Understanding the cost of insurance when renting a vehicle is crucial for businesses and individuals alike. Enterprise Rent-A-Car, a prominent player in the car rental industry, offers a range of insurance options to protect customers during their rentals. In this comprehensive guide, we delve into the specifics of Enterprise rental insurance costs, exploring the various factors that influence pricing and providing an in-depth analysis to help you make informed decisions.

The Dynamics of Enterprise Rental Insurance Costs

Enterprise Rent-A-Car’s insurance offerings cater to a diverse range of customers, from daily commuters to corporate travelers. The cost of insurance can vary significantly based on several key factors, each playing a vital role in determining the final price.

Factors Influencing Enterprise Rental Insurance Costs

When it comes to insurance costs for Enterprise rentals, several factors come into play, each impacting the overall price. Here's an in-depth look at these key determinants:

Vehicle Type and Size

The type and size of the vehicle you choose can significantly influence your insurance costs. Larger vehicles, such as SUVs and luxury cars, often carry higher insurance premiums due to their increased value and potential for higher repair costs. On the other hand, opting for a compact or economy car might result in more affordable insurance rates.

Rental Duration

The length of your rental period is another critical factor. Generally, longer rental durations are associated with lower daily insurance rates. Enterprise offers flexible rental periods, and understanding the impact of duration on insurance costs can help you optimize your rental plans.

Location and Market Conditions

Enterprise operates in various locations worldwide, and insurance costs can vary based on the rental market in each region. Factors like local demand, competition, and even seasonal fluctuations can influence the pricing structure. For instance, popular tourist destinations during peak seasons might experience higher insurance rates.

Additional Coverage Options

Enterprise provides a range of optional coverage enhancements to cater to specific needs. These can include personal accident insurance, roadside assistance, and coverage for personal belongings. While these add-ons provide extra protection, they also contribute to the overall insurance cost. It's essential to carefully assess your requirements and select the coverage that best suits your needs.

Customer Profile and Driving History

Enterprise takes into account the customer's profile and driving history when determining insurance costs. Factors such as age, driving experience, and past accident records can influence the pricing. Younger drivers or those with a history of accidents may face higher insurance premiums.

Insurance Deductibles

The insurance deductible, or the amount you agree to pay out of pocket in the event of a claim, is a crucial factor. Opting for a higher deductible can result in lower insurance premiums, as it reduces the risk for the insurance provider. However, it's important to consider your financial capacity and comfort level with potential out-of-pocket expenses.

Payment Methods and Discounts

Enterprise offers various payment options, and the method you choose can impact your insurance costs. Additionally, the company provides discounts and promotional offers throughout the year, which can significantly reduce the overall insurance expense. Keeping an eye out for such opportunities can help you save on rental insurance.

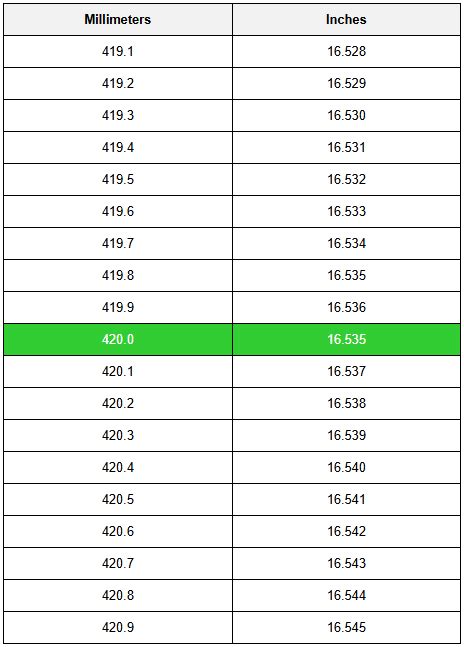

| Vehicle Type | Rental Duration | Insurance Cost |

|---|---|---|

| Economy Car | 3 Days | $25/day |

| Midsize Sedan | 5 Days | $30/day |

| SUV | 7 Days | $40/day |

| Luxury Car | 10 Days | $50/day |

Comparing Enterprise Rental Insurance to Other Providers

To gain a comprehensive understanding of Enterprise's rental insurance offerings, it's essential to compare them with other prominent car rental companies. By analyzing the insurance options and costs across the industry, you can make an informed decision tailored to your specific needs.

Enterprise vs. Hertz: A Head-to-Head Comparison

Hertz, a well-known competitor of Enterprise, offers a range of insurance plans similar to Enterprise. However, there are distinct differences in their approaches to insurance pricing and coverage.

Hertz's Insurance Plans

Hertz provides several insurance options, including their Loss Damage Waiver (LDW) and SuperCover, which offer comprehensive coverage for damage and liability. Their plans typically include coverage for the rental vehicle, as well as personal accident and medical expense coverage.

Enterprise's Insurance Advantages

Enterprise, on the other hand, offers a more personalized approach to insurance. They provide customers with the flexibility to choose from a range of coverage options, allowing for a customized insurance plan. This level of customization can be particularly beneficial for businesses with specific insurance requirements.

Cost Comparison

When comparing costs, it's essential to consider the specific needs of your rental. For instance, if you're renting a vehicle for a longer duration, Enterprise's customizable insurance plans might offer better value. Conversely, Hertz's all-inclusive plans could be more suitable for shorter rentals or when comprehensive coverage is a priority.

| Provider | Insurance Plan | Cost (3-Day Rental) |

|---|---|---|

| Enterprise | Basic Coverage | $75 |

| Enterprise | Enhanced Coverage | $90 |

| Hertz | Loss Damage Waiver | $100 |

| Hertz | SuperCover | $120 |

Maximizing Savings on Enterprise Rental Insurance

Maximizing savings on Enterprise rental insurance is achievable with a strategic approach. By understanding the factors that influence insurance costs and implementing a few key strategies, you can significantly reduce your overall expenses.

