The annual Open Enrollment period for health insurance is a critical time for individuals and families to review their coverage options, make necessary changes, and secure affordable healthcare plans. This period typically occurs once a year, allowing individuals to enroll in or switch health insurance plans outside of special enrollment periods triggered by qualifying life events. While the Open Enrollment dates may vary slightly depending on the specific plan or region, understanding these timelines is essential for effective healthcare planning.

Open Enrollment Dates for 2025: A Comprehensive Overview

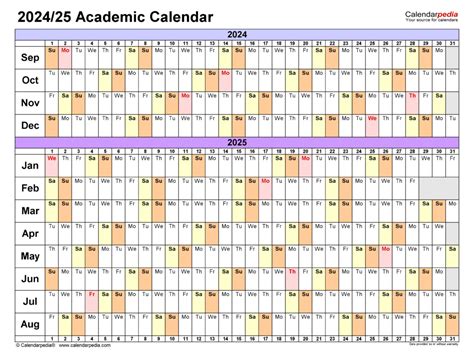

For the year 2025, the Open Enrollment period for health insurance is expected to commence on November 15, 2024, and conclude on January 15, 2025. This timeframe is standard for most health insurance plans in the United States, offering a 60-day window for individuals to navigate their coverage options.

Key Milestones for 2025 Open Enrollment

Here’s a breakdown of the key milestones within the 2025 Open Enrollment period:

- November 15, 2024 - Open Enrollment Begins: This date marks the official start of the Open Enrollment period, allowing individuals to begin exploring their coverage options and making informed decisions about their healthcare plans.

- December 15, 2024 - Mid-Point Check-In: As we reach the midpoint of the Open Enrollment period, it’s an opportune time to review progress and ensure that necessary changes or adjustments are made to healthcare plans. This milestone serves as a reminder to stay proactive in the enrollment process.

- January 15, 2025 - Open Enrollment Ends: The Open Enrollment period concludes on this date, bringing a close to the annual opportunity to enroll in or switch health insurance plans without a qualifying life event. It’s crucial to finalize any desired changes or selections before this deadline to avoid missing out on coverage for the upcoming year.

| Open Enrollment Dates | 2025 |

|---|---|

| Start Date | November 15, 2024 |

| End Date | January 15, 2025 |

Preparing for Open Enrollment: A Step-by-Step Guide

To make the most of the Open Enrollment period, here’s a step-by-step guide to help you navigate the process effectively:

- Assess Your Current Coverage: Start by evaluating your existing health insurance plan. Consider factors such as premiums, deductibles, copayments, and coverage limits. Assess whether your current plan aligns with your healthcare needs and budget.

- Research Available Options: Explore the range of health insurance plans offered during Open Enrollment. Compare premiums, coverage benefits, and provider networks to find a plan that best suits your needs. Consider utilizing online tools and resources provided by insurance providers or government websites to streamline your research.

- Review Plan Changes: Pay close attention to any changes made to your current plan or other available plans. These changes may include updates to premiums, coverage benefits, or provider networks. Understanding these alterations will help you make informed decisions during Open Enrollment.

- Consider Your Healthcare Needs: Assess your healthcare requirements for the upcoming year. Consider any anticipated medical expenses, prescription needs, or specialized care. Ensure that the plan you choose aligns with your healthcare needs to avoid unexpected out-of-pocket costs.

- Compare Costs and Benefits: While premiums are an essential factor, don’t solely base your decision on cost. Evaluate the overall value of the plan, considering deductibles, copayments, and coverage limits. A plan with a higher premium may offer more comprehensive benefits, potentially saving you money in the long run.

- Seek Professional Guidance: If you’re unsure about your options or have complex healthcare needs, consider consulting with a licensed insurance agent or financial advisor. They can provide expert advice tailored to your specific circumstances, helping you make informed decisions during Open Enrollment.

- Enroll or Make Changes: Once you’ve evaluated your options and made your decision, take action during the Open Enrollment period. Enroll in a new plan or make changes to your existing coverage to ensure you have the healthcare coverage you need for the upcoming year.

The Importance of Timely Enrollment

Enrolling in a health insurance plan during the Open Enrollment period is crucial for several reasons:

- It ensures you have access to affordable healthcare coverage throughout the year, protecting you from unexpected medical expenses.

- Open Enrollment provides an opportunity to review and compare different plans, allowing you to find the best fit for your healthcare needs and budget.

- By enrolling during this period, you avoid potential gaps in coverage and ensure seamless healthcare access without the need for a qualifying life event.

Special Enrollment Periods: An Exception to the Rule

While the Open Enrollment period is the standard timeframe for enrolling in health insurance plans, there are situations that warrant a Special Enrollment Period (SEP). A SEP allows individuals to enroll outside of the standard Open Enrollment window if they experience certain qualifying life events, such as marriage, divorce, birth or adoption of a child, loss of other health coverage, or a change in income that affects eligibility for premium tax credits.

Stay Informed, Stay Covered

Understanding the Open Enrollment period and staying informed about its dates and deadlines is a crucial aspect of effective healthcare planning. By marking these dates on your calendar and preparing in advance, you can make well-informed decisions about your healthcare coverage. Remember, timely enrollment during Open Enrollment ensures access to affordable healthcare and peace of mind for the year ahead.

Can I enroll in a health insurance plan outside of the Open Enrollment period?

+While the standard enrollment period is typically the only time individuals can enroll in a health insurance plan, there are certain qualifying life events that may trigger a Special Enrollment Period (SEP). During a SEP, you can enroll outside of the standard Open Enrollment window. Examples of qualifying life events include marriage, divorce, birth or adoption of a child, loss of other health coverage, or a change in income that affects eligibility for premium tax credits.

What happens if I miss the Open Enrollment deadline?

+If you miss the Open Enrollment deadline, you may be unable to enroll in a new health insurance plan until the next Open Enrollment period unless you qualify for a Special Enrollment Period (SEP). However, it’s important to note that failing to maintain continuous health insurance coverage may result in a fee or penalty under the Affordable Care Act (ACA). Therefore, it’s crucial to stay informed about the Open Enrollment dates and plan accordingly to avoid any potential gaps in coverage.

Are there any changes to the Open Enrollment period for 2025?

+As of the latest information, the Open Enrollment period for 2025 is expected to follow the standard timeline, beginning on November 15, 2024, and concluding on January 15, 2025. However, it’s always advisable to stay updated on any potential changes or announcements made by insurance providers or government agencies. Monitoring official sources will ensure you have the most accurate and up-to-date information regarding the Open Enrollment dates.