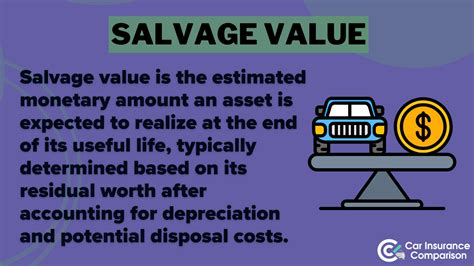

Salvage value, a term frequently encountered within the realms of accounting, asset management, and industrial asset disposal, denotes the estimated residual worth of an asset at the end of its useful life. This concept plays a crucial role in accounting for depreciation, financial planning, and asset liquidation strategies. Understanding salvage value involves a nuanced grasp of how assets depreciate over time, the methods used to estimate residual worth, and the implications for financial statements and decision-making processes. Experienced finance professionals often consider multiple factors—such as market conditions, asset wear and tear, technological obsolescence, and salvage markets—when determining salvage value. Recognizing the importance of salvage value is essential for accurate financial reporting, cost recovery, and strategic asset disposition.

Defining Salvage Value: A Core Concept in Asset Lifecycle Management

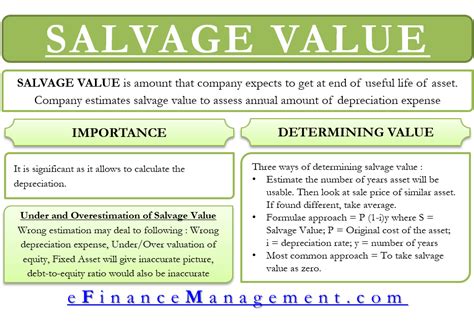

At its core, salvage value—also known as residual or scrap value—is the anticipated amount that an entity expects to recover upon disposal of an asset after it has been fully depreciated or has reached the end of its operational lifespan. This valuation plays a fundamental role in depreciation accounting, affecting both the book value of assets and the calculation of amortization expenses over asset life cycles. For example, if a manufacturing firm purchases machinery costing 200,000 with an expected useful life of 10 years, and estimates a salvage value of 20,000, this figure influences yearly depreciation charges and impacts overall financial performance assessments.

The Role of Salvage Value in Depreciation Methods

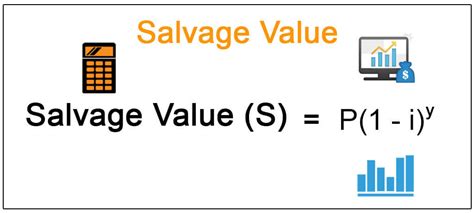

Salvage value is a pivotal parameter in multiple depreciation methods, which serve to allocate the acquisition cost of an asset over its estimated useful life. The straight-line depreciation method, one of the most common, subtracts salvage value from the initial cost to determine annual depreciation expense:

Depreciation Expense = (Cost - Salvage Value) / Useful Life

This formula ensures that the asset’s book value declines uniformly until reaching its salvage value at the end of its useful life. Conversely, declining balance and units-of-production methods also incorporate salvage value assumptions, although their calculations differ significantly, emphasizing the importance of precise salvage estimations for accurate financial reporting.

How Salvage Value Influences Financial and Strategic Decisions

Beyond accounting, salvage value significantly informs strategic decision-making regarding asset acquisition, asset replacement, and end-of-life disposal planning. Accurate salvage estimates can influence capital budgeting, informing decisions about whether to repair, upgrade, or replace machinery. For instance, a high salvage value might justify extended usage or refurbishments to maximize residual worth, whereas a low salvage might expedite disposition to recover investment quickly.

Impact on Taxation and Asset Liquidation

From a tax perspective, salvage value impacts depreciation deductions, thereby affecting taxable income. In jurisdictions where tax laws tie depreciation to salvage estimates, understated salvage values can lead to higher depreciation expenses, reducing taxable income in the short term but potentially complicating asset disposal revenue recognition later. Furthermore, salvage value considerations are central to asset liquidation processes, where residual worth informs offers, negotiations, and the timing of asset sale. Disposing of an asset with an underestimated salvage value risks undervaluing the asset’s worth, while overestimating salvage might result in unanticipated losses.

| Relevant Category | Substantive Data |

|---|---|

| Typical Salvage Values | In industrial equipment, salvage values typically range from 10% to 20% of initial cost, depending on asset type and market conditions. |

| Depreciation Impact | Inaccurate salvage estimates can skew depreciation expenses by up to 15-20%, affecting reported profit margins. |

| Market Trends | Technological obsolescence speeds up residual value decline; in tech-heavy industries, salvage value may approach zero within 3-5 years. |

Estimating Salvage Value: Methodologies and Best Practices

The process of estimating salvage value combines historical data analysis, market research, and professional judgment. Standard industry practices recommend conservative estimates rooted in empirical evidence, but they also require flexibility to account for asset-specific factors like condition, location, and market demand. Techniques include:

- Market Approach: Analyzing recent sale prices of similar assets in secondary markets.

