Understanding the Different Types of Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With a myriad of options available, it's crucial to understand the various types of car insurance to make an informed decision. This comprehensive guide aims to unravel the complexities, offering a clear insight into the different policies and their benefits.

The world of car insurance is diverse, catering to a wide range of needs and preferences. From comprehensive coverage to specialized policies, each type serves a unique purpose. By delving into the specifics, we can navigate the insurance landscape with confidence, ensuring we select the coverage that best aligns with our individual requirements.

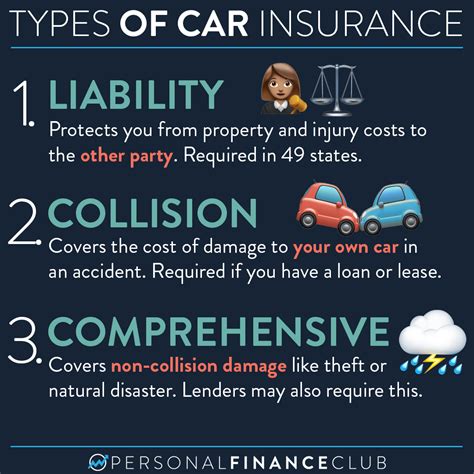

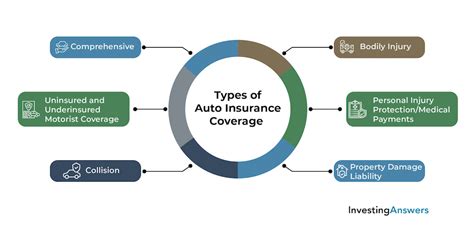

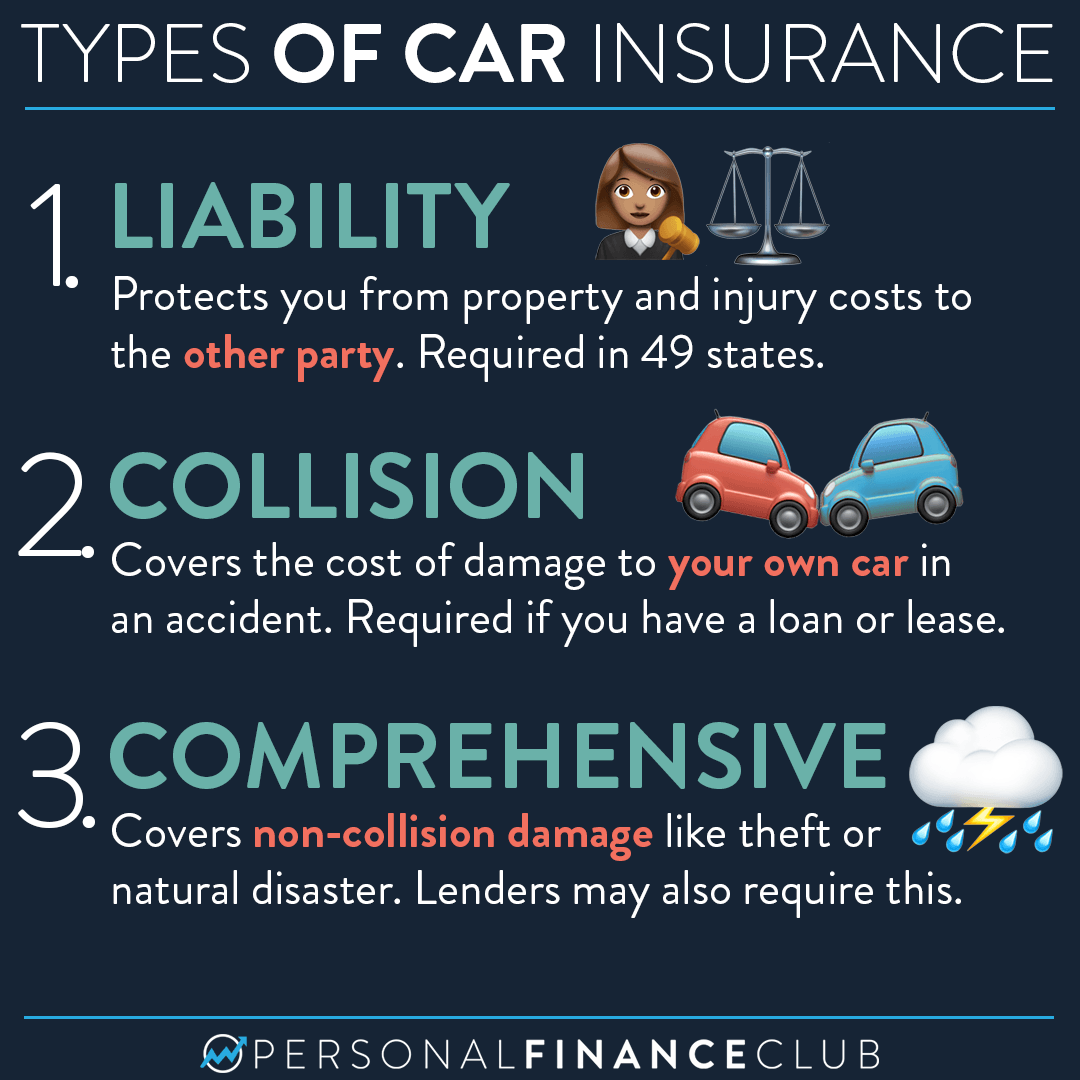

Comprehensive Car Insurance

Comprehensive car insurance, often considered the gold standard, provides an extensive level of protection. This policy covers a wide range of scenarios, including accidents, theft, natural disasters, and even vandalism. It is designed to offer a comprehensive safety net, ensuring drivers are financially safeguarded in various unexpected situations.

Key benefits of comprehensive insurance include:

- Wide-ranging coverage: This policy covers damage to your vehicle, regardless of the cause, be it an accident, a fallen tree, or a severe weather event.

- Personal injury protection: Many comprehensive plans include coverage for medical expenses, ensuring you're protected in the event of an injury.

- Uninsured/underinsured motorist coverage: This protects you if you're involved in an accident with a driver who doesn't have sufficient insurance.

