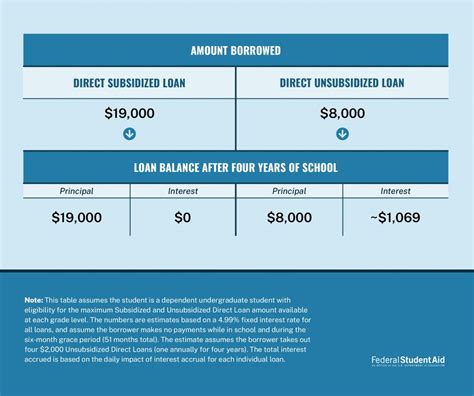

The unsubsidized loan interest rate is a crucial factor for borrowers, especially students, as it directly affects the total cost of their loan. As of today, the interest rates for unsubsidized loans can vary depending on the type of loan and the borrower's creditworthiness. For federal student loans, the interest rates are set by Congress and can change annually. For the 2022-2023 academic year, the interest rate for unsubsidized federal student loans is 4.99% for undergraduate students and 6.54% for graduate and professional students.

It's essential to note that these rates are subject to change, and borrowers should check the official government website or consult with their loan servicer for the most up-to-date information. Private lenders, on the other hand, may offer unsubsidized loans with varying interest rates, often based on the borrower's credit score and other factors. These rates can range from around 4% to over 12%, depending on the lender and the borrower's creditworthiness.

Key Points

- The current interest rate for unsubsidized federal student loans is 4.99% for undergraduate students and 6.54% for graduate and professional students.

- Private lenders may offer unsubsidized loans with varying interest rates, often based on the borrower's credit score.

- Interest rates for unsubsidized loans can change annually, and borrowers should check with their loan servicer or the official government website for the most up-to-date information.

- Borrowers with good credit may qualify for lower interest rates, while those with poor credit may face higher rates.

- Understanding the interest rate and terms of an unsubsidized loan is crucial for borrowers to make informed decisions about their borrowing options.

Understanding Unsubsidized Loan Interest Rates

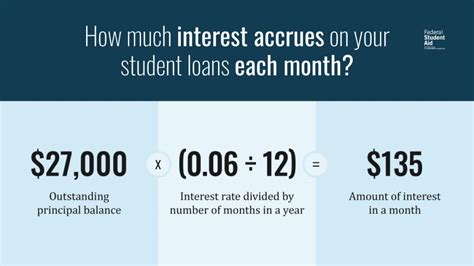

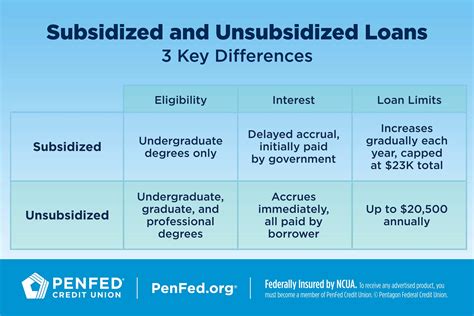

Unsubsidized loans, unlike subsidized loans, do not offer any government subsidy to cover the interest while the borrower is in school or during periods of deferment. This means that the borrower is responsible for paying the interest on the loan from the time it is disbursed. The interest rate for unsubsidized loans can have a significant impact on the total cost of the loan over time.

For example, a $10,000 unsubsidized loan with an interest rate of 4.99% will accrue approximately $499 in interest over a 12-month period, assuming simple interest. This means that the borrower will owe $10,499 at the end of the year, even if they have not made any payments. By understanding how interest rates work and the terms of their loan, borrowers can make more informed decisions about their borrowing options and develop strategies to manage their debt.

Factors Affecting Unsubsidized Loan Interest Rates

Several factors can influence the interest rate for unsubsidized loans, including the type of loan, the borrower’s creditworthiness, and market conditions. For federal student loans, the interest rates are set by Congress, and the rates can change annually. Private lenders, on the other hand, may use a variety of factors to determine the interest rate, including the borrower’s credit score, income, and debt-to-income ratio.

In general, borrowers with good credit may qualify for lower interest rates, while those with poor credit may face higher rates. It's essential for borrowers to shop around and compare rates from different lenders to find the best option for their needs. Additionally, borrowers should carefully review the terms of their loan, including the interest rate, fees, and repayment terms, to ensure they understand the total cost of the loan.

| Loan Type | Interest Rate | Repayment Term |

|---|---|---|

| Federal Undergraduate Loan | 4.99% | Up to 10 years |

| Federal Graduate Loan | 6.54% | Up to 10 years |

| Private Loan | 4% - 12% | Varies by lender |

Managing Unsubsidized Loan Debt

Managing unsubsidized loan debt requires a thoughtful and strategic approach. Borrowers should start by understanding the terms of their loan, including the interest rate, fees, and repayment terms. They should also explore options for reducing their interest rate, such as consolidating their loans or refinancing with a private lender.

In addition, borrowers should develop a plan for paying off their loan, including making regular payments and taking advantage of tax deductions for interest paid. By staying on top of their loan payments and making smart financial decisions, borrowers can minimize the impact of unsubsidized loan debt and achieve their long-term financial goals.

What is the current interest rate for unsubsidized federal student loans?

+The current interest rate for unsubsidized federal student loans is 4.99% for undergraduate students and 6.54% for graduate and professional students.

How do private lenders determine the interest rate for unsubsidized loans?

+Private lenders may use a variety of factors to determine the interest rate, including the borrower's credit score, income, and debt-to-income ratio.

What are some strategies for managing unsubsidized loan debt?

+Borrowers can manage their unsubsidized loan debt by understanding the terms of their loan, exploring options for reducing their interest rate, developing a plan for paying off their loan, and making regular payments.

Meta Description: Understand the current interest rates for unsubsidized loans, including federal student loans and private loans, and learn strategies for managing debt and reducing interest rates.