The Federal Insurance Contributions Act (FICA) tax is a crucial component of the US tax system, playing a significant role in funding social security and Medicare programs. Understanding FICA tax facts is essential for both employers and employees to navigate the complexities of payroll taxes. In this article, we will delve into five key FICA tax facts, providing insights into how FICA taxes work, their rates, and their implications for taxpayers.

Key Points

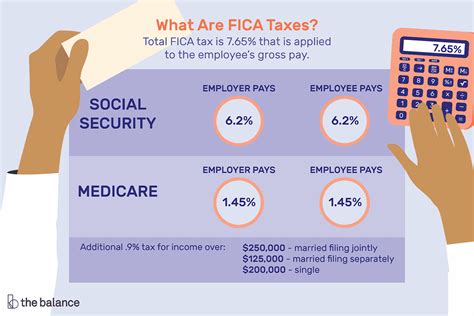

- FICA taxes fund social security and Medicare programs, with a total tax rate of 15.3% for employers and employees combined.

- The social security tax rate is 6.2% for employees and 6.2% for employers, while the Medicare tax rate is 1.45% for both employees and employers.

- FICA taxes are typically withheld from employees' wages, but self-employed individuals must pay both the employee and employer portions of FICA taxes.

- The social security wage base limits the amount of earnings subject to social security tax, but there is no wage base limit for Medicare tax.

- Certain types of income, such as tips and bonuses, are subject to FICA taxes, while others, like fringe benefits, may be exempt.

Understanding FICA Tax Rates and Components

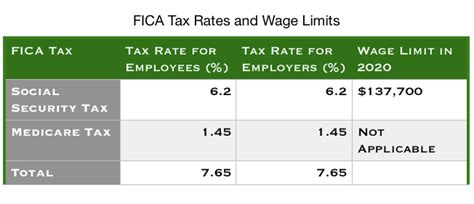

FICA taxes consist of two main components: social security tax and Medicare tax. The social security tax rate is 6.2% for employees and 6.2% for employers, totaling 12.4%. The Medicare tax rate is 1.45% for both employees and employers, making a total of 2.9%. For employers and employees combined, the total FICA tax rate is 15.3%. It is essential to note that these rates apply to most types of employment income, including wages, salaries, and tips.

Social Security Wage Base and Its Implications

The social security wage base is a critical factor in determining FICA taxes. In 2022, the social security wage base was $147,000, meaning that employees and employers only pay social security tax on earnings up to this amount. However, there is no wage base limit for Medicare tax, so all earnings are subject to the 1.45% Medicare tax rate. Understanding the social security wage base and its implications can help taxpayers and employers plan their tax obligations more effectively.

| FICA Tax Component | Employee Rate | Employer Rate |

|---|---|---|

| Social Security Tax | 6.2% | 6.2% |

| Medicare Tax | 1.45% | 1.45% |

| Total FICA Tax Rate | 7.65% | 7.65% |

FICA Tax Implications for Self-Employed Individuals

Self-employed individuals, including sole proprietors and partners in partnerships, are responsible for paying both the employee and employer portions of FICA taxes. This means that self-employed individuals must pay a total of 15.3% in FICA taxes, consisting of 12.4% for social security tax and 2.9% for Medicare tax. However, self-employed individuals can deduct half of their FICA taxes as a business expense, which can help reduce their taxable income.

Tips, Bonuses, and Other Types of Income Subject to FICA Taxes

Certain types of income, such as tips and bonuses, are subject to FICA taxes. Employers must withhold FICA taxes from these types of income, and employees must report them on their tax returns. On the other hand, some types of income, like fringe benefits, may be exempt from FICA taxes. Understanding which types of income are subject to FICA taxes can help employers and employees navigate the complexities of payroll taxes.

What is the total FICA tax rate for employers and employees combined?

+The total FICA tax rate for employers and employees combined is 15.3%, consisting of 12.4% for social security tax and 2.9% for Medicare tax.

Is there a wage base limit for Medicare tax?

+No, there is no wage base limit for Medicare tax. All earnings are subject to the 1.45% Medicare tax rate.

Can self-employed individuals deduct their FICA taxes as a business expense?

+Yes, self-employed individuals can deduct half of their FICA taxes as a business expense, which can help reduce their taxable income.

In conclusion, FICA taxes play a vital role in funding social security and Medicare programs. Understanding the five key FICA tax facts outlined in this article can help taxpayers and employers navigate the complexities of payroll taxes and ensure compliance with tax regulations. By considering the FICA tax implications for both employees and employers, self-employed individuals, and different types of income, taxpayers can make informed decisions about their tax obligations and minimize their tax liabilities.