In the intricate world of automotive giants, few brands evoke as much recognition and historical significance as Volkswagen. Established in 1937 in Germany, Volkswagen has grown from a modest idea aimed at producing affordable automobiles for the masses to becoming a behemoth in the global car manufacturing industry. Its ownership structure, however, remains both complex and fascinating, reflecting broader trends in corporate governance, international investment flows, and strategic alliances within the automotive sector. Understanding who owns Volkswagen isn't merely an exercise in corporate law; it offers insights into the strategic priorities, financial backing, and governance frameworks that shape the company's future trajectory.

Unraveling the Ownership Layers of Volkswagen: A Deep Dive into its Corporate Structure

To comprehend the ownership of Volkswagen, we must first explore its foundational structure. Volkswagen AG, the publicly traded parent company, functions as a holding entity that oversees its various subsidiaries, including renowned brands like Audi, Porsche, SEAT, Škoda, and Lamborghini. The core of its ownership is distributed across a combination of government stakeholders, institutional investors, and private shareholders, all operating within a highly regulated andtransparent environment.

One critical component of Volkswagen’s ownership is the Porsche-Piëch family, which historically held significant stakes. The Porsche and Piëch families, through their respective investment vehicles, wield substantial influence over decision-making processes. Meanwhile, institutional investors—ranging from pension funds to mutual funds—hold sizable portions of shares, especially following the company’s international stock listings. These layers of ownership collectively illustrate a mosaic of stakeholder interests that shape Volkswagen’s strategic decisions, corporate governance, and long-term vision.

The Role of Major Shareholders in Volkswagen’s Corporate Governance

At the forefront of Volkswagen’s ownership are two principal groups: the Porsche-Piëch family and the State of Lower Saxony. The former, via Porsche Automobil Holding SE, controls approximately 31% of Volkswagen’s voting rights, thereby maintaining a dominant influence on strategic directives. The Piëch family, originating from Ferdinand Piëch—who historically drove the company’s technological innovation—continues to be an influential stakeholder, albeit through complex ownership arrangements involving various holding companies.

Conversely, the State of Lower Saxony holds a noteworthy stake, approximately 20% of voting rights, making it a significant stakeholder with both economic and political interests. This particular stake is rooted in the company’s historic government relationship and strategic investments, notably during the company’s expansion phases.

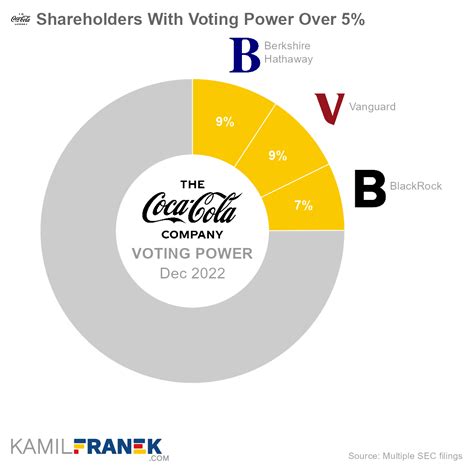

Institutional investors such as BlackRock and Vanguard also hold calibrated shares, collectively representing around 10–15% of the voting rights. Their influence tends to be more passive but vital in ratifying key decisions at annual general meetings, impacting the company’s governance and strategic direction.

| Relevant Category | Substantive Data |

|---|---|

| Major Shareholder | Porsche Automobil Holding SE (31%) |

| Government Stake | Lower Saxony (approximately 20%) |

| Institutional Investors | Combined 10–15% |

Evolution of Volkswagen’s Ownership: From Private to Public and Beyond

The historical course of Volkswagen’s ownership illustrates a fascinating evolution, shaped by post-World War II reconstruction, strategic mergers, and global capital markets. Initially, Volkswagen was largely privately held, with the Piëch family and government entities at the helm. Its initial public offering (IPO) in 1960 marked a significant shift, transitioning the company from a primarily private enterprise into a publicly traded corporation listed on the Frankfurt Stock Exchange.

This transition facilitated greater capital influx, enabling expansion into emerging markets and the development of new technological platforms. Over time, the company adopted complex cross-holdings, especially with Porsche AG, which further refined the concentration of ownership among certain stakeholders. The 2008 financial crisis and subsequent strategic realignments, including the Porsche AG’s attempted takeover, reshaped the ownership landscape yet again, revealing the intricate dance between private family interests, corporate entities, and public shareholders.

