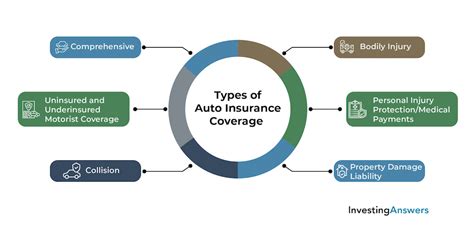

Understanding the various types of auto insurance is crucial for every vehicle owner. Auto insurance, also known as car insurance, is a policy that provides financial protection against physical damage, bodily injury, and other liabilities resulting from traffic incidents and road accidents. In this comprehensive guide, we will explore the different kinds of auto insurance policies, their coverage, and how they can benefit drivers.

Liability Insurance

Liability insurance is the most fundamental type of auto insurance and is often mandated by law in many countries and states. It is designed to cover the policyholder’s legal liability for bodily injury and property damage caused to others in an accident for which the insured driver is held responsible.

Types of Liability Coverage

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering of the injured parties in an accident caused by the insured driver. It also covers legal fees if a lawsuit is filed.

- Property Damage Liability: Property damage liability covers the cost of repairing or replacing the other party’s vehicle or any other property damaged in an accident caused by the insured driver.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Pays for medical costs, lost wages, and other expenses of injured individuals. |

| Property Damage Liability | Covers the cost of repairing or replacing damaged property, including vehicles. |

Benefits and Considerations

Liability insurance is essential as it protects the policyholder from significant financial losses resulting from accidents. However, it’s important to note that liability coverage only covers the other party’s damages and does not provide any compensation for the insured driver’s injuries or vehicle repairs. Policyholders should carefully review the coverage limits to ensure they have adequate protection.

Collision and Comprehensive Insurance

Collision and comprehensive insurance policies offer more comprehensive coverage compared to liability-only policies. These policies provide protection for the insured vehicle, in addition to covering the liabilities for injuries and property damage to others.

Collision Insurance

Collision insurance covers the cost of repairing or replacing the insured vehicle after an accident, regardless of who is at fault. This coverage is particularly beneficial for newer or more valuable vehicles, as it ensures that the driver is not left with a substantial financial burden in the event of an accident.

Comprehensive Insurance

Comprehensive insurance, often paired with collision coverage, provides protection against damage caused by events other than collisions. This includes damage from natural disasters, vandalism, theft, and even animal-related incidents. Comprehensive insurance is an excellent choice for drivers who want peace of mind and protection against a wide range of unforeseen circumstances.

| Coverage Type | Description |

|---|---|

| Collision Insurance | Covers repair or replacement costs for the insured vehicle after an accident. |

| Comprehensive Insurance | Protects against non-collision-related damages, including natural disasters and theft. |

Benefits and Considerations

Collision and comprehensive insurance policies provide more extensive coverage, offering financial protection for the insured vehicle. However, it’s important to weigh the benefits against the cost. These policies typically come with higher premiums, especially for older vehicles. Policyholders should assess their needs and consider factors such as the vehicle’s value, the likelihood of accidents, and their financial ability to cover potential losses.

Personal Injury Protection (PIP) and Medical Payments (MedPay)

Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage options focus on providing financial support for the insured driver and passengers in the event of an accident, regardless of fault.

Personal Injury Protection (PIP)

PIP coverage, commonly available in no-fault states, covers medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of who caused the accident. It also often includes additional benefits such as funeral expenses and rehabilitation costs.

Medical Payments (MedPay)

MedPay coverage provides supplemental medical expense coverage for the policyholder and their passengers, often covering deductibles and co-pays. It can be a valuable addition to a liability-only policy, ensuring that the insured driver and passengers have access to necessary medical care without incurring significant out-of-pocket expenses.

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other costs for the insured and passengers, regardless of fault. |

| Medical Payments (MedPay) | Provides supplemental medical expense coverage, including deductibles and co-pays. |

Benefits and Considerations

PIP and MedPay coverage options offer valuable protection for the policyholder and their passengers, ensuring that medical expenses are covered without the need to determine fault. These coverages are particularly beneficial in states with a high risk of accidents or where medical costs can be substantial. However, they may come with higher premiums, so policyholders should carefully evaluate their needs and financial situation.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage is designed to protect the policyholder in situations where the at-fault driver does not have sufficient insurance coverage to compensate for the damages caused.