- Comprehensive support: With comprehensive insurance, you often get additional services like roadside assistance and rental car coverage.

Real-World Example

Let's consider Sarah, a resident of a hurricane-prone area. With comprehensive insurance, she can rest easy knowing that her policy covers not just accidents but also potential damage from storms. This type of insurance provides a comprehensive solution for drivers like Sarah, offering a sense of security in an unpredictable environment.

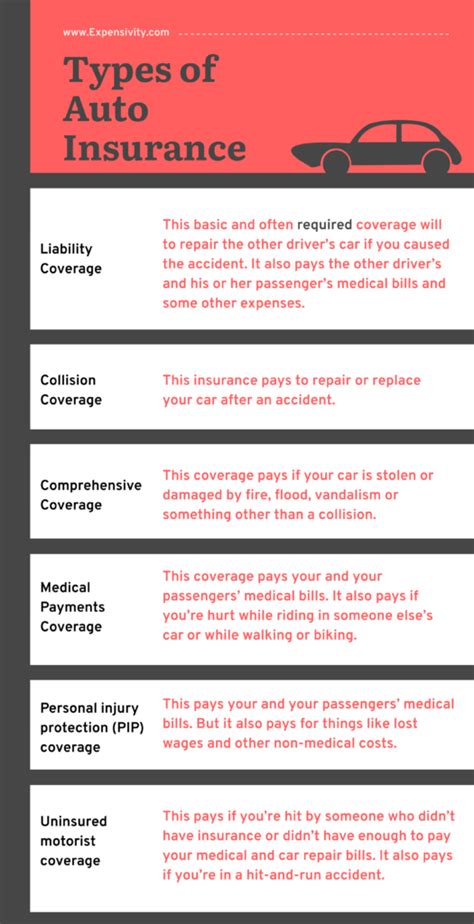

Liability-Only Car Insurance

Liability-only car insurance is a more budget-friendly option, primarily covering the financial responsibility of the policyholder towards others in the event of an accident. This policy type focuses on protecting the insured from claims made by third parties, such as other drivers, passengers, or property owners.

Key features of liability-only insurance include:

- Bodily injury liability: This covers medical expenses and lost wages for injured parties in an accident for which you are at fault.

- Property damage liability: This aspect of the policy covers the cost of repairing or replacing property damaged in an accident caused by the insured.

- Cost-effectiveness: Liability-only insurance is generally more affordable than comprehensive policies, making it an attractive option for those on a tight budget.

Case Study

Imagine John, a cautious driver with an excellent safety record. He chooses liability-only insurance, recognizing that he rarely needs coverage for his own vehicle. This policy suits his needs perfectly, providing the necessary protection without unnecessary costs.

