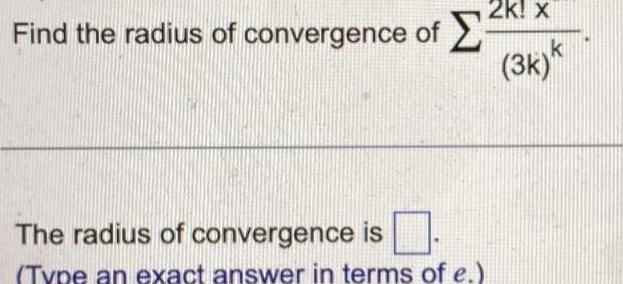

Vehicle insurance, also known as auto insurance or car insurance, is a crucial aspect of responsible vehicle ownership. It provides financial protection against potential losses and liabilities that may arise from operating a motor vehicle. With millions of vehicles on the roads worldwide, the need for adequate insurance coverage is paramount to ensure safety, security, and peace of mind for drivers and road users alike.

The Importance of Vehicle Insurance

Vehicle insurance plays a vital role in managing the risks associated with operating a vehicle. It offers a safety net for both the policyholder and other road users, covering a wide range of potential incidents and providing compensation for damages and injuries caused by accidents. Here are some key reasons why vehicle insurance is of utmost importance:

- Financial Protection: In the event of an accident, vehicle insurance provides financial coverage for repairs, medical expenses, and potential legal costs. This protection ensures that policyholders can manage the financial impact of accidents without incurring significant personal losses.

- Legal Compliance: In most jurisdictions, it is mandatory for vehicle owners to have valid insurance coverage. This requirement ensures that drivers are held accountable for their actions on the road and provides a mechanism for resolving disputes and compensating victims.

- Peace of Mind: Knowing that you have adequate insurance coverage gives drivers and passengers a sense of security. It allows them to focus on the road and enjoy their journeys without constant worry about potential accidents and their financial consequences.

- Road Safety: Vehicle insurance encourages responsible driving behavior. By providing financial incentives to drive safely and avoid accidents, insurance companies promote a culture of road safety, reducing the overall risk of accidents and injuries.

- Comprehensive Coverage: Modern vehicle insurance policies offer comprehensive protection, covering not only accidents but also other risks such as theft, vandalism, natural disasters, and even medical emergencies. This all-encompassing coverage provides policyholders with a comprehensive safety net.

Types of Vehicle Insurance Coverage

Vehicle insurance policies come in various forms, offering different levels of coverage to suit the needs of different drivers and vehicle owners. The specific types of coverage available may vary by region and insurance provider, but some common types include:

Liability Coverage

Liability insurance is a fundamental component of vehicle insurance, providing coverage for damages and injuries caused to others in an accident for which the policyholder is held responsible. This coverage includes:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by the policyholder.

- Property Damage Liability: Pays for the repair or replacement of property damaged in an accident, such as other vehicles, structures, or personal belongings.

Comprehensive Coverage

Comprehensive insurance, also known as “full coverage,” provides protection against a wide range of non-accident-related incidents. It typically includes coverage for:

- Theft: Covers the cost of replacing a stolen vehicle or its parts.

- Vandalism: Provides compensation for damages caused by intentional acts of vandalism.

- Natural Disasters: Covers damages resulting from events like hurricanes, floods, earthquakes, or wildfires.

- Falling Objects: Offers protection against damages caused by falling objects, such as tree branches.

- Animal Collisions: Pays for repairs if the policyholder's vehicle collides with an animal.

Collision Coverage

Collision insurance covers damages to the policyholder’s vehicle in the event of a collision with another vehicle or object, regardless of fault. This coverage is essential for protecting against costly repairs and can be especially valuable for drivers of newer or high-value vehicles.

Uninsured/Underinsured Motorist Coverage

This type of coverage provides protection for policyholders in situations where the at-fault driver does not have sufficient insurance coverage. It ensures that the policyholder is compensated for damages and injuries caused by an uninsured or underinsured driver.

Personal Injury Protection (PIP)

PIP, also known as no-fault insurance, covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident. It provides quick access to medical care and financial support during the recovery process.

Factors Affecting Vehicle Insurance Rates

Vehicle insurance rates can vary significantly based on a multitude of factors. Insurance companies use these factors to assess the risk associated with insuring a particular driver and vehicle. Some key factors that influence insurance rates include:

- Driver's Age and Experience: Younger drivers, especially those under 25, often face higher insurance premiums due to their relative lack of driving experience. As drivers gain more years of safe driving, their insurance rates tend to decrease.

