good lighting and a stable surface when taking photos of checks

- Verify check information and endorsements before submitting

- Avoid common errors such as folded or creased checks

- Monitor your account for deposited funds and potential issues

Understanding TD Mobile Deposit

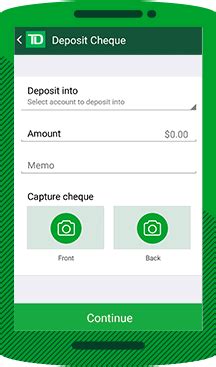

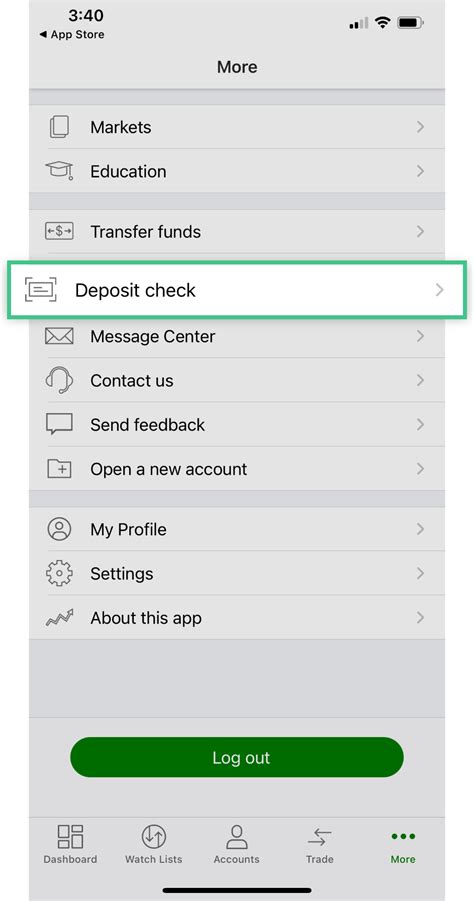

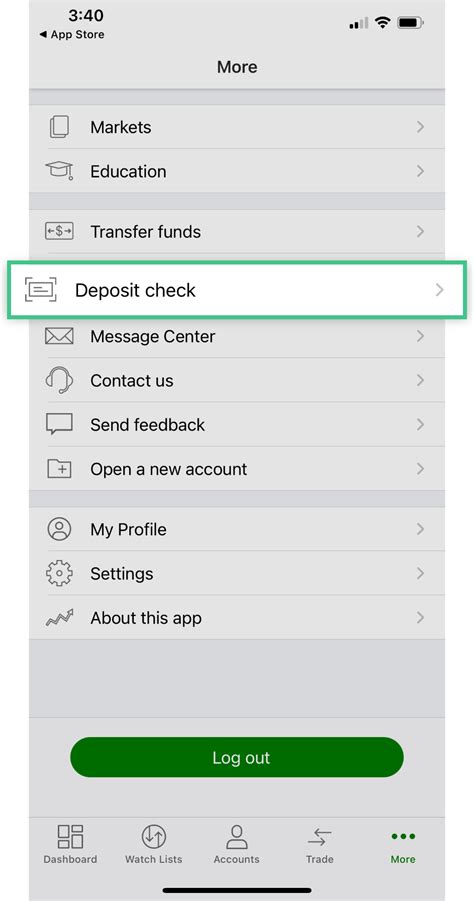

TD Mobile Deposit is a feature available through the TD Bank mobile app, allowing users to deposit checks into their accounts using their smartphone or tablet. This feature uses the device’s camera to capture images of the check, which are then transmitted to TD Bank for processing. To use TD Mobile Deposit, users must have a TD Bank account, the TD Bank mobile app, and a compatible mobile device.

System Requirements and Compatibility

Before using TD Mobile Deposit, it’s essential to ensure your mobile device meets the system requirements. The TD Bank mobile app is compatible with a range of devices, including iPhones and Android smartphones. Users should check the TD Bank website for the most up-to-date information on compatible devices and operating systems. Additionally, a strong internet connection is necessary for successful check deposits.

| Device Type | Operating System | Version |

|---|---|---|

| iPhone | iOS | 12.0 or later |

| Android Smartphone | Android | 8.0 or later |

Best Practices for Using TD Mobile Deposit

To ensure a smooth and secure experience with TD Mobile Deposit, follow these best practices:

Tip 1: Use Good Lighting and a Stable Surface

When taking photos of checks, use good lighting and a stable surface to prevent blurry or distorted images. This will help ensure that the check is processed correctly and reduce the risk of errors or rejections.

Tip 2: Verify Check Information and Endorsements

Before submitting a check for deposit, verify that the check information, including the date, payee, and amount, is correct. Additionally, ensure that the check is properly endorsed with your signature and any required restrictive endorsements.

Tip 3: Avoid Common Errors

Avoid common errors such as folded or creased checks, which can cause issues with image quality and processing. Also, ensure that the check is not torn or damaged in any way, as this can lead to rejection or delay.

Tip 4: Monitor Your Account

After submitting a check for deposit, monitor your account to ensure that the funds are credited correctly. Also, be aware of any potential issues or holds on the deposit, and contact TD Bank customer support if you have any questions or concerns.

Tip 5: Keep Records and Follow Up

Keep records of your deposited checks, including the check number, date, and amount. This will help you track your deposits and ensure that your account is accurate. If you encounter any issues or errors, follow up with TD Bank customer support to resolve the issue promptly.

What are the system requirements for TD Mobile Deposit?

+The TD Bank mobile app is compatible with iPhones and Android smartphones, with a minimum operating system version of iOS 12.0 or Android 8.0.

How do I ensure good image quality when taking photos of checks?

+Use good lighting and a stable surface when taking photos of checks. Ensure the check is flat and smooth, and the camera is focused correctly.

What should I do if I encounter an issue with TD Mobile Deposit?

+Contact TD Bank customer support for assistance with any issues or errors related to TD Mobile Deposit. They will be able to help you resolve the issue promptly.

In conclusion, TD Mobile Deposit is a convenient and secure feature offered by TD Bank, allowing users to deposit checks remotely using their mobile devices. By following the 5 tips outlined in this article, users can ensure a seamless and secure experience with TD Mobile Deposit. Remember to always verify check information and endorsements, use good lighting and a stable surface, avoid common errors, monitor your account, and keep records of your deposited checks. With these best practices and a little practice, you’ll be a pro at using TD Mobile Deposit in no time.