Uninsured Motorist Coverage

Uninsured Motorist coverage provides protection when the at-fault driver in an accident does not have insurance. It covers the policyholder’s bodily injury and property damage expenses, ensuring that the insured driver is not left with financial burdens.

Underinsured Motorist Coverage

Underinsured Motorist coverage comes into play when the at-fault driver’s liability insurance coverage is insufficient to cover the policyholder’s damages. It provides additional compensation to ensure that the insured driver is adequately compensated for their losses.

| Coverage Type | Description |

|---|---|

| Uninsured Motorist Coverage | Protects the policyholder when the at-fault driver has no insurance. |

| Underinsured Motorist Coverage | Provides additional compensation when the at-fault driver's insurance is inadequate. |

Benefits and Considerations

Uninsured/Underinsured Motorist coverage is an important safeguard for policyholders, as it protects them from the financial consequences of accidents caused by uninsured or underinsured drivers. This coverage is particularly valuable in areas with a high incidence of uninsured drivers. However, it’s important to note that this coverage may not be available in all states or may have specific requirements.

Additional Auto Insurance Coverages

In addition to the fundamental coverage types, auto insurance policies may offer various optional coverages to meet specific needs.

Rental Car Reimbursement

Rental Car Reimbursement coverage provides financial support for the cost of renting a vehicle while the insured vehicle is being repaired or is unavailable due to an insured event.

Roadside Assistance

Roadside Assistance coverage offers peace of mind by providing emergency services such as towing, flat tire changes, battery jump starts, and fuel delivery. This coverage is particularly beneficial for drivers who frequently travel long distances or in remote areas.

Gap Insurance

Gap Insurance, or Guaranteed Asset Protection, covers the difference between the actual cash value of the vehicle and the amount still owed on a loan or lease in the event of a total loss. It is highly recommended for drivers who have financed or leased their vehicles.

Custom Parts and Equipment Coverage

Custom Parts and Equipment Coverage provides additional protection for any custom modifications, accessories, or equipment installed on the insured vehicle. This coverage ensures that the policyholder is adequately compensated for these enhancements in the event of a total loss or theft.

| Coverage Type | Description |

|---|---|

| Rental Car Reimbursement | Covers the cost of renting a vehicle during repairs. |

| Roadside Assistance | Provides emergency services like towing and battery assistance. |

| Gap Insurance | Covers the gap between vehicle value and loan/lease amount. |

| Custom Parts and Equipment Coverage | Protects custom modifications and accessories. |

Benefits and Considerations

These additional coverages offer tailored protection for specific situations and needs. While they may not be necessary for all drivers, they can provide significant benefits for those who frequently rely on rental cars, travel in remote areas, have customized vehicles, or have outstanding loans or leases. Policyholders should carefully assess their individual circumstances to determine which optional coverages are most valuable to them.

Conclusion: Choosing the Right Auto Insurance

Selecting the appropriate auto insurance policy involves a careful consideration of various factors, including the type of vehicle, driving habits, financial situation, and the level of protection desired. It’s essential to review the available coverage options and customize the policy to meet individual needs.

By understanding the different types of auto insurance and their respective benefits, drivers can make informed decisions to ensure they have adequate protection on the road. Remember, auto insurance is not just a legal requirement; it's a crucial investment in your financial well-being and peace of mind.

What is the difference between liability and comprehensive insurance?

+Liability insurance covers the policyholder’s legal liability for bodily injury and property damage caused to others in an accident. Comprehensive insurance, on the other hand, provides protection against a wide range of non-collision-related damages, including natural disasters and theft.

Is PIP coverage mandatory in all states?

+No, PIP coverage is typically required in no-fault states, where accident victims have access to medical care and financial support regardless of who caused the accident. In other states, MedPay coverage may be an optional add-on to provide similar benefits.

How does Gap Insurance work?

+Gap Insurance covers the difference between the actual cash value of a vehicle and the amount still owed on a loan or lease in the event of a total loss. It ensures that the policyholder is not left with a financial burden if the vehicle’s value has depreciated significantly.