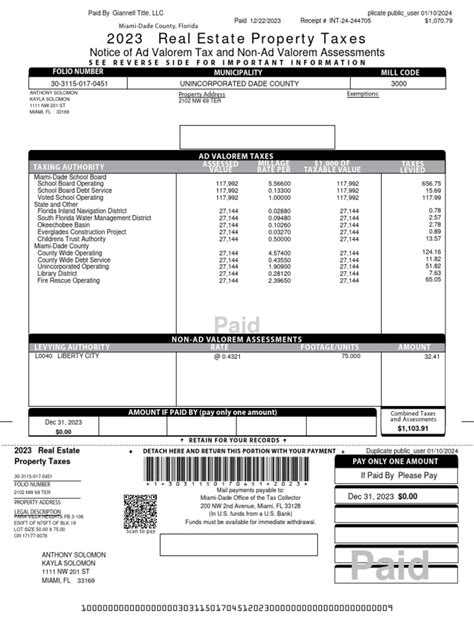

Miami-Dade County, located in the state of Florida, has a unique sales tax rate that applies to various transactions within the county. As of 2023, the total sales tax rate in Miami-Dade County is 7%, which is comprised of the state sales tax rate of 6% and the local sales tax rate of 1%. This rate applies to most goods and services sold within the county, with some exceptions and exemptions.

The state sales tax rate of 6% is imposed by the state of Florida and is applied to all sales transactions within the state. The local sales tax rate of 1% is imposed by Miami-Dade County and is used to fund local government services and infrastructure projects. The combined sales tax rate of 7% is one of the highest in the state of Florida, but it is still lower than many other major cities in the United States.

Key Points

- The total sales tax rate in Miami-Dade County is 7%, consisting of a 6% state sales tax rate and a 1% local sales tax rate.

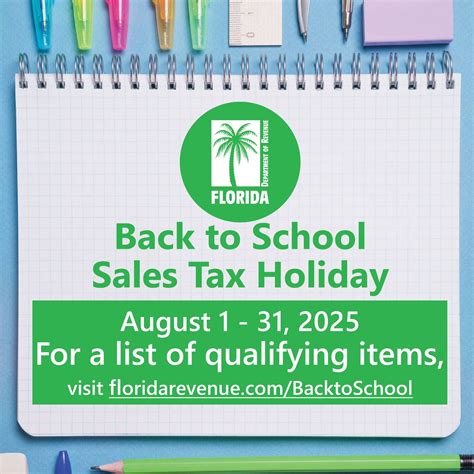

- The sales tax rate applies to most goods and services sold within the county, with some exceptions and exemptions.

- The state sales tax rate of 6% is imposed by the state of Florida and applies to all sales transactions within the state.

- The local sales tax rate of 1% is imposed by Miami-Dade County and is used to fund local government services and infrastructure projects.

- The combined sales tax rate of 7% is one of the highest in the state of Florida, but it is still lower than many other major cities in the United States.

Sales Tax Exemptions and Exceptions

While the sales tax rate in Miami-Dade County applies to most goods and services, there are some exemptions and exceptions. For example, groceries and certain medical products are exempt from sales tax. Additionally, some businesses, such as non-profit organizations and government agencies, may be exempt from paying sales tax on certain purchases.

It's also worth noting that some cities within Miami-Dade County may have their own sales tax rates, which can range from 0% to 1% in addition to the state and county rates. For example, the city of Miami has a sales tax rate of 0.5%, which is added to the state and county rates, resulting in a total sales tax rate of 7.5%.

Sales Tax Rates in Surrounding Cities

The sales tax rates in surrounding cities and counties can vary significantly. For example, Broward County, which is located just north of Miami-Dade County, has a sales tax rate of 7%, consisting of a 6% state sales tax rate and a 1% local sales tax rate. Palm Beach County, which is located just north of Broward County, has a sales tax rate of 7%, consisting of a 6% state sales tax rate and a 1% local sales tax rate.

| City/County | Sales Tax Rate |

|---|---|

| Miami-Dade County | 7% (6% state + 1% local) |

| Broward County | 7% (6% state + 1% local) |

| Palm Beach County | 7% (6% state + 1% local) |

| City of Miami | 7.5% (6% state + 1% county + 0.5% city) |

Sales Tax Compliance and Audits

Sales tax compliance is critical for businesses operating in Miami-Dade County. The Florida Department of Revenue is responsible for administering and enforcing the sales tax laws in the state, and businesses are required to register for a sales tax permit and file regular sales tax returns.

Businesses that fail to comply with sales tax laws and regulations may be subject to audits and penalties. The Florida Department of Revenue conducts regular audits to ensure compliance with sales tax laws, and businesses that are found to be non-compliant may be required to pay back taxes, penalties, and interest.

Sales Tax Audit Process

The sales tax audit process typically begins with a notification from the Florida Department of Revenue, which will inform the business of the audit and request documentation and records. The audit process may involve a review of the business’s sales tax returns, invoices, and other records to ensure compliance with sales tax laws and regulations.

Businesses that are subject to a sales tax audit should seek the advice of a qualified tax professional or attorney to ensure that their rights are protected and to minimize any potential penalties or liabilities.

What is the sales tax rate in Miami-Dade County?

+The sales tax rate in Miami-Dade County is 7%, consisting of a 6% state sales tax rate and a 1% local sales tax rate.

Are there any sales tax exemptions in Miami-Dade County?

+Yes, there are several sales tax exemptions in Miami-Dade County, including exemptions for groceries and certain medical products.

What is the sales tax rate in surrounding cities and counties?

+The sales tax rates in surrounding cities and counties can vary significantly, ranging from 7% to 7.5%.