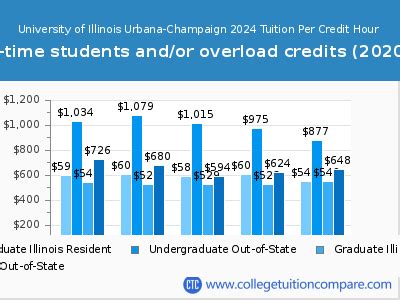

The University of Illinois at Urbana-Champaign (UIUC) is a world-renowned institution, attracting students from all over the globe with its academic excellence and vibrant campus life. However, like any other top-tier university, attending UIUC comes with a significant price tag. The cost of attendance can be a daunting factor for prospective students and their families. Here, we will delve into the realm of UIUC cost tips, providing valuable insights and strategies to help manage and mitigate the financial burden associated with attending this esteemed institution.

Understanding UIUC Costs: A Comprehensive Overview

Before diving into the cost-saving tips, it’s essential to understand the breakdown of UIUC’s costs. The total cost of attendance includes tuition, fees, room, board, books, supplies, transportation, and personal expenses. For the 2022-2023 academic year, the estimated total cost for Illinois residents is approximately 26,966, while out-of-state students can expect to pay around 44,988. These figures underscore the importance of financial planning and the need for strategies to reduce costs without compromising the quality of education or campus experience.

Key Points

- Apply for scholarships and grants to reduce reliance on loans.

- Consider on-campus employment opportunities to earn money while studying.

- Take advantage of UIUC's financial aid and cost estimation tools.

- Look into off-campus housing options that may offer more affordable rates.

- Utilize budgeting apps and resources to track and manage expenses effectively.

Tip 1: Scholarship Hunting and Financial Aid

One of the most effective ways to manage UIUC costs is by securing scholarships and grants. These forms of financial aid do not require repayment, making them an attractive option for students. UIUC offers a variety of scholarships, including merit-based and need-based awards. Additionally, the university participates in federal and state financial aid programs. Prospective students should submit their Free Application for Federal Student Aid (FAFSA) as early as possible to maximize their eligibility for aid. The FAFSA becomes available on October 1st each year, and UIUC’s priority deadline is December 15th for the following fall semester.

Tip 2: On-Campus Employment Opportunities

UIUC provides numerous on-campus job opportunities that can help students earn money to cover expenses. These jobs not only offer a source of income but also enhance students’ resumes and provide valuable work experience. The university’s Student Employment Office is a great resource for finding part-time jobs that can fit around academic schedules. Moreover, some on-campus jobs may offer additional benefits, such as professional development opportunities or tuition waivers, further enhancing their value.

Tip 3: Utilizing Financial Aid and Cost Estimation Tools

UIUC offers several tools and resources to help students and families estimate and manage costs. The Net Price Calculator provides an early estimate of the total annual UIUC cost, minus the grants and scholarships students may be eligible for. Additionally, the university’s financial aid office offers personalized counseling to help navigate the financial aid process and develop strategies for managing educational expenses. These resources can empower students and families to make informed decisions about their financial investments in education.

| Cost Component | Estimated Cost for 2022-2023 |

|---|---|

| Tuition and Fees (In-State) | $15,638 |

| Tuition and Fees (Out-of-State) | $26,962 |

| Room and Board | $10,452 |

| Books and Supplies | $1,200 |

| Transportation | $1,050 |

| Personal Expenses | $1,800 |

Long-Term Financial Planning and Budgeting Strategies

Beyond the immediate costs of attending UIUC, students and families should also consider long-term financial planning strategies. This includes saving for future educational expenses, understanding loan repayment options, and building good credit habits. By adopting a forward-thinking approach to financial management, students can minimize debt, maximize their educational investment, and position themselves for success upon graduation.

Tip 4: Exploring Off-Campus Housing Options

While UIUC offers a variety of on-campus housing options, exploring off-campus alternatives can sometimes provide more affordable rates, especially for upperclassmen or those with roommates. The Champaign-Urbana area has a range of apartments and houses available for rent, and some landlords offer competitive pricing and amenities. However, it’s essential to weigh the potential cost savings against factors like convenience, safety, and the impact on campus life and academic performance.

Tip 5: Budgeting and Expense Management

Effective budgeting is key to managing UIUC costs successfully. Students should track their expenses, create a budget that accounts for all necessary expenditures, and regularly review their financial situation to make adjustments as needed. Utilizing budgeting apps and spreadsheets can streamline this process, providing real-time insights into spending patterns and areas for cost reduction. By maintaining a disciplined approach to financial management, students can ensure that they make the most of their time at UIUC without accumulating unnecessary debt.

What is the average debt load for UIUC graduates?

+According to recent data, the average debt load for UIUC graduates varies but typically ranges between $20,000 to $30,000. However, this figure can be significantly influenced by factors such as in-state vs. out-of-state tuition status, the degree pursued, and individual financial circumstances.

Are there specific scholarships available for international students at UIUC?

+Yes, UIUC offers a limited number of scholarships to international students, including the Illinois International Scholarship and the President's Award Program. Additionally, international students may be eligible for external scholarships from their home countries or private organizations.

How can students balance part-time jobs with academic responsibilities at UIUC?

+Students can balance part-time jobs with academic responsibilities by prioritizing their time, setting clear boundaries between work and study hours, and communicating effectively with employers and academic advisors. Utilizing time management tools and seeking support from UIUC's resources, such as the Academic Support Center, can also be beneficial.

In conclusion, while attending the University of Illinois at Urbana-Champaign comes with significant costs, there are numerous strategies and resources available to help manage and mitigate these expenses. By understanding the breakdown of costs, leveraging scholarships and financial aid, exploring on-campus employment, utilizing budgeting tools, and considering off-campus housing options, students can make their UIUC experience more affordable and set themselves up for long-term financial success.