- Vehicle Type and Usage: The make, model, and age of the vehicle play a significant role in determining insurance rates. High-performance vehicles, luxury cars, and sports cars generally have higher insurance costs due to their increased risk of accidents and higher repair costs. Additionally, the primary purpose of the vehicle (e.g., commuting, business, pleasure) can also impact rates.

- Driving Record: A driver's history of accidents, traffic violations, and claims directly affects their insurance rates. Drivers with a clean record often enjoy lower premiums, while those with multiple accidents or violations may face higher costs.

- Location: Insurance rates can vary significantly by geographical region. Factors such as traffic density, crime rates, weather conditions, and the prevalence of accidents in a particular area can all influence insurance premiums.

- Credit History: In many cases, insurance companies consider a driver's credit score when determining insurance rates. Drivers with good credit scores are often viewed as more financially responsible and may qualify for lower premiums.

- Coverage and Deductibles: The level of coverage chosen by the policyholder and the associated deductibles directly impact insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums.

Tips for Choosing the Right Vehicle Insurance

Selecting the right vehicle insurance policy can be a complex decision, but considering the following tips can help ensure you make an informed choice:

- Compare Multiple Quotes: Obtain quotes from several insurance providers to compare coverage options and premiums. This allows you to find the best value for your specific needs.

- Understand Your Coverage Needs: Assess your unique circumstances and determine the level of coverage you require. Consider factors such as the value of your vehicle, your driving habits, and your financial situation.

- Review Policy Details: Carefully read through the policy documents to understand the specific terms, conditions, and exclusions. Pay attention to the coverage limits, deductibles, and any potential gaps in coverage.

- Consider Bundling Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling can result in significant savings and streamline your insurance management.

- Explore Discounts: Insurance providers often offer discounts for various reasons, such as safe driving records, vehicle safety features, and loyalty. Inquire about available discounts to maximize your savings.

- Maintain a Clean Driving Record: A clean driving record is crucial for keeping insurance premiums low. Avoid accidents, traffic violations, and reckless driving behaviors to maintain a positive record.

- Consider Telematics Programs: Some insurance companies offer telematics programs that track driving behavior through a device installed in the vehicle. Safe driving habits monitored by these programs can lead to reduced premiums.

The Future of Vehicle Insurance

The insurance industry is constantly evolving, and vehicle insurance is no exception. Several trends and advancements are shaping the future of auto insurance, including:

- Telematics and Usage-Based Insurance (UBI): Telematics technology allows insurance companies to track and analyze driving behavior in real-time. UBI programs offer policyholders the opportunity to lower their premiums by demonstrating safe driving habits. This technology is expected to play a significant role in personalized insurance offerings.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being utilized to enhance insurance underwriting and claims processing. These technologies can analyze vast amounts of data to identify patterns and make more accurate risk assessments, leading to improved pricing and coverage options.

- Autonomous Vehicles: The rise of autonomous vehicles presents both challenges and opportunities for the insurance industry. While autonomous technology has the potential to reduce accidents, it also introduces new liability and coverage questions. Insurance providers are actively researching and developing policies to address these emerging risks.

- Connected Car Technology: The integration of connected car technology allows vehicles to communicate with insurance providers and emergency services in real-time. This technology can enhance road safety, improve accident response times, and provide valuable data for insurance purposes.

- Peer-to-Peer Insurance: Peer-to-peer insurance models, also known as mutual insurance, are gaining popularity. These models allow groups of individuals to pool their resources and share risks collectively, potentially offering more affordable and personalized coverage options.

Conclusion

Vehicle insurance is an essential aspect of responsible vehicle ownership, providing financial protection and peace of mind to drivers and road users. With various coverage options and factors influencing insurance rates, it is crucial for vehicle owners to carefully evaluate their needs and choose the right insurance policy. As the insurance industry continues to evolve with technological advancements, the future of vehicle insurance promises more personalized and innovative solutions.

How can I lower my vehicle insurance premiums?

+There are several strategies to reduce your vehicle insurance premiums. These include maintaining a clean driving record, choosing a higher deductible, bundling policies with the same insurer, and exploring discounts for safe driving, vehicle safety features, and loyalty.

What happens if I’m involved in an accident with an uninsured driver?

+If you have uninsured/underinsured motorist coverage, your insurance policy will provide compensation for damages and injuries caused by an uninsured driver. This coverage ensures that you are protected even when the at-fault driver lacks sufficient insurance.

Can I get vehicle insurance for my classic car?

+Yes, there are specialized insurance providers that offer policies tailored to classic and vintage vehicles. These policies often provide unique coverage options, such as agreed-value coverage, which ensures that you receive the full value of your classic car in the event of a total loss.