Health insurance is a vital aspect of modern life, providing individuals and families with financial protection and access to essential healthcare services. However, the cost of healthcare and insurance premiums has been a growing concern for many, leading to a search for more affordable and accessible options. In this comprehensive guide, we will delve into the world of health insurance, exploring the factors that influence affordability, the available options, and strategies to make health coverage more financially manageable.

Understanding the Landscape of Health Insurance

Health insurance in the United States is a complex system, with various public and private entities offering coverage. The Affordable Care Act (ACA) brought significant reforms, making health insurance more accessible and introducing subsidies to lower costs for eligible individuals. Understanding the different types of health insurance plans is crucial in making informed decisions.

Types of Health Insurance Plans

Health insurance plans can be broadly categorized into public and private options:

- Public Plans: These include government-sponsored programs like Medicare (for seniors and certain disabilities) and Medicaid (for low-income individuals and families). The Children’s Health Insurance Program (CHIP) is another public option, offering coverage for children in families with modest incomes.

- Private Plans: These are offered by private insurance companies and are the most common form of health insurance. Private plans can be further divided into employer-sponsored coverage, individual or family plans, and short-term or temporary insurance. Each type offers different benefits, premiums, and coverage periods.

Factors Influencing Affordability

The affordability of health insurance is influenced by several key factors, including:

- Income and Household Size: Lower-income individuals and families may qualify for subsidies or Medicaid coverage, making insurance more affordable. Household size also impacts premiums, as plans often offer family rates.

- Age and Health Status: Younger individuals generally pay lower premiums, while older adults and those with pre-existing conditions may face higher costs. The ACA prohibits discrimination based on health status, but costs can still vary.

- Location: The cost of healthcare and insurance premiums can vary significantly by region and state. Rural areas may have fewer options and higher costs compared to urban centers.

- Plan Type and Coverage: Different plan types offer varying levels of coverage and benefits. High-deductible plans may have lower premiums but require higher out-of-pocket costs, while more comprehensive plans can be more expensive upfront but provide broader coverage.

Strategies for Affordable Health Insurance

Navigating the health insurance landscape to find an affordable plan can be challenging, but several strategies can help:

Utilizing Government Programs

Government programs like Medicare, Medicaid, and CHIP offer crucial financial support for those who qualify. Medicare provides coverage for seniors and those with disabilities, while Medicaid and CHIP aim to ensure that low-income individuals and families have access to necessary healthcare services.

Exploring Private Options

Private health insurance plans come in various forms, and understanding your options is key to finding an affordable fit. Employer-sponsored coverage is often the most cost-effective, as employers may contribute to premiums. Individual or family plans purchased directly from insurance companies or through the Health Insurance Marketplace offer flexibility but may have higher premiums. Short-term or temporary plans can provide coverage for specific periods, such as between jobs or during a transition, but they typically have limited benefits and may not comply with ACA requirements.

Comparing Plans and Utilizing Subsidies

When comparing health insurance plans, consider not only the premiums but also the deductibles, copayments, and coinsurance amounts. These out-of-pocket costs can significantly impact your overall expenses. The Health Insurance Marketplace allows you to compare plans and provides a tool to estimate your subsidy eligibility. Subsidies can reduce your premium costs, making insurance more affordable.

