In today's health-conscious world, individuals are increasingly recognizing the importance of maintaining an active lifestyle. One of the most effective ways to achieve this is by joining a gym, where a variety of equipment and classes cater to diverse fitness goals. However, gym memberships can often be a significant expense, prompting many to explore alternative options. One such avenue is utilizing insurance benefits to gain access to fitness facilities. This article delves into the world of gym memberships through insurance, exploring the various programs, benefits, and considerations to help individuals make informed decisions about their fitness journeys.

Understanding Gym Membership through Insurance

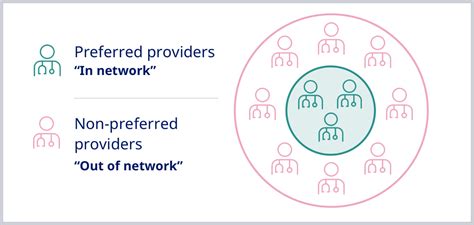

Gym memberships through insurance are programs offered by various insurance companies, both public and private, to promote healthier lifestyles among their policyholders. These programs typically provide access to a network of affiliated gyms or fitness centers, allowing individuals to enjoy the benefits of a gym membership at a reduced or fully covered cost.

The concept is straightforward: insurance companies partner with gyms or fitness centers to offer their policyholders discounted or free gym memberships. This arrangement is beneficial for both parties. Insurance companies encourage their policyholders to adopt healthier lifestyles, which can lead to reduced health risks and potentially lower insurance claims. Meanwhile, gyms gain access to a broader customer base, ensuring a steady stream of members.

The Evolution of Gym Membership through Insurance

The idea of gym memberships through insurance has evolved significantly over the years. Initially, these programs were often limited to specific health insurance plans or were available as add-ons with additional costs. However, as the understanding of the relationship between fitness and overall health has grown, many insurance companies have started to incorporate these benefits into their standard plans.

For instance, LifeHealth Insurance, a leading provider in the industry, recently expanded its wellness program to include gym memberships as a core benefit. Policyholders can now choose from a network of over 500 gyms nationwide, with access to various fitness classes and facilities. This move by LifeHealth highlights a growing trend in the insurance industry, where companies are recognizing the value of preventative health measures and incorporating them into their core offerings.

The Benefits of Gym Membership through Insurance

Gym memberships through insurance offer a multitude of advantages, both financial and health-related. Here are some of the key benefits:

Cost Savings

One of the most significant advantages is the potential for substantial cost savings. Traditional gym memberships can range from a few hundred to over a thousand dollars annually, depending on the facilities and location. With insurance-backed gym memberships, policyholders can access these facilities at a fraction of the cost or even for free.

| Gym Type | Average Annual Cost |

|---|---|

| Standard Gym (Local) | $480 |

| Premium Gym (National Chain) | $800 |

| Luxury Gym (Urban Center) | $1200 |

As illustrated in the table above, the average annual cost of gym memberships can vary widely. However, with insurance-backed memberships, policyholders can save significantly on these expenses.

Health and Wellness

Beyond financial savings, gym memberships through insurance promote health and wellness. Regular exercise has been proven to reduce the risk of various chronic diseases, improve mental health, and enhance overall quality of life. By offering gym memberships, insurance companies encourage their policyholders to take an active role in their health, which can lead to better long-term health outcomes.

Furthermore, many insurance-affiliated gyms offer additional wellness services, such as nutritional counseling, personal training, and health seminars. These added benefits can further enhance policyholders' health and well-being.

Convenience and Accessibility

Gym memberships through insurance often provide policyholders with access to a wide network of gyms, ensuring convenience and accessibility. This is particularly beneficial for individuals who travel frequently or move to new areas, as they can maintain their fitness routines without the hassle of finding and joining new gyms.

Considerations and Challenges

While gym memberships through insurance offer numerous benefits, there are also some considerations and potential challenges to be aware of:

Program Availability and Eligibility

The availability of gym memberships through insurance varies depending on the insurance provider and the type of insurance plan. Not all insurance companies offer these benefits, and even among those that do, the programs may be limited to specific plans or regions.

