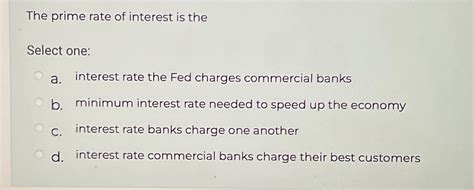

The prime rate, often considered the benchmark for the best customers, is a crucial concept in the financial sector. It refers to the interest rate that commercial banks charge their most creditworthy clients, typically large corporations with excellent credit history. This rate serves as a reference point for other interest rates, influencing the overall borrowing costs in the economy. In this article, we will delve into the world of prime rates, exploring their significance, how they are determined, and their impact on the financial landscape.

Key Points

- The prime rate is the interest rate charged to the most creditworthy customers, typically large corporations with excellent credit history.

- It is determined by the Federal Reserve, taking into account various economic factors, including inflation, employment rates, and GDP growth.

- The prime rate influences other interest rates, such as mortgage rates, credit card rates, and small business loan rates.

- A change in the prime rate can have a ripple effect on the economy, impacting borrowing costs, consumer spending, and business investment.

- Understanding the prime rate is essential for individuals and businesses to make informed decisions about borrowing and investing.

Understanding the Prime Rate

The prime rate is not a single, fixed rate, but rather a range of rates offered by banks to their best customers. It is typically lower than the rates charged to less creditworthy borrowers, reflecting the reduced risk associated with lending to established corporations. The prime rate is often used as a benchmark for other interest rates, such as mortgage rates, credit card rates, and small business loan rates. This means that changes in the prime rate can have a significant impact on the overall cost of borrowing in the economy.

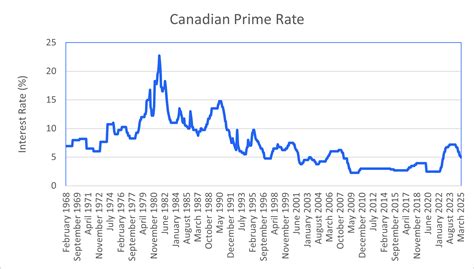

Determining the Prime Rate

The Federal Reserve, also known as the “Fed,” plays a crucial role in determining the prime rate. The Fed sets the federal funds target rate, which is the interest rate at which banks and other depository institutions lend and borrow money from each other. This rate, in turn, influences the prime rate, as banks adjust their lending rates to reflect changes in the federal funds target rate. The Fed takes into account various economic factors, including inflation, employment rates, and GDP growth, when making decisions about the federal funds target rate. For example, in 2020, the Fed lowered the federal funds target rate to 0% - 0.25% in response to the COVID-19 pandemic, resulting in a decrease in the prime rate to 3.25%.

| Year | Prime Rate | Federal Funds Target Rate |

|---|---|---|

| 2020 | 3.25% | 0% - 0.25% |

| 2019 | 4.75% | 1.50% - 1.75% |

| 2018 | 5.00% | 2.00% - 2.25% |

Impact of the Prime Rate on the Economy

A change in the prime rate can have a ripple effect on the economy, impacting borrowing costs, consumer spending, and business investment. When the prime rate decreases, borrowing becomes cheaper, which can lead to increased consumer spending and business investment. On the other hand, an increase in the prime rate can make borrowing more expensive, leading to reduced spending and investment. For example, a decrease in the prime rate can lead to an increase in mortgage refinancing, as homeowners take advantage of lower interest rates to reduce their monthly payments.

Practical Applications of the Prime Rate

The prime rate has various practical applications, including determining the interest rate charged on credit cards, personal loans, and small business loans. It is also used as a reference point for adjustable-rate mortgages and home equity lines of credit. Understanding the prime rate is essential for individuals and businesses to make informed decisions about borrowing and investing. For instance, a small business owner may use the prime rate to determine the interest rate charged on a line of credit, while an individual may use it to compare rates on personal loans.

In conclusion, the prime rate is a critical component of the financial system, influencing borrowing costs and economic activity. By understanding the prime rate and its determinants, individuals and businesses can make informed decisions about borrowing and investing, ultimately contributing to a more stable and prosperous economy.

What is the current prime rate?

+The current prime rate is 3.25%, as of 2022. However, it’s essential to note that the prime rate can fluctuate over time, reflecting changes in economic conditions and monetary policy.

How does the prime rate affect mortgage rates?

+The prime rate can influence mortgage rates, as changes in the prime rate can impact the overall cost of borrowing. However, mortgage rates are also influenced by other factors, such as credit score, loan term, and market conditions.

Can I negotiate the prime rate with my bank?

+While it’s possible to negotiate the interest rate with your bank, the prime rate is typically set by the bank and reflects the current market conditions. However, you may be able to negotiate a better rate if you have an excellent credit history and a strong relationship with your bank.