The Porsche-Piëch Family’s Strategic Influence and Its Impacts

Of particular note is the influence of the Porsche and Piëch families, which has historically guided the company’s technological innovation and strategic expansion. Ferdinand Piëch’s leadership, for example, dramatically transformed Volkswagen into a global powerhouse, emphasizing technological excellence and aggressive M&A moves. Today, although the Piëch family’s direct control has diminished, the entities they influence, notably Porsche Automobil Holding SE, retain decisive voting power, effectively shaping the company’s future directions.

This ownership setup exemplifies a hybrid control model—merging familial, corporate, and governmental influences—that affords strategic agility while maintaining stability for long-term investments in innovation and market adaptation.

Ownership in the Context of Volkswagen’s Global Reach and Market Position

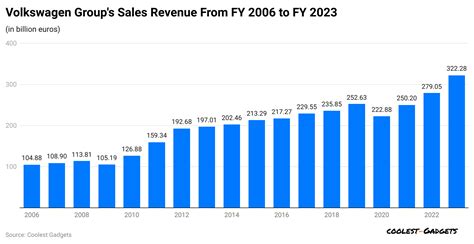

Volkswagen’s ownership structure is intrinsically linked to its expansive global footprint. With revenues surpassing €250 billion in 2022 and a production volume exceeding 10 million vehicles annually, the ownership arrangements support its position among the world’s top automakers. The diversified shareholder base and regional government stakes also reflect strategic regional interests—such as maintaining industrial stability in Europe, expanding in China, and competing fiercely in the United States and emerging markets.

Furthermore, the ownership framework allows Volkswagen to leverage cross-border investments, technological alliances, and joint ventures—particularly in China, where local government stakes and partnerships are vital to market success. Such complex ownership arrangements foster an ecosystem where strategic flexibility becomes integral to maintaining competitiveness amid disruptive industry shifts like electrification and autonomous driving.

Key Points

- Ownership complexity: The intertwined influence of families, government entities, and institutional investors shapes Volkswagen’s strategic decisions.

- Evolutionary landscape: Ownership has shifted from private roots to a mosaic of public holdings, alliances, and regional stakes.

- Strategic influence: Key stakeholders like Porsche and Lower Saxony significantly impact corporate governance and long-term planning.

- Global implications: Ownership structure influences market positioning, regulatory navigation, and technological innovation strategies.

- Future considerations: Ongoing shifts in stakeholder influence could impact Volkswagen's adaptation to industry transformations such as electric mobility.

Legal and Regulatory Implications of Volkswagen’s Ownership Model

Ownership structures like Volkswagen’s are not just governance formalities; they are subject to a dense web of legal frameworks and regulatory oversight. As a listed company, Volkswagen conforms to stringent disclosure requirements imposed by the European Union and German corporate law. These regulations aim for transparency, safeguarding minority shareholder interests, and preventing market abuse.

The influence of regional governments introduces additional layers of oversight, especially considering the European Union’s policies on state aid and competition law. Notably, the so-called “Volkswagen Law” of 1960, which granted regulatory privilege to the state and family stakeholders, was challenged and ultimately modified by EU directives, reflecting a broader trend towards market liberalization and shareholder rights protection.

Furthermore, the ownership structure has strategic implications in navigating international trade policies, tariffs, and emission standards—critical for a company operating across multiple jurisdictions with diverse legal frameworks.

Implications for Investors and Corporate Strategy

For investors, understanding the ownership architecture offers insights into governance stability, risk exposure, and strategic alignment. The confluence of influential stakeholders—familial, governmental, and institutional—serves as both an asset and potential point of friction, especially when pursuing innovation-driven growth versus stakeholder-controlled conservatism.

Corporate strategies are continually adapted to accommodate stakeholder influences, balancing immediate shareholder returns with long-term innovation investments. This tightrope walk becomes particularly evident as Volkswagen accelerates its push into electric vehicles and autonomous driving, where long-term strategic commitments may conflict with short-term stakeholder demands.

Who holds the majority ownership of Volkswagen?

+The majority voting power resides with Porsche Automobil Holding SE, controlling approximately 31% of voting rights, along with significant influence from the Lower Saxony government stake at around 20%.

How has Volkswagen’s ownership landscape changed over time?

+It has evolved from private family-controlled roots to a complex mix of family holdings, government stakes, public markets, and cross-holdings, driven by strategic mergers, IPOs, and industry reforms.

What role does the German government play in Volkswagen’s ownership?

+The German government, particularly Lower Saxony, holds a significant stake (around 20%), influencing strategic decisions and ensuring regional economic stability within the company’s governance framework.

Are institutional investors influential in Volkswagen’s decisions?

+Yes, institutional investors like BlackRock and Vanguard hold substantial minority stakes, often shaping voting outcomes and corporate direction, especially on governance and sustainability issues.