Collision Car Insurance

Collision car insurance is a specific type of coverage that comes into play when your vehicle collides with another vehicle or object. This policy provides protection for the damage caused to your car, regardless of who is at fault.

Key characteristics of collision insurance are:

- Collision coverage: As the name suggests, this policy covers damage to your vehicle resulting from a collision, be it with another car, a tree, or a lamp post.

- Deductible flexibility: Policyholders often have the option to choose their deductible, allowing them to balance cost and coverage as per their preference.

- Optional add-ons: Many collision policies offer additional coverages, such as rental car reimbursement or glass coverage, providing extra peace of mind.

Scenario Analysis

For Maria, a frequent commuter in a busy city, collision insurance is a wise choice. With the increased risk of accidents in urban areas, this policy provides crucial protection, ensuring her car is covered in the event of an unexpected collision.

Personal Injury Protection (PIP) Insurance

Personal Injury Protection, or PIP insurance, is a unique policy that focuses solely on the medical needs of the insured and their passengers following an accident. This coverage is particularly beneficial as it provides medical coverage regardless of who is at fault in the accident.

PIP insurance offers the following advantages:

- Medical coverage: This policy covers a wide range of medical expenses, including doctor visits, hospital stays, rehabilitation, and even funeral costs.

- Wage loss coverage: In many cases, PIP insurance also provides compensation for lost wages if the insured is unable to work due to injuries sustained in the accident.

- Broad coverage: Unlike other policies, PIP covers not just the policyholder but also their passengers, ensuring everyone in the vehicle is protected.

Practical Application

Consider Robert, who commutes long distances for work. In the event of an accident, PIP insurance ensures he receives the necessary medical care without having to worry about immediate payment, allowing him to focus on his recovery.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is a crucial aspect of car insurance, designed to protect policyholders when involved in an accident with a driver who either has no insurance or insufficient coverage to pay for the damages caused.

Key benefits of this coverage include:

- Protection against uninsured drivers: In the event of an accident with an uninsured driver, this coverage ensures you're not left footing the bill for repairs or medical expenses.

- Coverage for underinsured drivers: If you're involved in an accident with a driver who has insurance but not enough to cover the full extent of the damages, this policy steps in to provide additional coverage.

- Peace of mind: By adding this coverage to your policy, you gain an extra layer of protection, ensuring you're not left vulnerable in the event of an accident with an uninsured or underinsured driver.

Real-Life Scenario

Imagine Emily, who is involved in an accident caused by a driver who has no insurance. With uninsured motorist coverage, she can rest assured that her own policy will cover the costs, providing the necessary financial support to repair her vehicle and any medical expenses she incurs.

Comparative Analysis

To better understand the differences between these policies, let's compare them side by side:

| Policy Type | Coverage | Cost | Benefits |

|---|---|---|---|

| Comprehensive | Wide-ranging, including natural disasters | Higher | Comprehensive protection, additional services |

| Liability-Only | Third-party claims | Lower | Budget-friendly, suitable for cautious drivers |

| Collision | Specific to collisions | Varies | Tailored coverage, flexible deductibles |

| PIP | Medical needs of insured and passengers | Varies | Broad medical coverage, wage loss compensation |

| Uninsured/Underinsured Motorist | Protection against uninsured/underinsured drivers | Varies | Extra layer of protection, financial support |

Each type of car insurance offers distinct benefits, and the ideal policy depends on individual circumstances and preferences. By understanding these differences, drivers can make informed decisions, ensuring they have the coverage that best suits their needs.

Conclusion

Car insurance is a vital aspect of responsible vehicle ownership, and understanding the different types available is key to making the right choice. Whether you opt for the comprehensive protection of a full-coverage policy or the cost-effective benefits of liability-only insurance, having the right coverage provides peace of mind and financial security. Remember, the best policy is one that suits your individual needs and provides the protection you require on the road.

FAQ

What is the difference between comprehensive and liability-only insurance?

+Comprehensive insurance offers wide-ranging coverage, including accidents, theft, and natural disasters, while liability-only insurance focuses on protecting the insured from third-party claims, making it a more budget-friendly option.

How does collision insurance differ from comprehensive insurance?

+Collision insurance specifically covers damage to your vehicle resulting from a collision, whereas comprehensive insurance provides a more extensive coverage, including accidents, theft, and natural disasters.

What does Personal Injury Protection (PIP) insurance cover that other policies don’t?

+PIP insurance focuses solely on the medical needs of the insured and their passengers, providing coverage for a wide range of medical expenses and wage loss, regardless of fault in the accident.