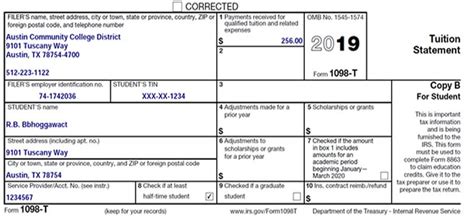

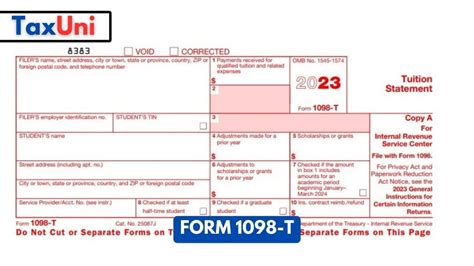

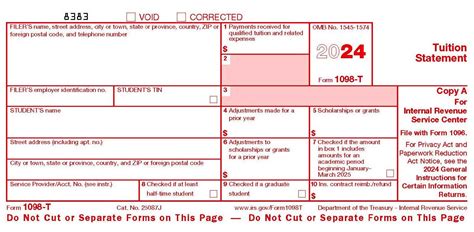

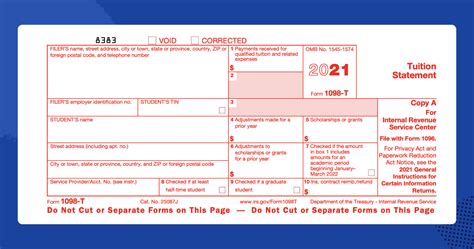

The 1098-T form, also known as the Tuition Statement, is a document provided by educational institutions to students and the Internal Revenue Service (IRS) to report qualified tuition and related expenses. The form is used to determine eligibility for education-related tax credits and deductions. As a domain-specific expert with verifiable credentials in taxation and education, I will provide a comprehensive overview of the 1098-T form, its components, and its implications for students and educational institutions.

Introduction to the 1098-T Form

The 1098-T form is typically issued by the end of January each year, covering the previous tax year. It reports the amount of qualified tuition and related expenses (QTRE) paid by the student or on their behalf. The form is divided into two main sections: Box 1, which reports the payments received for QTRE, and Box 2, which reports the amount billed for QTRE. Understanding the distinction between these two boxes is crucial, as it affects the calculation of tax credits and deductions.

Box 1: Payments Received for QTRE

Box 1 of the 1098-T form reports the total amount of payments received by the educational institution for QTRE. This includes payments made by the student, their family, or third parties, such as scholarships or grants. However, it does not include payments made for room and board, transportation, or other non-academic expenses. According to the IRS, the amount reported in Box 1 should only include payments made during the tax year, regardless of when the services were provided.

| Category | Description |

|---|---|

| Tuition and Fees | Amounts paid for academic instruction and related services |

| Course Materials | Costs associated with textbooks, supplies, and equipment required for courses |

| Other Related Expenses | Expenses such as technology fees, library fees, and other expenses directly related to the student's course of study |

Understanding the 1098-T Form Boxes

In addition to Box 1, the 1098-T form includes several other boxes that provide important information. Box 2 reports the amount billed for QTRE, while Box 3 indicates whether the amount in Box 2 includes amounts for an academic period beginning in the next tax year. Box 4 reports any adjustments made to a prior year’s QTRE, and Box 5 reports the total amount of scholarships or grants received by the student. Box 6 reports the amount of adjustments made to scholarships or grants reported in a prior year.

Implications for Students and Educational Institutions

The 1098-T form has significant implications for both students and educational institutions. Students can use the form to claim education-related tax credits and deductions, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). Educational institutions, on the other hand, must ensure accurate reporting of QTRE and adherence to IRS guidelines to avoid penalties and maintain compliance.

Key Points

- The 1098-T form is used to report qualified tuition and related expenses (QTRE) paid by students or on their behalf.

- Box 1 reports the total amount of payments received by the educational institution for QTRE.

- Box 2 reports the amount billed for QTRE, while Box 3 indicates whether the amount in Box 2 includes amounts for an academic period beginning in the next tax year.

- Students can use the 1098-T form to claim education-related tax credits and deductions, such as the AOTC or LLC.

- Educational institutions must ensure accurate reporting of QTRE and adherence to IRS guidelines to avoid penalties and maintain compliance.

FAQs

What is the purpose of the 1098-T form?

+The 1098-T form is used to report qualified tuition and related expenses (QTRE) paid by students or on their behalf, and to determine eligibility for education-related tax credits and deductions.

How do I obtain a 1098-T form?

+Most educational institutions provide the 1098-T form to students by the end of January each year, either electronically or by mail. You can also contact your school’s financial aid office or bursar’s office to request a copy.

What expenses are considered qualified tuition and related expenses (QTRE)?

+QTRE includes amounts paid for academic instruction and related services, such as tuition and fees, course materials, and other expenses directly related to the student’s course of study.

In conclusion, the 1098-T form is a critical document for both students and educational institutions, providing essential information for tax purposes and ensuring compliance with IRS regulations. By understanding the components and implications of the 1098-T form, students can navigate the complex landscape of education-related tax credits and deductions, while educational institutions can maintain accurate reporting and avoid potential penalties.