When considering a merger, it's essential to approach the process with a clear understanding of the complexities involved. A merger can be a strategic move to expand market share, reduce costs, and increase competitiveness, but it requires careful planning and execution. With years of experience in corporate finance and mergers and acquisitions, I've seen firsthand the importance of a well-thought-out strategy. In this article, we'll explore five key tips for a successful merger, highlighting the importance of due diligence, cultural alignment, strategic planning, effective communication, and post-merger integration.

Key Points

- Conduct thorough due diligence to identify potential risks and opportunities

- Ensure cultural alignment between the merging companies to facilitate a smooth transition

- Develop a comprehensive strategic plan to guide the merger process

- Establish effective communication channels to keep stakeholders informed

- Implement a robust post-merger integration plan to realize the full potential of the combined entity

Due Diligence: The Foundation of a Successful Merger

Due diligence is a critical component of the merger process, allowing companies to assess the potential risks and opportunities of a deal. This involves a thorough review of the target company’s financial statements, operations, management team, and market position. According to a study by KPMG, 70% of mergers and acquisitions fail to achieve their intended goals, often due to inadequate due diligence. By conducting thorough due diligence, companies can identify potential issues and develop strategies to address them, ultimately increasing the likelihood of a successful merger.

The Importance of Cultural Alignment

Cultural alignment is a crucial factor in the success of a merger. When two companies with different cultures merge, it can lead to integration challenges and decreased productivity. A study by Harvard Business Review found that cultural differences were a major contributor to merger failures, with 60% of executives citing cultural issues as a primary reason for failure. By assessing the cultural compatibility of the merging companies, organizations can develop strategies to mitigate potential conflicts and facilitate a smoother transition.

| Merger Stage | Key Considerations |

|---|---|

| Pre-Merger | Due diligence, cultural alignment, strategic planning |

| Merger Announcement | Communication strategy, stakeholder engagement |

| Post-Merger Integration | Integration planning, change management, performance monitoring |

Strategic Planning: Guiding the Merger Process

A comprehensive strategic plan is essential for guiding the merger process and ensuring that the combined entity achieves its intended goals. This involves defining the merger’s objectives, identifying key performance indicators, and developing a roadmap for integration. According to a report by McKinsey & Company, companies that develop a clear strategic plan prior to a merger are more likely to achieve their intended goals, with 80% of executives citing a clear plan as a key factor in merger success.

Effective Communication: Keeping Stakeholders Informed

Effective communication is critical during the merger process, as it helps to manage stakeholder expectations and mitigate potential risks. This involves developing a comprehensive communication strategy that addresses the needs of various stakeholder groups, including employees, customers, and investors. A study by Forbes found that transparent communication was a key factor in merger success, with 90% of executives citing open communication as essential for building trust and confidence among stakeholders.

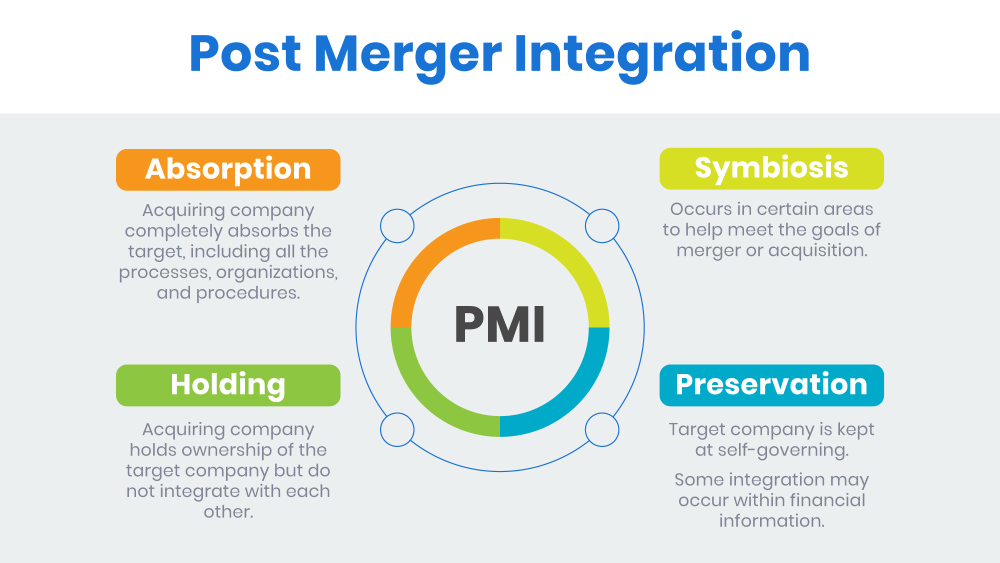

Post-Merger Integration: Realizing the Full Potential of the Combined Entity

Post-merger integration is a critical phase of the merger process, as it involves combining the operations, systems, and cultures of the merging companies. This requires a robust integration plan that addresses key areas such as organizational design, process alignment, and change management. According to a report by Deloitte, companies that develop a comprehensive integration plan are more likely to achieve their intended goals, with 75% of executives citing a well-planned integration as essential for merger success.

What are the key considerations during the pre-merger stage?

+The pre-merger stage involves due diligence, cultural alignment, and strategic planning. It's essential to conduct thorough due diligence to identify potential risks and opportunities, assess cultural compatibility, and develop a comprehensive strategic plan to guide the merger process.

How can companies ensure effective communication during the merger process?

+Companies can ensure effective communication by developing a comprehensive communication strategy that addresses the needs of various stakeholder groups. This involves transparent communication, regular updates, and a clear plan for addressing stakeholder concerns.

What are the key factors in post-merger integration success?

+The key factors in post-merger integration success include a comprehensive integration plan, organizational design, process alignment, and change management. Companies must develop a robust plan that addresses these areas and ensures a smooth transition for the combined entity.

In conclusion, a successful merger requires careful planning, execution, and integration. By following these five key tips – conducting thorough due diligence, ensuring cultural alignment, developing a comprehensive strategic plan, establishing effective communication, and implementing a robust post-merger integration plan – companies can increase the likelihood of a successful merger and achieve their intended goals. As a seasoned expert in mergers and acquisitions, I’ve seen the importance of these factors in facilitating a successful merger, and I hope that this article has provided valuable insights for organizations considering a merger.