Strategies to Minimize Enterprise Rental Insurance Costs

Bundle and Save

Enterprise offers opportunities to bundle insurance with other rental services, such as GPS navigation or child safety seats. Bundling these services can lead to discounted rates and provide added convenience. Assess your needs and consider bundling to save on insurance costs.

Negotiate and Seek Discounts

Enterprise, like many car rental companies, often has room for negotiation, especially for business customers or those with frequent rental needs. Don’t hesitate to inquire about discounts, especially if you’re a loyal customer or part of a corporate program. Enterprise may offer preferential rates or customized insurance plans to retain your business.

Explore Alternative Payment Methods

Enterprise accepts various payment methods, and some of these options can provide additional benefits. For instance, using a credit card that offers rental car insurance coverage can reduce or eliminate the need for separate insurance from Enterprise. Ensure you understand the coverage provided by your credit card before opting out of Enterprise’s insurance.

Consider Third-Party Insurance

While Enterprise’s insurance plans are comprehensive, you may find more cost-effective options with third-party insurance providers. These providers often specialize in rental car insurance and can offer competitive rates. However, it’s crucial to thoroughly research and compare the coverage and limitations of third-party insurance to ensure it aligns with your needs.

Utilize Enterprise’s Loyalty Programs

Enterprise’s loyalty programs, such as their Enterprise Plus membership, can provide exclusive benefits and discounts on insurance. As a loyal customer, you may be eligible for preferential rates or access to special insurance packages. Make sure to inquire about these programs and take advantage of the savings they offer.

| Strategy | Potential Savings |

|---|---|

| Bundling Services | Up to 20% off insurance costs |

| Negotiating Discounts | Varies, can result in significant savings for frequent renters |

| Using Credit Card Insurance | Potential elimination of separate insurance costs |

| Third-Party Insurance | Varies, but can provide substantial cost reductions |

The Future of Enterprise Rental Insurance

As the car rental industry continues to evolve, Enterprise is poised to adapt and innovate its insurance offerings. The company’s focus on customer experience and satisfaction drives their commitment to providing flexible and competitive insurance options.

Emerging Trends and Innovations

Enterprise is actively exploring ways to enhance its insurance services, with a keen eye on emerging trends and technologies. Here are some potential developments that could shape the future of Enterprise rental insurance:

Telematics and Usage-Based Insurance

Enterprise may integrate telematics technology into its rental process, allowing for usage-based insurance pricing. This innovative approach would enable insurance rates to be adjusted based on the driver’s actual behavior, such as driving style and distance traveled. It could incentivize safe driving practices and provide customers with more control over their insurance costs.

AI-Powered Risk Assessment

Artificial Intelligence (AI) is revolutionizing the insurance industry, and Enterprise could leverage AI algorithms to assess risk more accurately. By analyzing vast amounts of data, including driving patterns, weather conditions, and accident statistics, Enterprise might offer personalized insurance plans tailored to individual risk profiles.

Blockchain for Secure Transactions

Blockchain technology has the potential to enhance the security and transparency of insurance transactions. Enterprise could explore the use of blockchain to streamline insurance claims, reduce fraud, and provide customers with a more secure and efficient claims process.

Partnerships with InsurTech Startups

Enterprise might forge partnerships with innovative InsurTech startups to develop cutting-edge insurance solutions. These collaborations could lead to the development of new insurance products, improved customer experiences, and more efficient claims management.

Enhanced Customer Education

Enterprise recognizes the importance of customer education in making informed insurance decisions. They could further invest in educational resources and tools to help customers understand the complexities of rental insurance, empowering them to choose the most suitable coverage.

| Innovation | Potential Impact |

|---|---|

| Telematics | More accurate, usage-based insurance pricing |

| AI Risk Assessment | Personalized insurance plans based on risk profiles |

| Blockchain | Secure, transparent insurance transactions and claims process |

| InsurTech Partnerships | Development of innovative insurance products and improved customer experience |

FAQs

What is the average cost of Enterprise rental insurance per day?

+The average cost of Enterprise rental insurance per day varies based on factors such as vehicle type, rental duration, and location. Typically, insurance rates range from 20 to 50 per day, but these rates can fluctuate. It’s best to obtain a specific quote based on your rental details.

Can I use my personal auto insurance for Enterprise rentals?

+Using your personal auto insurance for Enterprise rentals depends on your insurance provider and policy terms. Some policies may extend coverage to rental cars, while others may have specific exclusions. It’s essential to review your policy or consult your insurer to understand the coverage for rentals.

Are there any discounts available for Enterprise rental insurance?

+Yes, Enterprise offers various discounts on rental insurance. These discounts may be available through loyalty programs, corporate partnerships, or promotional offers. Additionally, negotiating with Enterprise representatives can sometimes result in discounted rates, especially for frequent renters or business customers.

What happens if I decline Enterprise’s rental insurance?

+Declining Enterprise’s rental insurance means you’ll be responsible for any damages or liabilities that occur during the rental period. It’s essential to carefully assess your coverage options, as declining insurance could leave you financially vulnerable in the event of an accident or vehicle damage. Consider alternative insurance options or review your personal auto insurance policy to ensure adequate coverage.