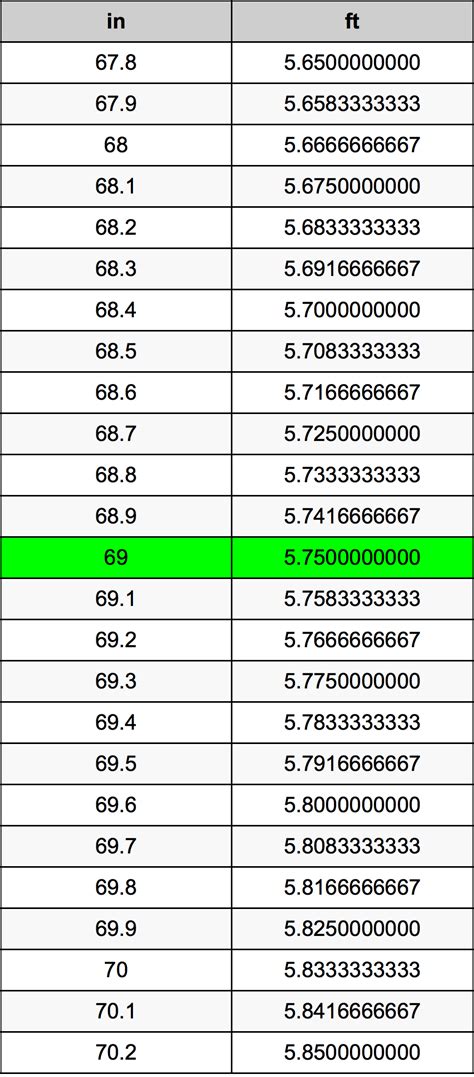

| Plan Type | Premium | Deductible | Copayment |

|---|---|---|---|

| Plan A | $400/month | $1,500 | $20 |

| Plan B | $350/month | $2,000 | $30 |

| Plan C | $500/month | $1,000 | $15 |

Maximizing Cost-Saving Opportunities

There are several ways to reduce your healthcare costs beyond choosing an affordable plan. Utilizing generic medications can significantly lower prescription expenses. Negotiating medical bills and exploring payment plans can also help manage costs. Additionally, preventive care services are often covered at no additional cost, so taking advantage of these services can improve your health and reduce future expenses.

Future Outlook and Emerging Trends

The health insurance landscape is continually evolving, with ongoing efforts to improve accessibility and affordability. Here are some key trends and potential future developments:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, allowing patients to access healthcare remotely. Telehealth can reduce costs by eliminating travel expenses and providing convenient access to specialists. As technology advances, we can expect further integration of virtual care into standard healthcare practices.

Value-Based Care Models

Value-based care focuses on delivering high-quality, cost-effective healthcare. This model rewards providers for positive patient outcomes rather than the quantity of services rendered. By incentivizing efficient and effective care, value-based models can reduce unnecessary procedures and lower healthcare costs.

Health Savings Accounts (HSAs)

HSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses. When paired with a high-deductible health plan, HSAs offer a powerful tool for managing healthcare costs. Contributions to HSAs are tax-deductible, and withdrawals for qualified expenses are tax-free. HSAs allow individuals to save for future healthcare needs and can provide significant long-term financial benefits.

Expanded Coverage Options

Efforts to expand coverage options and improve affordability are ongoing. Proposals for universal healthcare or Medicare expansion aim to provide coverage for all Americans, regardless of income or pre-existing conditions. While these proposals face political challenges, they reflect a growing recognition of the need for comprehensive and affordable healthcare.

Conclusion

Affordable health insurance is a crucial aspect of financial well-being and access to necessary healthcare services. By understanding the landscape of health insurance, exploring available options, and utilizing cost-saving strategies, individuals and families can find coverage that meets their needs and budgets. As the healthcare industry continues to evolve, staying informed about emerging trends and potential policy changes can help ensure you make the best decisions for your health and financial security.

How do I know if I qualify for government-sponsored health insurance programs like Medicaid or CHIP?

+

Eligibility for government-sponsored health insurance programs is based on various factors, including income, household size, and age. You can check your eligibility through the official government websites or by contacting your state’s Medicaid office. These programs aim to provide coverage for those who may not be able to afford private insurance, so it’s worth exploring your options.

Are there any disadvantages to choosing a high-deductible health plan to save on premiums?

+

High-deductible health plans can be a cost-effective option, but they do come with some considerations. If you anticipate needing extensive medical care, a high-deductible plan may result in higher out-of-pocket costs before your insurance coverage kicks in. Additionally, these plans may have limited coverage for certain services, so it’s essential to review the plan’s details carefully.

What is the Affordable Care Act (ACA), and how does it impact health insurance affordability?

+

The Affordable Care Act, often referred to as Obamacare, was a landmark healthcare reform law enacted in 2010. The ACA aimed to increase the affordability and accessibility of health insurance by introducing subsidies for low- and middle-income individuals, prohibiting discrimination based on pre-existing conditions, and expanding Medicaid coverage. It has significantly impacted the insurance landscape, making coverage more accessible for many Americans.