When unexpected expenses arise, having access to emergency cash can be a lifesaver. However, for individuals with bad credit, obtaining immediate financial assistance can be a daunting task. Traditional lenders often view bad credit as a high-risk factor, making it challenging to secure a loan. Nevertheless, there are alternative options available that cater specifically to individuals with poor credit scores, providing them with the necessary funds to overcome financial emergencies.

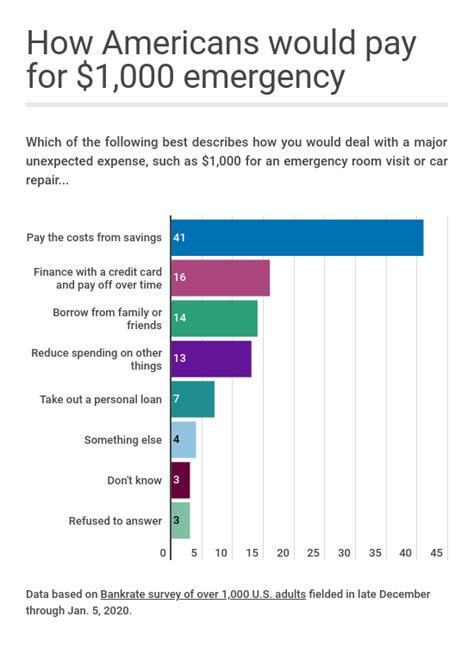

In the United States, for instance, approximately 30% of the population has a credit score below 601, which is considered subprime. This demographic faces significant barriers when attempting to access credit from conventional sources. To address this issue, various financial institutions and online lenders have developed products tailored to individuals with bad credit, offering a range of solutions for emergency cash needs. These options may come with higher interest rates and fees, but they can provide a vital lifeline during times of financial distress.

Key Points

- Bad credit can limit access to emergency cash from traditional lenders

- Alternative lenders offer options for individuals with poor credit scores

- Higher interest rates and fees are common with bad credit loans

- Online lenders and financial institutions provide a range of emergency cash solutions

- Secured loans and credit builder loans can help improve credit scores over time

Understanding Bad Credit and Emergency Cash Options

Bad credit is typically defined as a credit score below 600, although this threshold can vary depending on the lender and the specific credit scoring model used. Credit scores are calculated based on payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. A poor credit score can result from late payments, high credit card balances, or a limited credit history. When facing financial emergencies, individuals with bad credit may feel overwhelmed and unsure of where to turn for assistance.

Fortunately, the financial landscape has evolved to include a variety of emergency cash options for individuals with bad credit. These options include payday loans, title loans, installment loans, and credit builder loans, among others. Each type of loan has its own set of requirements, interest rates, and repayment terms. For example, payday loans are short-term, high-interest loans that must be repaid by the borrower's next payday, while installment loans offer longer repayment periods and potentially lower interest rates.

Types of Emergency Cash Loans for Bad Credit

When exploring emergency cash loans for bad credit, it’s essential to understand the different types of loans available and their associated terms. Payday loans, for instance, are designed to provide quick access to cash but come with extremely high interest rates, often exceeding 300% APR. Installment loans, on the other hand, offer more flexible repayment terms, with interest rates ranging from 60% to 200% APR, depending on the lender and the borrower’s creditworthiness.

Secured loans, such as title loans, require collateral, like a vehicle, to secure the loan. These loans can offer lower interest rates but risk the borrower losing their collateral if they default on payments. Credit builder loans are specifically designed to help individuals improve their credit scores over time. These loans involve borrowing a small amount of money and repaying it in installments, with the lender reporting payments to the credit bureaus to help establish or rebuild credit.

| Loan Type | Interest Rate Range | Repayment Terms |

|---|---|---|

| Payday Loan | 300% - 600% APR | Due on next payday |

| Installment Loan | 60% - 200% APR | Several months to several years |

| Secured Loan (Title Loan) | 100% - 300% APR | Several months to several years |

| Credit Builder Loan | 6% - 36% APR | Several months to several years |

Applying for Emergency Cash Loans with Bad Credit

The application process for emergency cash loans with bad credit typically involves providing personal and financial information to the lender. This may include proof of income, employment status, and bank account details. Some lenders may also require a credit check, although this is not always the case. The application process can often be completed online, and approval decisions are usually made quickly, sometimes within minutes.

Once approved, the loan funds are typically deposited into the borrower's bank account, although some lenders may offer in-person pickup or other disbursement methods. It's essential to review the loan agreement carefully before signing, ensuring you understand all the terms and conditions, including the interest rate, fees, and repayment schedule.

Managing Repayments and Improving Credit Scores

Repaying emergency cash loans on time is critical to avoiding additional fees and interest charges. Late payments can lead to further credit score damage, making it even more challenging to access credit in the future. By making timely payments, individuals can begin to rebuild their credit and potentially qualify for better loan terms in the future.

For those looking to improve their credit scores, credit monitoring services can provide valuable insights into credit report data and offer suggestions for improvement. Credit counseling agencies can also offer guidance on managing debt and creating a budget. Over time, with responsible credit behavior and on-time payments, individuals can work towards achieving better credit health and accessing more favorable loan options.

What are the consequences of late payments on emergency cash loans?

+Late payments can result in additional fees, higher interest rates, and further damage to your credit score, making it harder to obtain credit in the future.

Can emergency cash loans help improve my credit score?

+Some emergency cash loans, like credit builder loans, are designed to help improve your credit score over time by reporting your payments to the credit bureaus.

What are the typical interest rates for emergency cash loans with bad credit?

+Interest rates for emergency cash loans with bad credit can range from 60% to over 600% APR, depending on the type of loan and the lender.

In conclusion, while having bad credit can limit access to emergency cash, it’s not an insurmountable barrier. By understanding the different types of loans available, carefully evaluating the terms and conditions, and making timely repayments, individuals can navigate the challenges of emergency cash needs even with poor credit. As the financial landscape continues to evolve, more options and resources are becoming available to help individuals manage their finances, improve their credit, and secure the emergency cash they need when unexpected expenses arise.