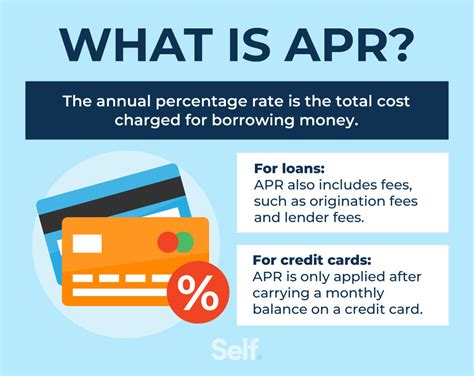

The term "APR" is commonly associated with credit cards, and understanding its meaning is crucial for individuals who use these financial tools. APR stands for Annual Percentage Rate, which represents the interest rate charged on a credit card's outstanding balance over a year. It's a key factor in determining the cost of borrowing money through a credit card. The APR is typically expressed as a yearly rate, and it can vary significantly from one credit card to another, depending on the issuer, the type of card, and the individual's creditworthiness.

In the context of credit cards, the APR is not just a simple interest rate; it's a complex calculation that takes into account various factors, including the prime rate, the card issuer's base rate, and the individual's credit score. A higher APR means that the cardholder will be charged more in interest over time, making it more expensive to carry a balance on the card. On the other hand, a lower APR can lead to significant savings in interest charges, especially for individuals who carry a balance from month to month.

Key Points

- APR stands for Annual Percentage Rate, representing the interest rate charged on a credit card's outstanding balance over a year.

- The APR is a key factor in determining the cost of borrowing money through a credit card.

- APR varies significantly from one credit card to another, depending on the issuer, the type of card, and the individual's creditworthiness.

- A higher APR means more interest charged over time, while a lower APR leads to savings in interest charges.

- Understanding APR is crucial for making informed decisions about credit card usage and managing debt effectively.

How APR Works on Credit Cards

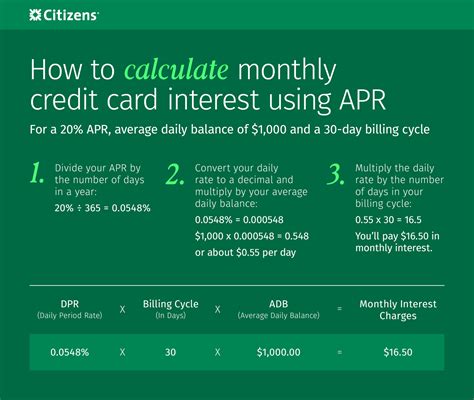

The APR on a credit card is calculated based on the outstanding balance, and it’s typically charged when the cardholder doesn’t pay the full balance by the due date. The interest rate is applied to the remaining balance, and the resulting interest charge is added to the outstanding balance. This process is called compounding, and it can lead to a snowball effect, where the interest charges accumulate rapidly over time.

For example, if a credit card has an APR of 18%, and the cardholder has an outstanding balance of $1,000, the interest charge for the year would be $180 (18% of $1,000). However, if the cardholder only pays the minimum payment each month, the interest charge will be higher, and the balance will take longer to pay off. This is why it's essential to understand the APR and make timely payments to avoid accumulating excessive interest charges.

Types of APR on Credit Cards

There are several types of APR associated with credit cards, including:

- Purchase APR: The interest rate charged on purchases made with the credit card.

- Balance Transfer APR: The interest rate charged on balances transferred from another credit card.

- Cash Advance APR: The interest rate charged on cash advances taken from the credit card.

- Penalty APR: A higher interest rate charged when the cardholder misses a payment or exceeds the credit limit.

| APR Type | Description | Example |

|---|---|---|

| Purchase APR | Interest rate on purchases | 18% on $1,000 purchase |

| Balance Transfer APR | Interest rate on balance transfers | 12% on $500 balance transfer |

| Cash Advance APR | Interest rate on cash advances | 24% on $200 cash advance |

| Penalty APR | Higher interest rate for late payments or exceeded credit limit | 29% on $1,000 outstanding balance |

Strategies for Managing APR on Credit Cards

Managing APR on credit cards requires a combination of strategies, including:

- Paying the full balance each month: Avoiding interest charges by paying the full balance on time.

- Making timely payments: Avoiding late fees and penalty APR by making payments on time.

- Transferring balances to lower-APR cards: Transferring high-interest balances to credit cards with lower APR.

- Negotiating with the issuer: Contacting the credit card issuer to negotiate a lower APR or more favorable terms.

By implementing these strategies, individuals can reduce their APR-related costs and make the most of their credit cards. It's essential to remember that APR is just one factor to consider when choosing a credit card, and other features like rewards, fees, and credit limits should also be taken into account.

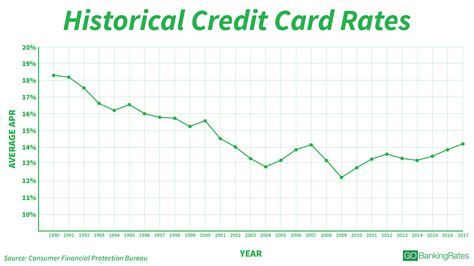

What is the average APR on credit cards?

+The average APR on credit cards varies depending on the type of card and the individual's creditworthiness. However, according to recent data, the average APR on credit cards is around 17%.

How can I avoid paying APR on my credit card?

+To avoid paying APR on your credit card, make sure to pay the full balance each month. You can also consider transferring your balance to a credit card with a 0% introductory APR or negotiating with your issuer to get a lower APR.

What happens if I miss a payment and my APR increases?

+If you miss a payment and your APR increases, you'll be charged a higher interest rate on your outstanding balance. This can lead to a significant increase in your debt over time. To avoid this, make sure to make timely payments and consider negotiating with your issuer to get a lower APR.

In conclusion, understanding APR on credit cards is essential for managing debt effectively and making informed decisions about credit card usage. By recognizing the different types of APR, calculating APR, and implementing strategies for managing APR, individuals can reduce their APR-related costs and make the most of their credit cards.