- Cost Approach: Estimating residual value based on current disposal or scrap prices.

- Income Approach: Projecting future cash flows from sale or recycling, discounted at an appropriate rate.

Moreover, regulatory frameworks, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), provide guidelines to ensure consistency and comparability in salvage value estimation.

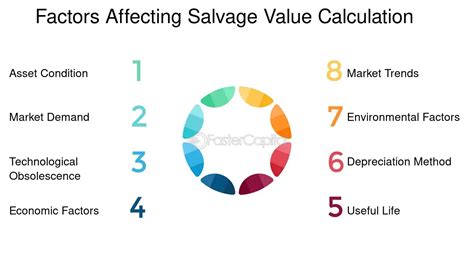

Factors Affecting Salvage Value Accuracy

Accurate estimation depends on several variables:

- Market volatility: Fluctuations in scrap prices or secondhand equipment demand can alter residual estimates significantly.

- Technological innovation: Rapid advancements may render assets obsolete faster, decreasing salvage values.

- Asset condition and maintenance history: Well-maintained assets tend to retain higher residual worth.

- Regulatory and environmental considerations: Disposal regulations or environmental sanctions may impact salvage disposal options and prices.

Limitations and Challenges in Salvage Value Prediction

Despite best practices, estimating salvage value is inherently uncertain. Several challenges undermine precision, including unpredictable market conditions, technological obsolescence, and fluctuating commodity prices. In some cases, salvage value might be essentially negligible, especially for highly specialized or rapidly evolving assets. Furthermore, accounting standards necessitate that estimates are reasonable and justifiable, but subjectivity often influences final figures. This variability underscores the need for transparency and documentation in valuation assumptions.

Case Study: Heavy Machinery in Manufacturing

Consider a manufacturing firm disposing of a 15-year-old CNC milling machine initially purchased for 500,000. The company estimates a salvage value of around 50,000, based on recent scrap sales and residual market demand. However, changing technology and reduced demand for used CNC equipment lead to actual liquidation proceeds of approximately $30,000. This discrepancy highlights the importance of conservative estimates and ongoing market analysis to avoid overvaluation and ensure reliable financial statements.

Future Trends and Evolving Perspectives on Salvage Value

Emerging industry trends—including the circular economy, sustainable asset repurposing, and digital twins—are reshaping how salvage value is conceptualized. Companies increasingly view residual assets not just as scrap but as potential components for reuse or recycling, often tied to new valuation models that incorporate environmental impact assessments. Advanced predictive analytics and AI-driven market forecasting enhance the accuracy of salvage estimates, allowing for dynamic adjustment as conditions evolve.

Environmental and Regulatory Influences

Growing regulatory emphasis on environmental sustainability prompts firms to consider ecological impacts during salvage estimation. In some jurisdictions, recyclable scrap prices have increased due to recycling initiatives, influencing salvage values upward. Conversely, environmental restrictions might hinder asset disposal options, decreasing residual worth or extending asset lifespan.

| Related Industry Developments | Implication for Salvage Value |

|---|---|

| Digital Asset Tracking | Enables precise valuation and lifecycle monitoring, improving salvage estimates. |

| Sustainable Disposal Regulations | Require environmentally friendly recycling, possibly increasing salvage potential for certain assets. |

| AI and Big Data | Enhance predictive accuracy of residual asset prices, reducing estimation uncertainties. |

Concluding Perspectives

In sum, salvage value remains a complex yet vital component of asset management, influencing depreciation, taxation, strategic planning, and disposal processes. While estimation challenges persist—exacerbated by market volatility and rapid technological change—adopting rigorous, evidence-based approaches can mitigate risks. As industries evolve toward sustainability and digital integration, the traditional notion of salvage value expands, encompassing environmental considerations, reuse potential, and advanced data analytics. For professionals engaged in asset lifecycle management, maintaining flexibility, staying informed of market trends, and incorporating comprehensive evaluation techniques will ensure more accurate residual valuations and smarter financial decisions.

What is the main purpose of calculating salvage value?

+The primary purpose is to accurately allocate the cost of an asset over its useful life for financial reporting, tax deductions, and determining residual worth during disposal or resale.

How does salvage value affect depreciation calculations?

+Salvage value reduces the depreciable amount of an asset, impacting annual depreciation expense calculations. Incorrect estimates can lead to either overstated or understated expenses, affecting profit reporting.

What factors are considered when estimating salvage value?

+Factors include current market demand, asset condition, technological obsolescence, scrap or resale prices, regulatory impacts, and historical sale data of similar assets.

Can salvage value be negative?

+While uncommon, a negative salvage value indicates disposal costs exceeding expected residual worth, often because of environmental liabilities or costly decommissioning requirements.

How do industry standards guide salvage value estimation?

+Standards like IFRS and GAAP recommend using market-based techniques, maintaining consistency, and documenting assumptions to ensure realistic and comparable salvage estimates across entities.