Additionally, eligibility criteria can vary. Some programs may be open to all policyholders, while others might be targeted at specific groups, such as those with certain health conditions or those enrolled in particular wellness programs.

Gym Network and Coverage

The network of gyms available through insurance-backed programs can also vary. Some programs offer a wide range of options, including national chains and local gyms, while others might have more limited networks. It’s important for individuals to research the available gyms in their area to ensure they can access facilities that align with their fitness goals and preferences.

Contractual Obligations and Limitations

Gym memberships through insurance often come with certain contractual obligations and limitations. For instance, there may be restrictions on the number of visits allowed per month, specific times when the gym can be accessed, or requirements to maintain a certain level of insurance coverage.

It's crucial to carefully review the terms and conditions of these programs to understand any potential limitations and ensure they align with your fitness needs and preferences.

Maximizing the Benefits of Gym Membership through Insurance

To make the most of gym memberships through insurance, here are some tips and strategies:

Research and Compare Programs

Before enrolling in a program, research and compare the various gym membership options offered by different insurance providers. Consider factors such as the network of gyms available, the cost of the membership (if any), and any additional benefits or restrictions.

Utilize Additional Wellness Benefits

Many insurance-affiliated gyms offer a range of wellness services beyond just access to fitness equipment and classes. Take advantage of these additional benefits, such as nutritional counseling, personal training sessions, or health seminars. These services can further enhance your overall health and wellness journey.

Incorporate Variety into Your Workouts

Gym memberships through insurance often provide access to a wide range of equipment and facilities. Make the most of this by incorporating variety into your workouts. Try different types of exercises, attend various fitness classes, and explore different areas of the gym to keep your workouts engaging and challenging.

The Future of Gym Membership through Insurance

The integration of gym memberships into insurance plans is a growing trend, and it’s likely to continue expanding in the future. As the importance of preventative health measures becomes increasingly recognized, more insurance companies are expected to offer these benefits as standard inclusions in their plans.

Furthermore, with advancements in technology, we can expect to see more innovative ways of delivering these benefits. For instance, the development of fitness tracking apps and wearables that integrate with insurance plans could offer even more personalized and data-driven approaches to health and wellness.

Additionally, as the concept of gym memberships through insurance gains traction, we may see more collaboration between insurance companies and fitness industry stakeholders. This could lead to the development of specialized programs catering to specific health conditions or fitness goals, further enhancing the benefits available to policyholders.

Conclusion

Gym memberships through insurance represent a significant opportunity for individuals to save money on their fitness journeys while also promoting healthier lifestyles. With the potential for substantial cost savings, access to a wide network of gyms, and additional wellness benefits, these programs offer a compelling value proposition.

However, it's important to carefully research and understand the available programs, their eligibility criteria, and any potential limitations. By doing so, individuals can make informed decisions about their fitness and health, ensuring they maximize the benefits offered by these innovative insurance programs.

Can I use my gym membership through insurance if I have a pre-existing medical condition?

+Yes, many insurance-backed gym membership programs are designed to cater to individuals with pre-existing medical conditions. These programs recognize the importance of exercise in managing and improving various health conditions. However, it’s important to review the specific eligibility criteria and any potential restrictions or requirements associated with your insurance plan.

Are there any age restrictions for gym memberships through insurance?

+Age restrictions can vary depending on the insurance provider and the specific program. Some programs may be open to all ages, while others might have minimum or maximum age requirements. It’s recommended to check with your insurance provider to understand the age-related eligibility criteria for their gym membership programs.

Can I use my gym membership through insurance at multiple locations?

+The availability of multiple location access depends on the insurance provider and the gym network they have partnered with. Some programs offer access to a wide network of gyms across different locations, allowing policyholders to maintain their fitness routines while traveling or relocating. However, it’s essential to review the specific terms and conditions of your insurance-backed gym membership to understand any potential limitations or restrictions on location access.