In the sunny state of Florida, known for its beautiful beaches and vibrant communities, home insurance is not just a choice but a necessity. The unique climate and geographic features of Florida present distinct challenges when it comes to protecting your home and belongings. From hurricanes and storms to potential water damage and mold, Florida homeowners face a range of risks that require specialized coverage. In this comprehensive guide, we'll delve into the world of Florida house insurance, exploring the leading companies, their offerings, and the factors that make them stand out in this competitive market.

Navigating the Florida Insurance Landscape

Florida’s insurance market is diverse and complex, with a mix of national carriers, regional insurers, and even state-backed entities. This diversity can be a double-edged sword for homeowners, offering a wide range of options but also making it challenging to identify the best fit for your specific needs. Here’s a closer look at the key players and what they bring to the table.

The National Carriers: A Stable Choice

National insurance companies like State Farm, Allstate, and Progressive have a strong presence in Florida. These carriers offer a comprehensive suite of insurance products, including home, auto, life, and health insurance. Their national reach means they can provide a consistent level of service and coverage across the country, making them a popular choice for homeowners seeking familiarity and stability.

For instance, State Farm, one of the largest providers in Florida, offers a Homeowner's Insurance Policy tailored to the state's unique needs. This policy includes coverage for wind damage, a critical feature given Florida's susceptibility to hurricanes and tropical storms. Allstate, another major player, provides a Premium Plus Package that covers mold damage, a common issue in the humid Florida climate.

| Insurance Carrier | Unique Coverage |

|---|---|

| State Farm | Wind Damage Protection |

| Allstate | Mold Damage Coverage |

| Progressive | Flexible Payment Plans |

In addition to these benefits, national carriers often provide discounts for bundling multiple insurance policies, such as combining home and auto insurance. This can be a significant cost-saver for homeowners, especially those who prefer the convenience of a one-stop shop for their insurance needs.

Regional Insurers: Tailored to Florida’s Needs

While national carriers offer broad coverage, regional insurers like Universal Property & Casualty Insurance and People’s Trust Insurance Company have a deeper understanding of the specific risks and challenges faced by Florida homeowners. These companies are often more agile and responsive to the unique needs of the market, making them a popular choice for those seeking tailored coverage.

Universal Property & Casualty Insurance, for example, specializes in windstorm and hurricane coverage, offering policies with higher windstorm deductibles to reflect the higher risk in Florida. This allows homeowners to save on premiums while still being adequately protected against the state's most common natural disasters.

People's Trust Insurance Company, on the other hand, focuses on mold prevention and mitigation. Their policies include coverage for mold remediation, helping homeowners address mold issues promptly and effectively. This is particularly valuable in Florida's humid environment, where mold can quickly become a costly problem.

State-Backed Entities: A Safety Net

In recognition of the unique risks faced by Florida homeowners, the state has established its own insurance entities. The Florida Hurricane Catastrophe Fund (FHCF) and the Florida Citizens Property Insurance Corporation (FCPIC) provide a safety net for homeowners who may struggle to find coverage in the private market. These entities offer basic property insurance at competitive rates, ensuring that even high-risk properties can be adequately protected.

The FHCF provides reinsurance coverage to insurance companies, helping to stabilize the market and ensure that homeowners can access the coverage they need. Meanwhile, the FCPIC offers a range of policies, including homeowners', condo, and renters' insurance, with a focus on affordability and accessibility. This makes it a go-to option for many Florida residents, particularly those with older homes or those in high-risk areas.

Factors to Consider When Choosing a Florida House Insurance Company

With so many options available, selecting the right Florida house insurance company can be a daunting task. Here are some key factors to consider when making your decision:

- Coverage Options: Ensure the company offers coverage tailored to Florida's unique risks, including wind damage, hurricane protection, and mold coverage.

- Pricing and Discounts: Compare rates and look for discounts that can help lower your premiums, such as bundling discounts or loyalty rewards.

- Customer Service: Read reviews and assess the company's reputation for prompt and effective service. Consider factors like claim response times and customer satisfaction ratings.

- Financial Stability: Check the company's financial ratings to ensure they have the resources to pay out claims, even in the event of a major catastrophe.

- Policy Features: Look for policies that offer flexible payment options, additional coverages (like identity theft protection or equipment breakdown), and optional endorsements to customize your policy to your specific needs.

The Bottom Line: Your Florida Home Deserves Protection

Florida’s unique climate and geography present a set of challenges that require specialized insurance coverage. Whether you choose a national carrier for its stability and comprehensive offerings, a regional insurer for its tailored approach, or a state-backed entity for its affordability and accessibility, ensuring your home is adequately protected is crucial. By understanding the options available and the factors that influence your decision, you can make an informed choice that provides the peace of mind and protection your Florida home deserves.

What is the average cost of home insurance in Florida?

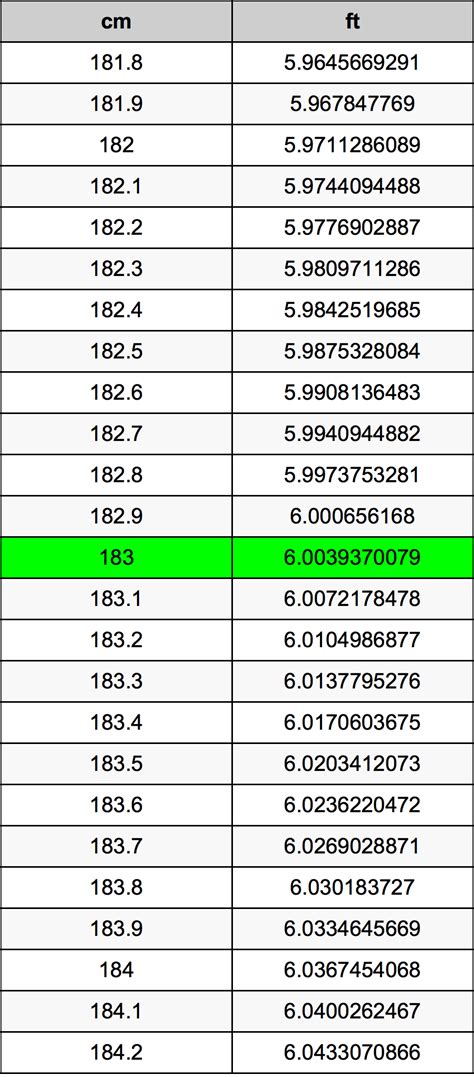

+The average cost of home insurance in Florida can vary widely based on factors like location, home value, and coverage limits. According to recent data, the average premium for a 250,000 home is around 2,800 per year. However, rates can range from 1,500 to 5,000 or more, depending on individual circumstances.

Are there any discounts available for Florida homeowners?

+Yes, many insurance companies offer discounts to Florida homeowners. These can include discounts for bundle policies (combining home and auto insurance), loyalty rewards for long-term customers, home safety features like security systems, and claim-free records. Some insurers also offer discounts for new homes or homes with certain construction features that enhance their resilience against natural disasters.

How can I save money on my Florida house insurance?

+To save money on your Florida house insurance, consider the following strategies: shop around for quotes from multiple insurers, increase your deductible (but ensure it’s an amount you can afford to pay out of pocket), bundle your policies to take advantage of discounts, and review your coverage regularly to ensure you’re not overinsured or paying for unnecessary coverage.