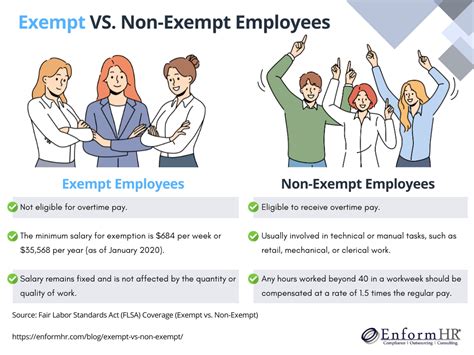

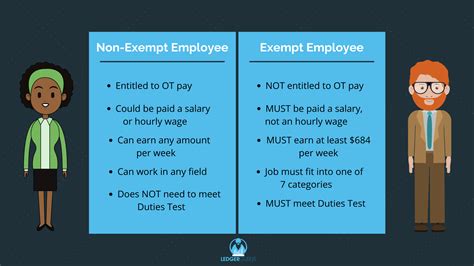

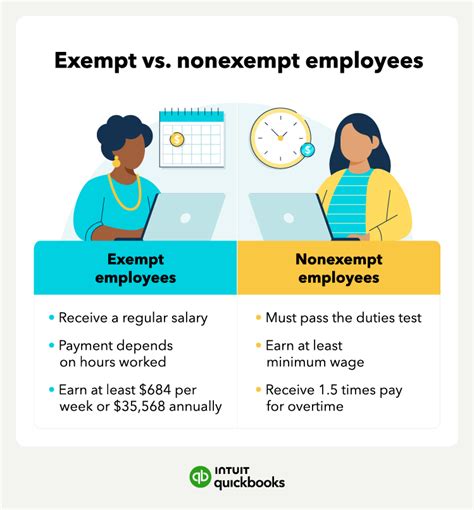

Understanding the rights and protections afforded to non-exempt employees is crucial for both employers and employees alike. Non-exempt employees, as defined by the Fair Labor Standards Act (FLSA), are those who are entitled to receive overtime pay for working more than 40 hours in a workweek. This category typically includes hourly workers and some salaried employees who do not meet the specific requirements for exemption. Here are five key facts about non-exempt employees that highlight their status under labor laws:

Eligibility for Overtime Pay

One of the most significant distinctions between non-exempt and exempt employees is the eligibility for overtime pay. Non-exempt employees must be paid at least one and a half times their regular rate of pay for any hours worked beyond 40 in a workweek. This provision is designed to compensate employees for the extra effort and time they put into their work, ensuring they are fairly rewarded for their labor. For example, if a non-exempt employee is paid 20 per hour, they must receive 30 per hour for any overtime work. Employers must accurately track the hours worked by non-exempt employees to ensure compliance with overtime pay requirements.

Record Keeping Requirements

Employers are mandated by law to keep accurate records of the hours worked by non-exempt employees. These records must include the number of hours worked each day and each week, the rate of pay, and the amount of pay received for each pay period. Additionally, records of any overtime worked and the corresponding overtime pay must be maintained. The FLSA requires that these records be kept for a certain period, typically three years, and be made available for inspection by the U.S. Department of Labor’s Wage and Hour Division upon request. Failure to maintain these records can lead to penalties and fines, even if the employer has paid the employees correctly.

| Category | Requirement |

|---|---|

| Hours Worked | Accurate daily and weekly hours |

| Rate of Pay | Regular and overtime rates |

| Pay Received | Amount of pay for each pay period |

| Record Retention | Minimum of three years |

Minimum Wage Protections

Non-exempt employees are also protected by minimum wage laws. The federal minimum wage is set by the FLSA, but many states and local governments have established higher minimum wages. Employers must pay non-exempt employees at least the applicable minimum wage for all hours worked. It’s important to note that minimum wage laws apply not just to hourly employees but also to salaried non-exempt employees, whose salary must translate to at least the minimum wage when divided by the number of hours they are expected to work in a week.

Meal and Rest Breaks

While the FLSA does not require employers to provide meal or rest breaks, many states have laws that mandate such breaks for non-exempt employees. Employers must be aware of the laws in their jurisdiction and ensure compliance. During these breaks, employees must be completely relieved of their duties and be free to use the time as they wish. Employers who fail to provide required breaks or who dock employees’ pay for break times when they are actually working may face legal consequences.

Key Points

- Non-exempt employees are entitled to overtime pay for work exceeding 40 hours in a week.

- Accurate record keeping of hours worked, pay rates, and overtime is mandatory.

- Non-exempt employees are protected by minimum wage laws, which can vary by state and locality.

- Meal and rest breaks are subject to state laws, and employers must comply with applicable regulations.

- Understanding and adhering to FLSA guidelines for calculating regular rates of pay, including when bonuses or commissions are involved, is essential for compliance.

In conclusion, the distinction between non-exempt and exempt employees has significant implications for labor law compliance, particularly regarding overtime pay, minimum wage, and record-keeping requirements. Employers must be diligent in understanding and adhering to these regulations to avoid potential legal issues and to ensure fair treatment of their employees. As labor laws continue to evolve, staying informed about the latest developments and adjustments in federal, state, and local regulations is crucial for maintaining a compliant and equitable work environment.

What is the primary distinction between non-exempt and exempt employees under the FLSA?

+The primary distinction is the eligibility for overtime pay. Non-exempt employees are entitled to receive overtime pay for working more than 40 hours in a workweek, whereas exempt employees are not entitled to overtime pay regardless of the number of hours worked.

How often must employers pay non-exempt employees?

+Employers must pay non-exempt employees at least once a month, but the exact frequency can depend on state laws. Payments must include compensation for all hours worked, including overtime, in the pay period.

Can non-exempt employees be required to work on holidays?

+Yes, non-exempt employees can be required to work on holidays, but they must be paid for their work. There is no federal law that requires employers to give non-exempt employees holidays off with pay, but some states may have such requirements.